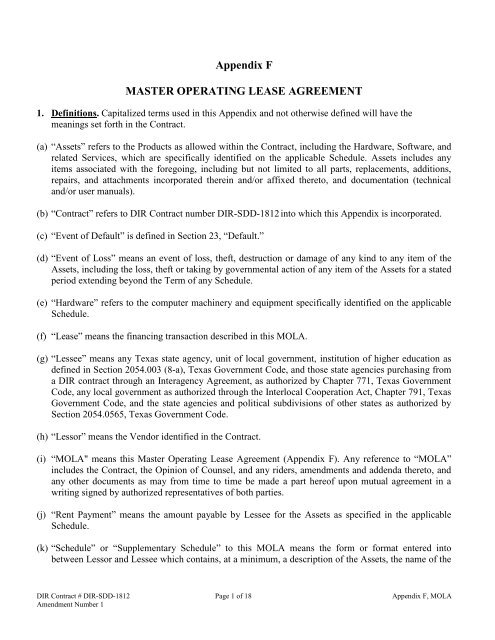

The document that has all the details written on it is called the lease. The person who owns the item that will be leased or rented is called the lessor. The person who is paying the money to use the item is called the lessee. If it is a house, building, or land that is being leased, the person who pays the money is called the tenant.

Special Consideration for Lessors

The lease agreement is a contract between the lessor vs lessee for the use of the asset or property. It outlines the terms of the contract and sets the legal obligations associated with the use of the asset. Both parties are signatories to the agreement and are required to abide by its rules. If either of the parties contravenes the conditions of the lease agreement, the contract can be terminated.

For example, a tenant farmer is a person who rents a farm from its owner. Lessor is among the many important contributors in two contributors of the leasing contract who owns or has the possession of the property and provides it as leasing to the lessee for a specified interval. The lessor will probably be every explicit individual and a licensed entity. In most of the circumstances, vendor and lessor of the property will probably be one and the equivalent particular person.

This can mean a substantial difference in balance sheet impact between a real estate gross lease and net lease. The Preliminary Views and first Exposure Draft called for eliminating the FAS 13 test which classifies leases as operating leases or capital leases, and treating all leases similarly to current capital leases. One implication of this is that expenses are “front loaded,” because interest expense is higher in the early part of the lease term while the liability is higher.

The lessee assumes both risks and benefits of the ownership of the asset. A capital lease is a long-term lease that spans most of the asset’s useful life. Leases with a maximum term of 12 months or less would be treated in accordance with current operating lease rules. With each payment, cash is debited, the receivable is credited, and unearned (interest) income is credited. If the cost or carrying amount of the asset being leased is different from its fair value at inception, then the difference is recognized as a profit and the lease is called a sales-type lease.

What is another word for lessor?

lessor Definitions and Synonyms someone who allows another person to pay to use their land or property under a lease (=a legal agreement). The person who uses the land or property is the lessee. Synonyms and related words.

Real Estate Investing Guide

For example, if the lessee conducts illegal activities on the premises of the lessor, the latter holds the right to cancel the contract and evict the lessee from the property. Some lease agreements include the option of the lessee buying the leased asset or property at the end of the lease period. Under an operating lease, the lessor records rent revenue (credit) and a corresponding debit to either cash/rent receivable. The asset remains on the lessor’s books as an owned asset, and the lessor records depreciation expense over the life of the asset. Instead, the rent is reclassified as interest and obligation payments, similarly to a mortgage (with the interest calculated each rental period on the outstanding obligation balance).

A lease is a contract between a property owner and a tenant that transfers the owner’s rights to the exclusive possession and use of the real estate property to the tenant for an agreed-upon period. The lease states the length of time the contract is to run and the amount of the tenant’s rent. In legal terms, the tenant’s legal right to possess the property is deemed tenancy. Subleasing occurs when the tenant transfers a part of their legal tenancy to a third-party as a new tenant.

A finance lease is very similar to buying an asset through external finance. It allows a lessee to own an asset with the help of direct finance from the lessor. The lessee has the option to be the permanent owner of the asset at the end of the lease term.

Who is lessor and who is lessee?

What is a Lessor? A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner of an asset that is leased under an agreement to a lessee. The lessee makes a one-time payment or a series of periodic payments to the lessor in return for the use of the asset.

- It lets the lessee use the leased asset for a specific period of time, which is generally less compared to the asset’s useful life.

- A finance lease is very similar to buying an asset through external finance.

- A lease is a legal agreement by which the owner of a specific asset (lessor) allows a second party (lessee) to use the asset for a specific period in exchange for periodic payments to the lessor.

In the final ASC 842 release, capital lease accounting has only minor changes, though they are now called “finance leases,” consistent with IFRS terminology. The concept of “executory costs,” which were excluded from capitalization under FAS 13, has been replaced by “nonlease components,” which are payments due as part of a lease agreement which reflect goods or services separate from the asset. Importantly, passthrough costs paid by the lessor and rebilled to the lessee, such as taxes and insurance, no longer qualify to be excluded from capitalization (either for finance or for operating leases).

This most commonly applies when a manufacturer is using leasing as a method of selling its product. Other capital lessor leases, where the cost and fair value are the same, are called direct financing leases.

Effective with the second Exposure Draft, the new standard has been given the new Accounting Standards Codification topic number 842 (the topic number for leases was previously 840). The accounting profession recognizes leases as either an operating lease or a capital lease (finance lease). An operating lease records no asset or liability on the financial statements, the amount paid is expensed as incurred. On the other hand, a capital lease is recorded as both an asset and a liability on the financial statements, generally at the present value of the rental payments (but never greater than the asset’s fair market value).

lessor Definitions and Synonyms

A lease is a legal agreement by which the owner of a specific asset (lessor) allows a second party (lessee) to use the asset for a specific period in exchange for periodic payments to the lessor. It lets the lessee use the leased asset for a specific period of time, which is generally less compared to the asset’s useful life.

If the lease has an ownership transfer or bargain purchase option, the depreciable life is the asset’s economic life; otherwise, the depreciable life is the lease term. Over the life of the lease, the interest and depreciation combined will be equal to the rent payments. Rental of personal property or real property for periods longer than a year, which is governed by the signing of a lease, is known as leasing. Leasing is usually used for high-value capital equipment, both in business and by consumers.

A third type of lessor capital lease, called a leveraged lease, is used to recognize leases where the acquisition of the leased asset is substantially financed by debt. A lease is a contract calling for the lessee (user) to pay the lessor (owner) for use of an asset for a specified period of time.

Lessor

The primary standard for lease accounting is Statement of Financial Accounting Standards No. 13 (FAS 13), which has been amended several times; it is known as topic 840 in the FASB’s new Accounting Standards Codification. Lease accounting is an important accounting section as it differs depending on the end user. A lessor is the owner of the asset and a lessee uses the leased asset by paying periodically to the lessor. The accounting and reporting of the lease in different ways has varying effects on financial statements and ratios.

As there are many ways to view how these contracts affect the balance sheets of both the lessee and lessor, FASB created a standard for US accountants and businesses. Renting (also called leasing) is where someone pays money to use something for a definite amount of time.

When the lessor leases an immovable property, he has the restricted rights over the belongings leased. The lessor might have restricted permission to enter for explicit restore and repairs features solely. However, he has correct to finish the lease contract in case he founds there’s any illegal use of the property or intentional damages triggered.

A lease in which the renter benefits from an increase in value of the asset is known as a finance lease. A leasing agreement which is not a finance lease is known as an operating lease. also referred to as finance lease, is a lease in which the lessee acquires full control of the asset and is responsible for all maintenance and other costs associated with the asset. GAAP requires that this type of lease agreement be recorded on the lessee’s balance sheet as an asset with a corresponding liability. Any interest and principal payments are recorded separately in the income statement.