Unlike an LLP that has to be taxed as a pass-through, in an LLC you can choose how you’re taxed. LLCs and LLPs are both legal entities that allow companies to engage in business activity. LLCs are typically better for most small business owners because they offer more tax flexibility, are easier to set up and have fewer restrictions on members. An LLP is better for forming partnerships to practice accounting, architecture or law. Limited liability companies and limited liability partnerships are special organizations that hybrid aspects of partnership with benefits of corporations.

Limited liability organization owners receive tax deductions and lower reported income for business losses. Limited liability is a type of legal structure for an organization where a corporate loss will not exceed the amount invested in a partnership or limited liability company. In other words, investors’ and owners’ private assets are not at risk if the company fails. In Germany, it’s known as aftungHeschränkter bit mesellschaft G.

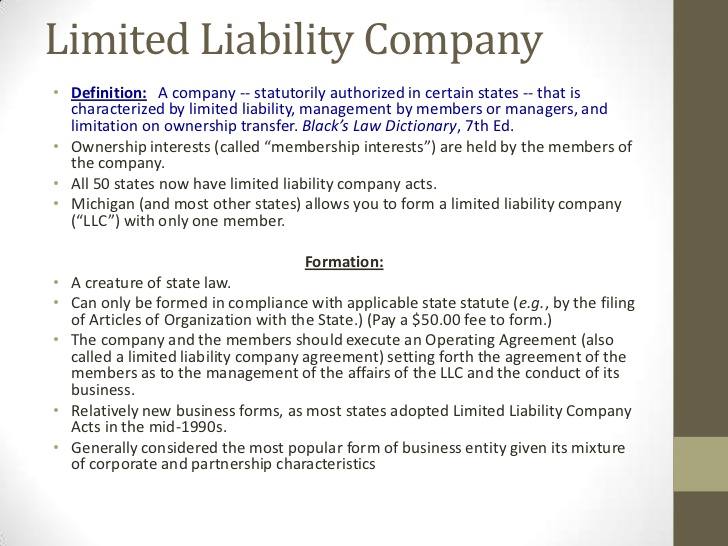

When setting up an LLC, you’ll need to choose a business name that complies with your state’s rules for LLC names. The main part of the business name is generally very flexible, but each state has a list of prohibited words, such as “corporation,” “incorporated,” “insurance,” “city,” and others. Your legal name must end with an LLC designator, such as “Limited Liability Company,” “LLC,” etc. Also, the name cannot be the same as another LLC on file in the state in which you are filing.

Limited liability is a legal status where a person’s financial liability is limited to a fixed sum, most commonly the value of a person’s investment in a company or partnership. If a company with limited liability is sued, then the claimants are suing the company, not its owners or investors. The same is true for the members of a limited liability partnership and the limited partners in a limited partnership.

Limited Liability Partnerships

By contrast, sole proprietors and partners in general partnerships are each liable for all the debts of the business (unlimited liability). LLCs can be started by either individuals or partnerships, usually to separate an owner’s business and personal finances. Unless an LLC elects to be taxed like a corporation, the IRS views it as either a sole proprietorship or partnership and requires the company’s income to be reported on the individual’s tax return. In these cases, the LLC isn’t legally required to maintain an income or report a profit.

A limited liability company, or LLC, is a legal structure that provides businesses run by single owners or partnerships with increased legal and personal asset protections. Any small business can organize as an LLC, which can give owners different options for filing and reporting taxes. As the names suggest, LLCs and LLPs protect their owners from the lawsuits and actions against their businesses.

What does it mean to have limited liability?

Limited liability is a type of legal structure for an organization where a corporate loss will not exceed the amount invested in a partnership or limited liability company. The limited liability feature is one of the biggest advantages of investing in publicly listed companies.

Limited Liability

This means that a physician who is part of a group practice organized as an LLP doesn’t have to worry about his personal assets if his group is sued for the malpractice of another doctor in the group. In this sense limited liability organizations give the same protections as corporations, which is a distinct advantage over partnerships and proprietorships. However, in an LLP, the managing partner or partners receive control but also bear full legal responsibility for the organization and are personally on the line. A limited liability company (LLC) is a business structure in the United States whereby the owners are not personally liable for the company’s debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

Which Type of Organization Is Best For Your Business?

Limited liability companies involve owners called members who can be individuals or corporations. Limited liability partnerships involve one or two managing partners who bear full liability as in a simple partnership, and then limited or silent partners who receive liability protections.

While the limited liability feature is similar to that of a corporation, the availability of flow-through taxation to the members of an LLC is a feature of partnerships. A limited liability company (LLC) is a corporate structure in the United States whereby the owners are not personally liable for the company’s debts or liabilities. A limited liability company (LLC) is the recommended legal entity for most small businesses. Unless you plan to practice law, accounting, or architecture, an LLC is a better choice over the LLP. LLCs are also better for holding real estate and offer more tax flexibility than an LLP.

- A limited liability company, or LLC, is a legal structure that provides businesses run by single owners or partnerships with increased legal and personal asset protections.

- As the names suggest, LLCs and LLPs protect their owners from the lawsuits and actions against their businesses.

Like other types of partnerships, limited liability partnerships involve having at least two individuals act as owners of a business. This involves contributing to and sharing the financial results, whether good or bad, and each individual putting his effort and expertise into operating the business. Partners may all act as managers unlike what regular limited partnerships allow. Further, each partner’s financial risk lies just in the funds he’s invested, so there’s less concern over creditors taking personal assets if the business doesn’t succeed. U.S. businesses can be formed as sole proprietors, partnerships, qualified joint ventures, corporations, limited liability companies, trusts, or estates.

By 2010, LLCs became recognized in all 50 states and in the District of Columbia, each with its own state statutes regulating the creation, management, and termination surrounding LLCs. Similar to a corporation, an LLC is individual legal entity that has the capability to sue or to be sued. A Limited Liability Company or LLC is a business structure in which the owners or members have limited liability with respect to the actions of the company. An LLC offers the members the benefit of personal liability protection, meaning that the business liability cannot be recovered from the personal assets of the owners. If you plan to operate a business with at least one other person and want to limit risk to your personal assets, then you might consider forming a limited liability partnership.

A sole proprietor running a small business may decide to re-structure his business holdings at some point to reduce the level of liabilities. In a limited liability company, personal assets are no longer subject to business liabilities and business assets can not be seized in the event of a personal bankruptcy. A personal vehicle used for business purposes can be transferred into the LLC with certain considerations. Owners of an S-Corp can pay themselves a salary and are exempt from self-employment tax. What’s more, like LLCs and LLPs, S-Corps do not pay taxes on corporate profits as those taxes are passed on to company owners each year.

Both LLPs and LLCs shield their owners from personal liability resulting from company obligations or damages resulting from their operations. LLPs offer a greater degree of liability protection to partners engaged in the management of their business. There are also several cases in which the owners of either LLCs or LLPs can expose themselves to personal liability.

Alphabet has created a holding company called XXVI Holdings Inc. that will be the umbrella over Alphabet and all its businesses; the name refers to the 26 letters in the English alphabet. In addition, Google itself will change from a corporation to a limited liability company (LLC), which Alphabet believes better fits an affiliate company owned by a parent.

This structure is used when there is more than one member of the LLC being formed. This partnership means each of the co-owners is now responsible for the debts, business transactions and taxes the business creates. Each of them has a say in the sale of assets, and each of them pays taxes on her share of the business income. There are different types of limited liability companies, and each has its own benefits. Several limited liability structures exist such as limited liability partnerships (LPs and LLPs), limited liability companies (LLCs), and corporations.

Limited liability companies are created with members that are not personally liable for the company’s debts. In fact, multi-member LLCs are considered partnerships by default. An LLC that is designated as a partnership is not taxed and must comply with Form 1065 and Schedule K-1 requirements.

While there is no IRS penalty on an LLC for not generating an income, states charge filing and annual fees to maintain an LLC. In an LLP all partners have protection against personal liability, even from actions taken by other partners. Where LLC owners sometimes give up personal liability protection if they’re actively engaged in the management of the company, this is not the case for limited liability partnerships.

A LLP is a separate legal entity which provides limited liability for the members in respect of some of the liabilities of the business, like a limited liability company. Businesses that are larger or need to raise capital may find alternatives to both an LLP and LLC a better fit. You can learn more about how other entities stack up by reading our LLC vs. S-Corp vs. C-Corp article. Regardless of the legal structure you choose for your business, you may also benefit from registering a DBA (doing business as).

Such companies usually do work in professional services industries like law, medicine and engineering and allow each partner to work independently. Limited liability organizations enjoy “pass through” taxation. This means the company itself pays no taxes and instead passes the profits and losses through to its owners in proportion to their shares of equity. Owners then include the profits or losses allocated to them on their personal tax returns. This creates a significant advantage over corporations, whose shareholders do not receive any personal financial relief from their company’s losses.

However, there are cases where the liability shield can be pierced. A limited liability company (LLC) is a fairly modern business entity that is governed by the laws of each state. In the 1970s, Florida and Wyoming became the first states to recognize this type of business structure.

Variations within these categories can exist and will depend on each individual situation. Here we explore the definitions and differences of limited, general, and joint venture partnerships.