Accounting helps business owners and managers keep track of their finances by keeping track of various expenses. It means they can identify potential opportunities or risks more quickly and uncover hidden costs or wasted resources. They can include legal fees, audit fees, marketing expenses, professional development training, and travel costs. Ultimately, your company’s choice of words for miscellaneous costs will depend on the situation and industry standards. Most importantly, all employees must know what the term means and be able to explain it to report their related costs correctly. This way, organizations can ensure they have an accurate picture of their finances.

- Instead, they usually refer to discretionary purchases with no specific purpose or predetermined budget, such as tickets for entertainment events or gifts for clients.

- Ultimately, your company’s choice of words for miscellaneous costs will depend on the situation and industry standards.

- You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

- When budgeting for miscellaneous expenses, businesses must allocate funds accordingly to cover all their necessary costs without overspending or going overboard with allocations.

But it’s important to know that miscellaneous expenses are not personal expenses and need to be kept track of separately when filing taxes or managing the finances of a business. Therefore, organizations must track these miscellaneous expenses to maintain a transparent cost structure. Organizations can better understand their total financial picture and plan accordingly by tracking miscellaneous expenses separately. This category is given its own aggregated line on an income statement account for clear and concise tax return-filing purposes. A tax deduction can be made on miscellaneous expenses for business use based on your country’s regulations.

Frequently Asked Questions – Miscellaneous Expenses Defined and Explained

It includes airfare, accommodations, and meals while away from home on business trips. Miscellaneous expenses are those that do not fit into the categories of day-to-day operational costs. Instead, they usually refer to discretionary purchases with no specific purpose or predetermined budget, such as tickets for entertainment events or gifts for clients. Periodic publications and subscription services such as business journals or industry-related courses fall under this miscellaneous category.

However, it’s helpful to make sure any expense you’re considering claiming as miscellaneous doesn’t fit into an expense category you have already set up. Small transactions that aren’t categorized into your already defined business expense categories are grouped in the general ledger rather than being listed individually. A manufacturing company is faced with sudden changes in industry compliance standards, requiring immediate updates to their equipment to adhere to new environmental regulations.

AccountingTools

These expenses can vary greatly depending on the type of business and its operations. When businesses plan for the future, they need to know how much things will cost so that their budgets and plans stay on track. Companies can better plan for cash flow and other financial needs if they know how much money they might have to spend. Keep track of fees you pay for consultants as well as fees for services from outside professionals who advise you on business matters. These accounting and legal fees may be considered miscellaneous expenses and may be tax-deductible.

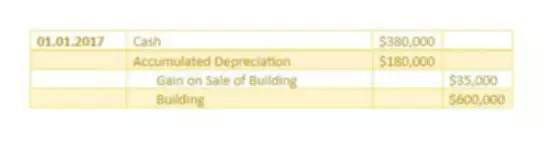

However, they’re key to running a business smoothly and can often reduce your tax bill. Necessary tools that cost more than a few hundred dollars and that last longer than one year are generally considered capital expenses and must be considered for depreciation instead. This article emphasizes the importance of awareness and preparation to avoid exploitation during the sale. It discusses key steps such as thorough valuation, preparing financial documentation, seeking professional advice, and implementing a secure sales strategy. Additionally, it highlights the significance of negotiation and mitigating risks. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

What are Miscellaneous (Misc.) Expenses? – Miscellaneous Expenses Defined and Explained

For businesses, it is essential to understand what counts as miscellaneous expenses, how to record them accurately, and how they affect financial statements. It also helps them make good decisions about using their resources and create detailed plans for their overall budgeting strategies. By accurately predicting their needs for miscellaneous expenses, companies can stay ahead of the curve when it comes to managing their finances and ensuring they stay on track. A business has incurred legal fees related to a dispute with another company. The cost of the fees they will incur could fall under the “miscellaneous expenses” account.

Miscellaneous expenses, meaning costs that don’t fall into a specific tax category, must be recorded and accounted for in your business’s general ledger account. If your items under miscellaneous expenses increase in size and usage, then the miscellaneous expense should be given its own account. These examples show how miscellaneous expenses can capture costs that do not fit into any other category or relate to specific one-off items or services. By keeping track of these costs correctly, businesses can make sure they have a clear picture of their finances and how they are doing over time.

Preparing to Sell Your Business: How to Avoid Being Cheated When Selling Your Business

Knowing how miscellaneous items will affect your bottom line and carefully tracking them could make all the difference. Tracking miscellaneous expenses gives taxpayers an accurate picture of what deductions they are eligible for. This can result in a lower overall tax bill or a higher refund, depending on how much they spent throughout the year. But, depending on how they are made, they may also appear on balance sheets or cash flow statements.

In a growing business, there may be a number of small expense items that gradually increase in size. A reasonable accounting practice is to initially record these expenses in a miscellaneous expense account, and then monitor the contents of this account over time. If any items within the account increase in size, then you can create a separate account for them. Similarly, some expenses may shrink over time, in which case the accounts in which they are stored can be eliminated, and these expenses shifted into the miscellaneous expense account. When it comes to financial reporting, you’ll find miscellaneous expenses detailed on the income statement.

These expenses may include legal fees, professional fees, business travel, and automobile use for business purposes. Also, employers with employees may be able to deduct the premiums they pay for workers’ compensation insurance. Tax deductions can be made on miscellaneous expenses, as is the case with any other operating expense of a business. Come tax season, you can write off your miscellaneous expenses in the same way you claim your other business operating costs on your tax returns. There’s no limit on the number of miscellaneous expenses a business owner can deduct from their income.