Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The furniture’s salvage value is zero, and it is decided to provide depreciation @ 10% p.a. Importantly, depreciation should not be confused with an asset’s market value. Any decrease in the market value of an asset cannot be regarded as depreciation.

- GAAP only allows downward adjustments from historical cost, which are called impairment losses.

- With this method, your monthly depreciation amount will remain the same throughout the life of the asset.

- The path from traditional to modern accounting is different for every organization.

- The fixed asset and the accumulated depreciation will show up in the business’s balance sheet.

- They reduce this labor by using a capitalization limit to restrict the number of expenditures that are classified as fixed assets.

- Companies come to BlackLine because their traditional manual accounting processes are not sustainable.

A good example is a car, which can lose 30% of its market value as soon as you drive it off the lot, but its book value on the balance sheet will still be pretty close to the purchase price. GAAP only allows downward adjustments from historical cost, which are called impairment losses. This is a difference from IFRS, which allows for both upward and downward asset revaluation. An asset is any resource that has monetary value, however, depreciation applies only to what are referred to as fixed assets or tangible assets. BlackLine partners with top global Business Process Outsourcers and equips them with solutions to better serve their clients and achieve market-leading automation, efficiencies, and risk control.

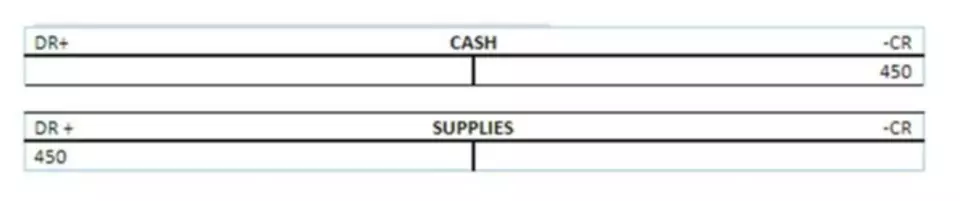

Journal Entry For Depreciation

More than 4,000 companies of all sizes, across all industries, trust BlackLine to help them modernize their financial close, accounts receivable, and intercompany accounting processes. Gain global visibility and insight into accounting processes while reducing risk, increasing productivity, and ensuring accuracy. Close the gaps left in critical finance and accounting processes with minimal IT support. Increase accuracy and efficiency across your account reconciliation process and produce timely and accurate financial statements. Drive accuracy in the financial close by providing a streamlined method to substantiate your balance sheet. Finally, depreciation is not intended to reduce the cost of a fixed asset to its market value.

Drive visibility, accountability, and control across every accounting checklist. When provision for depreciation/accumulated depreciation is maintained. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

The journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal entry to the accumulated depreciation account in the balance sheet. The journal entry for depreciation can be a simple entry designed to accommodate all types of fixed assets, or it may be subdivided into separate entries for each type of fixed asset. Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.

The goal is to match the cost of the asset to the revenues in the accounting periods in which the asset is being used. An adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and the decrease in value of the fixed asset on the balance sheet. The entry generally involves debiting depreciation expense and crediting accumulated depreciation. If you’re lucky enough to use an accounting software application that includes a fixed assets module, you can record any depreciation journal entries directly in the software. In many cases, even using software, you’ll still have to enter a journal entry manually into your application in order to record depreciation expense.

A provision for depreciation or an accumulated depreciation account is maintained where depreciation is credited separately. Outside of the accounting world, depreciation means the decline in value of an item after purchase. In accounting, depreciation is the process of allocating the cost of an item over its anticipated useful life.

This provides a complete journal entry management system that enables accountants to create, review, and approve journals, then electronically certify and store them with all supporting documentation. Businesses also follow the double-entry system of accounting, which holds that every transaction has an equal and opposite effect in at least two different places. According to the double-entry system, entries will also be made in a so-called contra asset account.

Monitor changes in real time to identify and analyze customer risk signals. However, it can indirectly impact cash flow by reducing taxable income and, as a result, lowering the amount of taxes that a company has to pay. This method requires you to assign all depreciated assets to a specific asset category. An updated table is available in Publication 946, How to Depreciate Property. When using MACRS, you can use either straight-line or double-declining method of depreciation.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. A lorry costs $4,000 and will have a scrap value of $500 after continuous use of 10 years.

What is the journal entry to record depreciation expense?

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the financial statements, the net income of the concerned company is decreased by the same amount. However, the company’s cash reserve is not impacted by the recording as depreciation is a non-cash item. Therefore, the cash balance would have been reduced at the time of the acquisition of the asset.

- The accelerated depreciation method calculates a faster rate of depreciation in the early life of the asset, which is beneficial for tax purposes.

- Over time, the net book value of an asset will decrease until its salvage value is reached.

- In each accounting period, part of the cost of certain assets (equipment, building, vehicle, etc.) will be moved from the balance sheet to depreciation expense on the income statement.

- The units of production depreciation method is useful when calculating depreciation for a piece of equipment or machinery whose useful life is based on the number of units it will produce rather than a specific number of years.

- Automatically create, populate, and post journals to your ERP based on your rules.

- It’s important to note that the book value of an asset may differ significantly from its market value.

Calculating depreciation accurately and recording it promptly can help reduce your taxes, provide investors with a much better picture of your business finances, and ensure that your balance sheet and income statement are accurate. Let us consider the example of a company called XYZ Ltd that bought a cake baking oven at the beginning of the year on January 1, 2018, and the oven is worth $15,000. The owner of the company estimates that the useful life of this oven is about ten years, and probably it won’t be worth anything after those ten years. Show how the journal entry for the depreciation expense will be recorded at the end of the accounting period on December 31, 2018. The depreciation journal entries in the contra asset account will be cumulative, which means that over time they will add up until they offset the total original value of the asset. Depreciation journal entries will be recorded as debits in the expense account.

Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers. Go beyond with end-to-end transformation.Powerful technology is only part of the story. Successful transformation requires expert guidance from a trusted partner.

The Difference Between Carrying Cost and Market Value

This decrease in value is matched with an increase in accumulated depreciation, which provides a more accurate valuation of assets on the balance sheet. Even if you’re using accounting software, if it doesn’t have a fixed assets module, you’ll still be entering the depreciation journal entry manually. For those still using ledgers and spreadsheets, you’ll also be recording the entry manually, but in your ledgers, not in your software. As a contra account, accumulated depreciation reduces the book value of that asset on the balance sheet.

When assets are purchased, they are recorded at their historical cost in an asset account on the balance sheet. At the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. The main objective of a journal entry for depreciation expense is to abide by the matching principle.

The reason for using depreciation to gradually reduce the recorded cost of a fixed asset is to recognize a portion of the asset’s expense at the same time that the company records the revenue that was generated by the fixed asset. Prior to recording a journal entry, be sure that you have created a contra asset account for your accumulated depreciation, which will be used to track your accumulated depreciation expense entries to date. When recording a journal entry, you have two options, depending on your current accounting method. The depreciation expense appears on the income statement like any other expense. The accumulated depreciation is a contra asset account; it is shown as a deduction from the cost of the related asset in the balance sheet.

Without accurate information, organizations risk making poor business decisions, paying too much, issuing inaccurate financial statements, and other errors. To mitigate financial statement risk and increase operational effectiveness, consumer goods organizations are turning to modern accounting and leading best practices. Simply sticking with ‘the way it’s always been done’ is a thing of the past.

Double declining depreciation

Finance and IT leaders share a common goal of equipping their organizations with ways to work smarter to enable competitive advantage. This intersection between CFO and CIO priorities is driving more unity in terms of strategy and execution. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

This method requires you to assign each depreciated asset to a specific asset category. Remember that depreciation rules are governed by the IRS, and the method you choose to depreciate your assets will directly affect year-end taxes, so choose wisely. The method currently used by the IRS is the Modified Accelerated Cost Recovery System (MACRS). Finally, accountants will determine the residual value or salvage value of the asset, which is what the asset will likely sell for at the end of its useful life. This loss in value must be accurately recorded so it can be properly factored into the business’s total, or net, asset calculations.