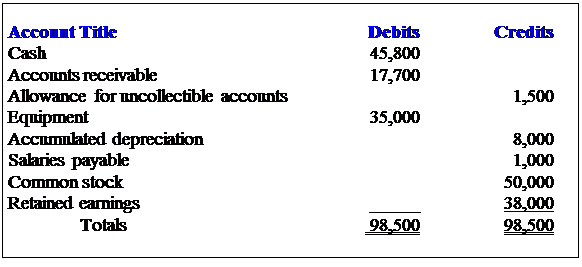

After Payroll Entry

It is usually included in the current liabilities on the balance sheet as it is expected to be paid within one year. Outstanding salaries are salaries that are due and have not yet been paid. Outstanding salaries is a liability and in particular an accrued expense.

Difference

between the salary expense and salary payable:

The organization is required to have a minimum of 20 employees and a payout of Rs 36 lakhs with an average salary per account of Rs per month. It is a zero balance salary account so that you don’t need to maintain minimum balance in the account. Employees will also get an International Debit card with no annual fees and higher cash withdrawal and spend limit per day. All individuals working in private, public sector companies are required to open a salary account where monthly salary can be credited by the employer.

Suppose in the above example the net wages due to the employee were 1,100. A business provides a cash advance to an employee part way through a month for 300. The amount is to be repaid at the end of the month when the employee receives payment of their wages for the month.

Types of Salary Payment Journal Entries

When the time comes for the company to pay its employees, the bank takes the money from the company’s account and then distributes it to the employers accordingly. However, if your question is related to the chapter “Company Final Accounts”, it will come under current Liability under the heading of “Other Current Liabilities”. So, you are not required to worry about fulfilling minimum balance requirement. HDFC Bank provides free International Debit Card with domestic shopping limit of Rs 2.75 lakhs and ATM cash withdrawal limit of Rs 50000. interest for end of day account balance of below ₹50 Lacs and 4% p.a.

Salary Payable

Free bill pay facility, free email alerts, fuel surcharge waiver and preferential rates on loan are some of the other features offered by HDFC Bank if you opt for Classic Salary Account. Additional Facilities – Check the additional facilities that the bank is providing with your salary account such as credit card, preferential rates on personal loan, home loan, car loan etc. As it can be noted that all the payables account has been cleared to 0 since they were paid out. These differences are helpful when considering any conversion of a Salary Account into a Savings Account, or if you frequently switch jobs. A Salary Account is an account to which your salary gets credited.

Is salary payable a debit or credit?

Salaries payable is a liability account that contains the amounts of any salaries owed to employees, which have not yet been paid to them. The balance in the account represents the salaries liability of a business as of the balance sheet date.

Corporate individuals are usually found asking about the best salary accounts available in India. Most of the companies have a tie-up with a bank which provides salary account to its employees.

On the other hand, if your bank permits, you can convert your Savings Account to your Salary Account. This is possible if you change your job, and your new employer happens to have a banking relationship with the same bank for its employees’ Salary Accounts. Outstanding Salary A/c is a Representative Personal Account as it represents a group of people to whom some amount of salary is payable. Similarly other outstanding and prepaid expenses also fall under the category of representative personal accounts.

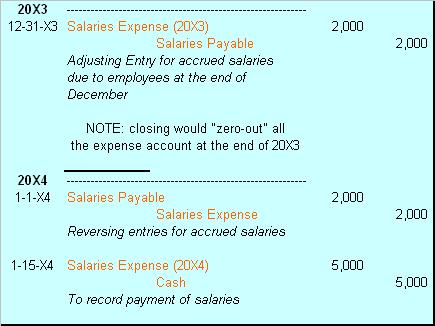

When the wage advance is made to the employee, the business will record the following payroll advance journal entry. The accrued salaries entry is a debit to the compensation (or salaries) expense account, and a credit to the accrued wages (or salaries) account.

Axis Bank assigns a dedicated relationship manager for all your banking needs and offers preferential treatment on entering an Axis Bank branch or while calling the phone banking centre. Also, it provides preferential rates on personal loans, home loans, car loans etc. Some of the additional benefits offered by Axis Bank are unlimited free NEFT transactions, SMS alerts. Employees will also get a complimentary Platinum Debit Card with annual charges waived. Also, employees will be able to avail a Personal Accidental Death of Rs 5 lakhs on debit card with an additional International Air Coverage of Rs 25 lakhs on purchase of air tickets with your HDFC Debit card.

- So, Unpaid salary to be shown as liability under ‘Expenses Payable’ or ‘Salary Payable’ in Balance sheet on liabilities side and on other aspect of dual entry to be placed in Profit & Loss Account.

- Outstanding salary account represents the salary due but not paid to its employees.

The column order on the spreadsheet is date, description, debit and credit. Enter the gross payroll amount (salary expense) in the debit (left) column. Starting on the next line, on one line each, enter a payable account in the description column and the amount deducted from your employee’s pay in the credit (right) column. Further, when the salary is paid, it can be paid via various methods which include Bank, Cash, Online modes, etc. and the same has to be entered in the journal entry. The main salary journal entry will be recording for the initial payroll.

What is Wages Payable?

Usually, banks open these accounts on request of corporations and major companies. Each employee of the company gets their own Salary Account which they are required to operate on their own.

Outstanding salary account represents the salary due but not paid to its employees. Further, to be very specific, the Oustanding salary account is having the nature of a representative personal account as it represents a person/ group of person to whom the entity is liable to pay salary. So, Unpaid salary to be shown as liability under ‘Expenses Payable’ or ‘Salary Payable’ in Balance sheet on liabilities side and on other aspect of dual entry to be placed in Profit & Loss Account. A payroll advance journal entry is used when a business wants to give an employee a cash advance of their wages. The payroll advance is in effect a short term interest free loan to the employee to be repaid when they next receive their wage payment.

This journal entry will be then reversed in the next accounting period so that the initial recognition or the initial recordation entry can take its place. This entry also can be ignored or avoided if the salary or wage amount is not material. Salary payable can be attributed to the type of payroll journal entry that shall be used to record in the books of account the compensation which shall be paid to the employees.

Personal accounts are subdivided into Natural account, Artificial account and Representative account. He was surprised and taken away with the facts I familiarized him about the salary account.

Salary payable is the amount of liability of the company towards its employees against the services provided by them but not yet paid. Salary payable is a current liability account that contains all the balance or unpaid amount of wages. Salary Accounts usually don’t come with a minimum balance requirement, while banks require that you maintain a certain amount of minimum balance in your Savings Account. Settle all dues and de-activate all auto payments of utility bills, credit cards, loan EMI’s, etc from that salary account.

He couldn’t believe the charges he paid to the banks for this ‘zero’ balance accounts. He had no idea what happened to his salary account after he left his job and kept the account activated. The other day, my friend was bragging me about how he holds 4 bank accounts (Salary) with their debit and credit card with over 5 lac limit. During further discussion, he disclosed that some of the accounts he had held for over 3 years now and that he wasn’t frequent with transactions because it was a zero balance account. Axis Bank introduced Priority Salary Account to provide its customers with exclusive benefits and enjoy Axis Priority privileges.

The features and benefits of the salary account can vary with the type of account your bank offers depending on the salary. But, there are many organizations that allow their employees to open a salary account with a bank as per their convenience. This is important because businesses tend to accrue payroll every day, so an accurate payroll accrual figure is a moving target. Noting the date indicates that your figures are specific to the timeframe when your financial statement was compiled.

In accordance to banks, they apply the credit to increment /increase(here in your bank account) and debit is known as decrement (suppose you have paid in by your debit card). Continuing with the above example and details, consider now that Vanilla Bond Pvt Ltd pays its employees salary on every 29th of the month via NEFT from Chase Bank account. You as the accountant of the firm are required to post the journal entries while making payment of salary in the books of account of the firm. Salary payable is classified as a current liability account that appears under the head of current liabilities on the balance sheet.

The accrued wages account is a liability account, and so appears in the balance sheet. If the amount is payable within one year, then this line item is classified as a current liability on the balance sheet.

Accounts payable is an obligation that a business owes to creditors for buying goods or services. Accounts payable do not involve a promissory note, usually do not carry interest, and are a short-term liability (usually paid within a month).

Payroll accruals are sums that your business owes to workers for hours they have worked. Because few companies pay employees immediately, there is usually a lag time between the end of a pay period and the date you compensate employees for their time. This information is relevant when you create a balance sheet because it represents an amount that your company does not actually own, although you may have the money in the bank. Payroll accruals are also important for internal accounting because they help your company to determine how much you spent on payroll during any given month.