Types of Liabilities

Accounts payable include all of the company’s short-term debts or obligations. The analysis of current liabilities is important to investors and creditors. Banks, for example, want to know before extending credit whether a company is collecting—or getting paid—for its accounts receivables in a timely manner. On the other hand, on-time payment of the company’s payables is important as well.

After all, those are all positive numbers on a balance sheet that can make a company look great. But without considering the debt, business leaders are ignoring key indicators to the financial solvency of the company. Understand the difference between current vs. long-term liabilities, so that you can properly define needed working capital and ratios.

How Do Accounts Payable Show on the Balance Sheet?

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. Liabilities includes all credit accounts on which your business owes principal and interest. These debts typically result from the use of borrowed money to pay for immediate asset needs. Long-term liabilities include any accounts on which you owe money beyond the next 12 months. Proper double entry bookkeeping requires that there must always be an offsetting debit and credit for all entries made into the general ledger.

How Long-Term Liabilities are Used

Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000.

Business leaders should work with key financial advisors, such as bookkeepers and accountants to fully understand trends, and to establish strategies for success. Using long-term debt wisely can help grow a company to the next level, but the business must have the current assets to meet the new obligations added to current liabilities. Long-term liabilities are a useful tool for management analysis in the application of financial ratios.

The long-term debt is most often tied to major purchases used over time to operate the business. Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title.

The current portion of long-term debt is separated out because it needs to be covered by more liquid assets, such as cash. Long-term debt can be covered by various activities such as a company’s primary business net income, future investment income, or cash from new debt agreements. If a company has a loan payable that requires it to make monthly payments for several years, only the principal due in the next twelve months should be reported on the balance sheet as a current liability.

At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity. The other party would record the transaction as an increase to its accounts receivable in the same amount.

Together, current and long-term liability makes up the “total liabilities” section. Current accounts usually include credit accounts your business maintains for inventory and supplies.

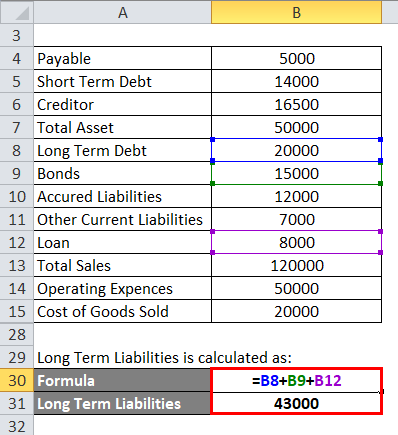

Long-Term Liabilities

The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivables, which is money owed by customers for sales. The ratio of current assets to current liabilities is an important one in determining a company’s ongoing ability to pay its debts as they are due.

When the bill is paid, the accountant debits accounts payable to decrease the liability balance. The offsetting credit is made to the cash account, which also decreases the cash balance. Accounts payable (AP) is an account within the general ledger that represents a company’s obligation to pay off a short-term debt to its creditors or suppliers. Another common usage of “AP” refers to the business department or division that is responsible for making payments owed by the company to suppliers and other creditors.

Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales. An example of a current liability is money owed to suppliers in the form of accounts payable. Current liabilities are defined over the course of a 12-month period, unless the company has elected a different financial cycle. Current liabilities are found with information on the balance sheet and income statement.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

Both the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities. A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders. For example, if the business above also received an invoice for lawn care services in the amount of $50, the total of both entries in accounts payable would equal $550 prior to the company paying off those debts. Owing others money is generally perceived as a problem, but long-term liabilities serve positive functions as well.

What are some examples of long term liabilities?

Examples of long-term liabilities are bonds payable, long-term loans, capital leases, pension liabilities, post-retirement healthcare liabilities, deferred compensation, deferred revenues, deferred income taxes, and derivative liabilities.

A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default.

Current liability obligations play a different role than long-term liabilities. Although some people use the phrases “accounts payable” and “trade payables” interchangeably, the phrases refer to similar but slightly different situations. Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory.

Long-term liabilities include mortgage loans, debentures, long-term bonds issued to investors, pension obligations and any deferred tax liabilities for the company. Keep in mind that a portion of all long-term liabilities is counted in current liabilities, namely the next 12 months of payments. Current liabilities are debts and interest amounts owed and payable within the next 12 months. Any principal balances due beyond 12 months are recorded as long-term liabilities.

To record accounts payable, the accountantcredits accounts payable when the bill or invoice is received. The debit offset for this entry is typically to an expense account for the good or service that was purchased on credit. The debit could also be to an asset account if the item purchased was a capitalizable asset.

Deduct this total from the total balance of the debt and enter it in the current liabilities section of the balance sheet. The account for this current portion is usually named Current (or Short term) portion of note (or loan) payable. Long term debt is defined as debt that matures in a period longer than one year from the date of the balance sheet. Generally accepted accounting principles (GAAP) requires the presentation of long term debt in two parts. Potential investors can determine a company’s risk exposure by calculating the long term debt to capitalization ratio.

These obligations include notes payable, accounts payable, and accrued expenses. A company may have many open payments due to vendors at any one time. All outstanding payments due to vendors are recorded in accounts payable.

The current ratio measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables. It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Long-term liabilities are any debts and payables due at a future date that’s at least 12 months out. This is reflected in the balance sheet, and they are obligations, but they do not pose an immediate threat to the financial stability of a company’s working capital.

Debtors are shown as assets in the balance sheet under the current assets section while creditors are shown as liabilities in the balance sheet under the current liabilities section. Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion. Calculate the current or short term portion of the debt by adding up the principal payments due each month during the company’s fiscal year.

Long-term financing at low interest rates helps your company grow and expand through new buildings and equipment. If your borrowing rate is low and your investment in assets pays big dividends, you made a wise move. Too much long-term liability can overwhelm your business, however. Plus, high long-term liabilities can scare off investors and new creditors. Business leaders love to talk about revenues, net profits and assets.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions. Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities.