However, if the salary cost is classified as a manufacturing (product) cost, then it will be added to Work In Process Inventory along with other manufacturing costs for the period. To the extent that goods are still in process at the end of the period, part of the salary cost will remain with these goods in the Work in Process Inventory account. Only that portion of the salary cost that has been assigned to finished units will leave the Work In Process Inventory account and be transferred into the Finished Goods Inventory account. In like manner, to the extent that goods are unsold at the end of the period, part of the salary cost will remain with these goods in the Finished Goods Inventory account.

The insurance company’s liability is probably just $156,000, which is the amount of cost associated with the ending Finished Goods inventory as shown in part above. The relevant measure of activity for a steel company is probably the volume of steel produced. Fixed costs for a steel company include factory rent and depreciation, property taxes, many administrative costs, salaries, and periodic depreciation of equipment.

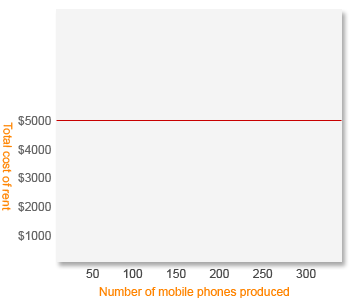

Example of Mixed Costs

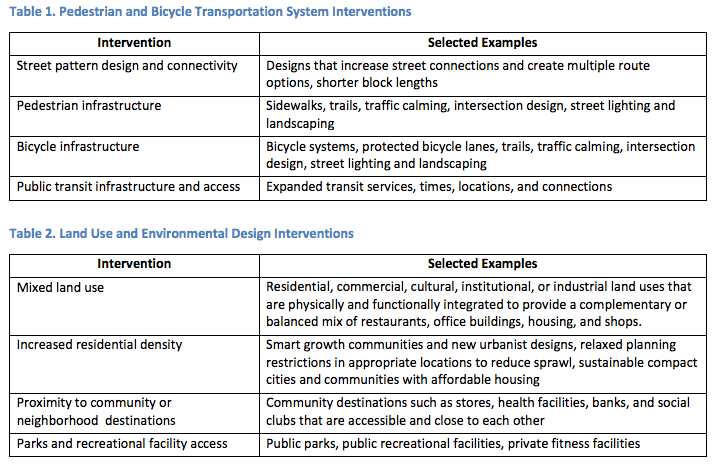

2-5The schedule of cost of goods manufactured lists the manufacturing costs that have been incurred during the period. These costs are organized under the three major categories of direct materials, direct labor, and manufacturing overhead. The total costs incurred are adjusted for any change in the Work in Process inventory to determine the cost of goods manufactured (i.e. finished) during the period. No, the insurance company probably does not owe Solar Technology $226,000. The key question is how “cost” was defined in the insurance contract.

In contrast to fixed costs, variable costs vary (in total) directly with changes in volume of production or sales. In particular, total variable costs change as total volume changes. If pizza production increases from inch pizzas to inch pizzas per day, the amount of dough required per day to make 10-inch pizzas would double. Direct materials and sales commissions are variable costs. Accountants look at your factory overhead account to find your mixed costs.

Mixed Cost

A number of different measures of activity could be used at a hospital. Some hospitals use a measure called patient-days, which counts a patient in the hospital for one day as a patient-day. Fixed costs at a hospital include the rental and depreciation of buildings, administrative salaries, utilities, insurance, and the costs of equipment.

Variable costs include the costs of drugs and supplies and some labor costs. A company could treat the cost of fringe benefits relating to direct labor workers as part of manufacturing overhead. This approach spreads the cost of such fringe benefits over all units of output.

Variable costs are directly tied to your sales and production. Gross profit is simply total revenue minus the cost of goods sold, or COGS.

2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs. The flow is from direct materials, direct labor, and manufacturing overhead to Work in Process.

Rent for a factory, for example, could be tied directly to the production facility. However, companies can sometimes tie fixed costs to the units produced in a particular facility. A cost that is classified as a period cost will be recognized on the income statement as an expense in the current period. If some units are unsold at the end of the period, the costs of those unsold units are treated as assets. Therefore, by reclassifying period costs as product costs, the company is able to carry some costs forward in inventories that would have been treated as current expenses.

Alternatively, the company could treat the cost of fringe benefits relating to direct labor workers as additional direct labor cost. This latter approach charges the costs of fringe benefits to specific jobs rather than to all units of output. 2-8Yes, costs such as salaries and depreciation can end up as assets on the balance sheet if these are manufacturing costs. Manufacturing costs are inventoried until the associated finished goods are sold. Thus, if some units are still in inventory, such costs may be part of either Work in Process inventory or Finished Goods inventory at the end of a period.

Factory overhead contains all your manufacturing costs except the direct materials and direct labor. Some mixed manufacturing costs originate from your leased factory equipment and machinery. A mixed cost contains a fixed base rate and a variable rate that fluctuates with use.

- 2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs.

- As goods are completed, their cost is removed from Work in Process and transferred to Finished Goods.

If Company XYZ decides to produce 2,000,000 widgets next year, its total production costs may only rise to $1,500,000 ($0.75 per widget) because it can spread its fixed costs over more units. Although Company XYZ’s total costs increase from $1,000,000 to $1,500,000, each widget becomes less expensive to produce and therefore more profitable. The difference between fixed and variable costs is essential to know for your business’s future. Variable expenses are tied in to your business’s productivity.

2-3A product cost is any cost involved in purchasing or manufacturing goods. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. A period cost is a cost that is taken directly to the income statement as an expense in the period in which it is incurred. This idea is also referred to as diminishing marginal cost.For example, let’s assume it costs Company XYZ $1,000,000 to produce 1,000,000 widgets per year ($1 per widget). This $1,000,000 cost includes $500,000 of administrative, insurance, and marketing expenses, which are generally fixed.

The amount of raw materials and inventory you buy and the costs of shipping and delivery are all variable. The more in demand your products are, the more the costs go up. Fixed costs include rent, utilities, payments on loans, depreciation and advertising. You can change a fixed cost – move to somewhere with lower rent, for instance – but the costs don’t fluctuate otherwise. Even if the economy craters and your sales drop to zero, fixed costs don’t disappear.

Are utilities a mixed cost?

Example of Mixed Costs The annual expense of operating an automobile is a mixed cost. Some of the expenses are fixed because they do not change in total as the number of annual miles change. These include insurance, parking fees, and some depreciation.

Managerial Accounting

The $226,000 figure is overstated since it includes elements of selling and administrative expenses as well as all of the product costs. The $226,000 figure also does not recognize that some costs incurred during the period are in the ending Raw Materials and Work in Process inventory accounts, as explained in part above.

Although direct costs are typically variable costs, they can also be fixed costs. Rent for a factory, for example, could be tied directly to a production facility. You can categorize your business costs as fixed, variable and mixed based on how they change in response to your sales or production output. Fixed costs remain the same no matter how many units you produce or sell.

Variable costs include the cost of raw materials, some energy costs, some labor costs, and some supply costs. The reported net operating income for the year will differ depending on how the salary cost is classified. If the salary cost is classified as a selling expense all of it will appear on the income statement as a period cost.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The remainder of the salary costs will be on the balance sheet as part of inventories. Although direct costs are typically variable costs, they can also include fixed costs.

Merchandising Mixed Costs

As goods are completed, their cost is removed from Work in Process and transferred to Finished Goods. As goods are sold, their cost is removed from Finished Goods and transferred to Cost of Goods Sold. No distinction has been made between period expenses and product costs on the income statement filed by the company’s accountant. Since there were ending inventories, some of the product costs should appear on the balance sheet as assets rather than on the income statement as expenses.