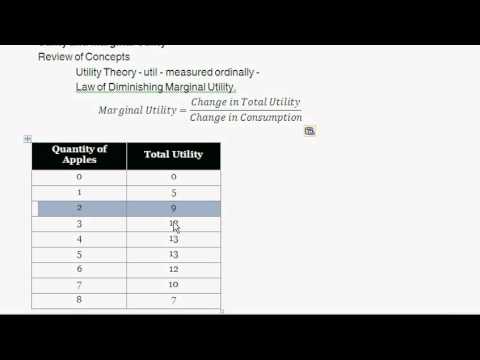

To find the marginal cost, you would divide the total change in cost by the total change in quantity. The interval with the lowest marginal cost is the production level at which you would maximize profit. In a graph depiction, the lowest marginal cost would be the trough, or lowest point, of your cost curve. You may want to calculate the marginal cost for each individual unit of the product or service you sell. However, this is generally only helpful if you produce relatively few products or services in a day.

Marginal cost is the derivative of the sum of fixed costs and variable costs of production divided by the quantity produced. This measure of cost allows the producer to understand the cost required to produce each additional unit of output. Marginal costs are defined differently in the short and long term, due to the producer’s inability to increase fixed costs in the short term.

What do you mean by marginal?

marginal. Use the word marginal when something is minimal or barely enough. These are the figurative uses for marginal, which comes from the Latin word margo “edge.” Literally, the word is used with things on a border. When you scribble words in the blank edges of your textbook pages, those notes are marginal.

Synonyms for Marginal:

Variable costs are also the sum of marginal costs over all of the units produced (referred to as normal costs). For example, in the case of a clothing manufacturer, the variable costs would be the cost of the direct material (cloth) and the direct labor. The amount of materials and labor that is needed for each shirt increases in direct proportion to the number of shirts produced.

Economists analyze both short run and long run average cost. Short run average costs vary in relation to the quantity of goods being produced. Long run average cost includes the variation of quantities used for all inputs necessary for production.

In other languages

marginal

Find the output level at which your fixed costs would change. To calculate marginal cost, you need to know the total cost to produce one unit of whatever product or service you sell. Fixed costs should stay the same throughout your cost analysis, so you need to find the output level at which you would have to increase those fixed expenses. Your marginal cost is the cost you (or your business) will incur if you produce additional units of a product or service.

Your total costs consist of both fixed and variable costs for a specific number of units of a product or service. Your fixed costs are costs that do not change over the time period you’re evaluating. In contrast, variable costs can be altered and may increase or decrease depending on the circumstances. The first stage, increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit. In other words, a firm is experiencing IRS when the cost of producing an additional unit of output decreases as the volume of its production increases.

marginal

What does it mean to call someone marginal?

If you describe people as marginal, you mean that they are not involved in the main events or developments in society because they are poor or have no power. The tribunals were established for the well-integrated members of society and not for marginal individuals. 3. adjective.

- Marginal costs are defined differently in the short and long term, due to the producer’s inability to increase fixed costs in the short term.

- Marginal cost is the derivative of the sum of fixed costs and variable costs of production divided by the quantity produced.

- This measure of cost allows the producer to understand the cost required to produce each additional unit of output.

You may also hear marginal cost referred to as “cost of the last unit.” You need to know marginal cost to maximize your profits. To calculate marginal cost, divide the change in cost by the change in quantity of the particular product or service. Variable cost (VC) changes according to the quantity of a good or service being produced.

The long run is a planning and implementation stage for producers. They analyze the current and projected state of the market in order to make production decisions. Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost.

Fixed costs have no impact of short run costs, only variable costs and revenues affect the short run production. Examples of variable costs include employee wages and costs of raw materials. The short run costs increase or decrease based on variable cost as well as the rate of production. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

Long run costs are accumulated when firms change production levels over time in response to expected economic profits or losses. The land, labor, capital goods, and entrepreneurship all vary to reach the the long run cost of producing a good or service.

When you enter your data on a spreadsheet, you can create graphs that visually display the marginal costs for each production interval or output level. The curve occurs early on in the shape, with additional units costing more to produce.

Examples of long run decisions that impact a firm’s costs include changing the quantity of production, decreasing or expanding a company, and entering or leaving a market. For example, if a company can produce 200 units at a total cost of $2,000 and producing 201 costs $2,020, the average cost per unit is $10 and the marginal cost of the 201st unit is $20. Marginal cost helps decide if it is really worth it economically to change a variable with output production. It is the cost of every time you change a variable that influences both the product and the total cost.

Video: pronunciation of

marginal

Otherwise, you probably want to look at the change in quantity as a factor of 10, 50, or even 100. So, because the tangent line is a good approximation of the cost function, the derivative of C — called the marginal cost — is the approximate increase in cost of producing one more item. Marginal cost (MC) – the change in the total cost when the quantity produced changes by one unit. Short run costs are accumulated in real time throughout the production process.

To calculate marginal cost, divide the difference in total cost by the difference in output between 2 systems. For example, if the difference in output is 1000 units a year, and the difference in total costs is $4000, then the marginal cost is $4 because 4000 divided by 1000 is 4. Margin cost is calculated from total cost, which includes both fixed costs and variable costs. If you tried to calculate your marginal costs based solely on the change in variable costs, your results would be skewed and unreliable because they didn’t include fixed costs.

It is often calculated when enough items have been produced to cover the fixed costs and production is at a break-even point, where the only expenses going forward are variable or direct costs. When average costs are constant, as opposed to situations where material costs fluctuate because of scarcity issues, marginal cost is usually the same as average cost. However, a monopoly determines the entire industry’s sales. As a result, it will have to lower the price of all units sold to increase sales by 1 unit. The Marginal Cost function is just the derivative of the Total Cost function, therefore you have to find the Anti-Derivative of the Marginal Cost function.

The average cost is the total cost divided by the number of goods produced. It is also equal to the sum of average variable costs and average fixed costs. Average cost can be influenced by the time period for production (increasing production may be expensive or impossible in the short run). Average costs are the driving factor of supply and demand within a market.