Marketable Securities

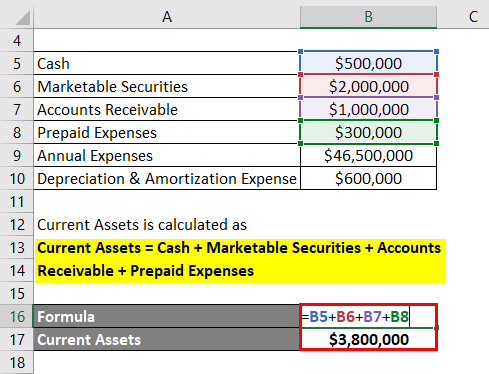

A current asset is anything a business owns that a business expects to convert into cash in less than one year. Lenders like to see a strong position in current assets on a firm’s balance sheet because it means the company is likely to be able to meet its short-term obligations.

Owning shares of a company’s stock represents a percentage of ownership in the company. As the company grows and increases in value, the investor may receive a dividend or monetary return from the company in the form of a higher share price. Investment companies known as mutual funds sell fund shares and use the income generated from sales to manage and maintain a portfolio of securities. A mutual fund may choose to focus its portfolio on a particular type of security or combine types of securities as an investment strategy.

In general, market securities are traded on public stock or bond exchanges because these are markets where a buyer can be found quickly. Typically, they’re very low-risk investments, but they tend to produce low rates of return. Marketable securities refers to assets that can be sold within a short period of time, generally through a quoted public market. Marketable securities provide investors with a liquidity comparable to cash along with the ability to earn a return when the assets are not being used.

Securities may be represented by a certificate or, more typically, “non-certificated”, that is in electronic (dematerialized) or “book entry” only form. A security is a financial instrument or document that represents a claim on the entity that issues the document. A security is also a financial asset that holds monetary value and can be purchased or sold in the appropriate financial market or exchange.

There are two basic requirements for a company to classify an investment as short-term. First, it must be liquid, like a stock listed on a major exchange that trades frequently or U.S.

No matter what it invests in, a mutual fund is considered a marketable security, because it can provide a financial return and is highly liquid. Marketable equity securities include investments in common and preferred stock.

Second, the management must intend to sell the security within a relatively short period, such as 12 months. Marketable debt securities, aka “short-term paper,” that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments.

Investing in marketable securities offers a modest amount of income from funds held in reserve, which is a better option than simply letting them sit idle. Bonds are the most common form of marketable debt security and are a useful source of capital to businesses that are looking to grow.

Current Ratio

Cash and cash equivalents, such as money in checking or savings accounts, are the first items listed. For example, a company can sell Treasury bonds it owns simply by placing the order with a broker. Inventory is considered the least liquid current asset type, so it comes last. In this case, the sale is added to accounts receivable and doesn’t produce any cash until payment arrives from the customer.

- Mutual FundsA Mutual Fund is an investment fund that raises money from investors – shareholders – and invests in stocks, bonds, options, commodities and other marketable securities.

Are Marketable Securities Current Assets?

The two major investments were corporate securities, which represented $138 billion, and U.S. The company’s investment in commercial paper was worth $17.4 billion and mutual funds were $800 million.

Unit Investment Trust – UITA Unit Investment Trust is an investment security with features similar to both mutual funds and fixed income securities. Shares or ‘Units’ of the trust are sold to investors, who receive a pro-rated portion of interest and principal from the investment. Similar to fixed income securities, Units are generally sold in principal amounts of $1,000 or greater, and make regular interest and principal payments. Apple Inc. also held short-term investments, listed as marketable securities, of $254 billion as of March 31, 2018.

Mutual FundsA Mutual Fund is an investment fund that raises money from investors – shareholders – and invests in stocks, bonds, options, commodities and other marketable securities. Mutual funds offer investors instant diversification, for a small management fee (generally less than 1% of net assets), through access to a large, professionally managed, portfolio of investments. Marketable securities are defined as any unrestricted financial instrument that can be bought or sold on a public stock exchange or a public bond exchange. Therefore, marketable securities are classified as either marketable equity security or marketable debt security.

Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid. For the primary market to thrive, there must be a secondary market, or aftermarket that provides liquidity for the investment security—where holders of securities can sell them to other investors for cash. Otherwise, few people would purchase primary issues, and, thus, companies and governments would be restricted in raising equity capital (money) for their operations. Many smaller issues and most debt securities trade in the decentralized, dealer-based over-the-counter markets. Current asset types are listed in order of liquidity, with the most liquid appearing first.

What are examples of marketable securities?

Marketable securities are securities or debts that are to be sold or redeemed within a year. These are financial instruments that can be easily converted to cash such as government bonds, common stock or certificates of deposit.

government securities of $8.2 billion and certificates/time deposits of $7.3 billion. Mortgage/asset-backed securities were at $20 billion and municipal securities at $973 million, rounded out its short-term investments.

Investors do not actually own the individual instruments in the fund but hold rights to the fund as a whole. This means that the holdings in the fund can change as the financial markets fluctuate and fund managers buy and sell portfolio holdings. A marketable security is a highly liquid financial instrument, such as publicly traded bonds or shares of stock. “Liquid” means the security can easily be converted into cash on short notice by the business that holds it. A marketable security is a short-term investment, meaning the business plans to hold it for less than one year.

Trading Securities

The return on these types of securities is low, due to the fact that marketable securities are highly liquid and are considered safe investments. The combination of securities held by the mutual fund is known as its portfolio. Each share a fund sells indicates the portion of ownership in the fund portfolio and the revenue generated by the holdings.

Short-term investments, also known as marketable securities or temporary investments, are those which can easily be converted to cash, typically within 5 years. Many short-term investments are sold or converted to cash after a period of only 3-12 months. Some common examples of short term investments include CDs, money market accounts, high-yield savings accounts, government bonds and Treasury bills. Usually, these investments are high-quality and highly liquid assets or investment vehicles.