Merchandising

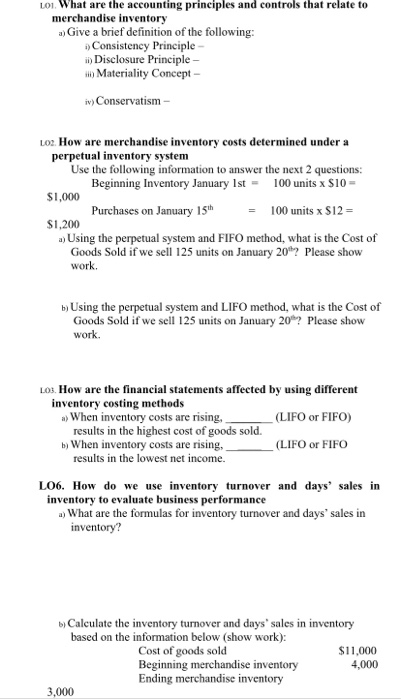

In this type of valuation, you assume that the first items that are added to inventory are the first ones sold. In this method, the assumption is that the last items added to inventory are the first items sold. Merchandise inventory is the cost of goods on hand and available for sale at any given time. Merchandise inventory (also called Inventory) is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease.

Service companies do not sell tangible goods to produce income; rather, they provide services to customers or clients who value their innovation and expertise. Examples of service companies include consultants, accountants,financial planners, and insurance providers.

Northern Merchandising Company sold inventory that cost $12,000 for $20,000 cash. The cost of inventory items that have not been sold (Merchandise inventory) is reported as an asset on the balance sheet. The cost of the items sold (Cost of Goods Sold) is expensed on the income statement. Under perpetual inventory procedure, the Merchandise Inventory account provides close control by showing the cost of the goods that are supposed to be on hand at any particular time.

Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in theaccounts payable subsidiary ledger. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. Accounts payableis the amount of short-term debt or money owed to suppliers and creditors by a company.

Notice that inventory is not expensed until it is actually sold. Here is the entry to record a bulk inventory purchase by a retailer early in the year. Since inventory is something that a business owns, it is considered an asset and reported as such on the balance sheet. The dollar value that corresponds to the inventory account depends on the valuation method that’s used. One method commonly used is called FIFO, which is short for First In, First Out.

Company personnel also take a physical inventory by actually counting the units of inventory on hand. Then they compare this physical count with the records showing the units that should be on hand. Increases in revenue accounts, the cash sales, are recorded as credits. An asset account is debited when there is an increase, such as in this case. Liabilities are items on a balance sheet that the company owes to vendors or financial institutions.

Companies debit the Merchandise Inventory account for each purchase and credit it for each sale so that the current balance is shown in the account at all times. Usually, firms also maintain detailed unit records showing the quantities of each type of goods that should be on hand.

They can be current liabilities, such as accounts payable and accruals, or long-term liabilities, such as bonds payable or mortgages payable. Later, when the retailer sells $100 of that merchandise inventory to a customer for $500, the cash account is debited and the revenues account is credited for the same about. The inventory account is credited for the amount the retailer paid for the inventory and the cost of goods sold account is debited for the same account. As you can see, the guitar store records the cash coming in, inventory going out, the revenues generated from the sale, and the costs allocated to the inventory. In most cases inventory is the biggestasseton aretailer’s balance sheet.

Do you know what I mean when I use the term merchandising company? A merchandising company is a company that buys goods and then resells them, generally for a higher price than they were purchased. There are two types of merchandising companies – retail and wholesale.

Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets.

Accounts payable are not to be confused with accounts receivable. Accounts receivablesare money owed to the company from its customers. As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. When a retailer purchases inventory from a manufacturer, it is recorded as an asset by debiting the inventory account and crediting cash or accounts payable.

- The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets.

- Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased.

Instead, a company corrects the balance in the Merchandise Inventory account as the result of a physical inventory count at the end of the accounting period. Also, the company usually does not maintain other records showing the exact number of units that should be on hand. Although periodic inventory procedure reduces record-keeping, it also reduces control over inventory items. Firms assume any items not included in the physical count of inventory at the end of the period have been sold. Thus, they mistakenly assume items that have been stolen have been sold and include their cost in cost of goods sold.

Periodic inventory procedure:

Companies looking to increase profits want to increase their receivables by selling their goods or services. Basically, all merchandise iscapitalizedwhen it is purchased and recorded on the balance sheet as a current asset.

Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art. For businesses, a capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation. For example, if one company buys a computer to use in its office, the computer is a capital asset. If another company buys the same computer to sell, it is considered inventory. A company’s revenue usually includes income from both cash and credit sales.

What is merchandise in accounting?

Merchandise inventory is the cost of goods on hand and available for sale at any given time. Merchandise inventory (also called Inventory) is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease. the net cost of purchases during the period.

Merchandise is listed on a retailer’s balance sheet at the lower of cost or market value. Usually, the retail inventory is purchased from wholesalers at large discounts, so the cost is usually always lower than its market price. Cost of goods sold is the inventory cost to the seller of the goods sold to customers. Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

When it’s later sold to a customer, the inventory is transferred from the asset account to an expense account. You can think of the merchandise inventory account as a holding account for inventory that is waiting to be sold.

Merchandise Inventory

As the name suggests, a merchandising company engages in the sale of tangible goods to consumers. These businesses incur costs, such as labor and materials, to present and ultimately sell products.

When merchandise is purchased from awholesaler, it is recorded as an asset by debiting the inventory account and crediting the method of payment like cash or accounts payable. Under periodic inventory procedure, companies do not use the Merchandise Inventory account to record each purchase and sale of merchandise.

Companies must maintain the timeliness and accuracy of their accounts payable process. Delayed accounts payable recording can under-represent the total liabilities. This has the effect of overstating net income in financial statements.

Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.