The US GAAP requires that all selling and administrative expenses be treated as period costs. Example of period costs includes marketing costs, office rent, and indirect labor. This video explains the concept of period costs in managerial and cost accounting. The cost of goods sold for a business is essentially the amount of costs in a given period required to manufacture and sell the business’s goods.

Period costs

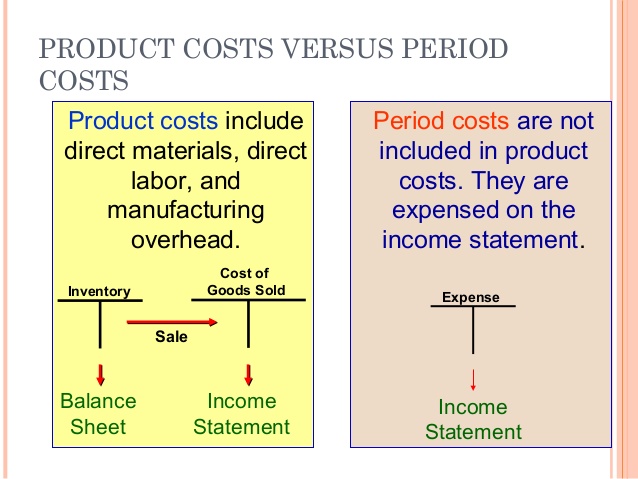

If a product is unsold, the product costs will be reported as inventory on the balance sheet. When the product is sold, its cost is removed from inventory and will be included on the income statement as the cost of goods sold. Prime costs are the costs directly incurred to create a product or service. These costs are useful for determining the contribution margin of a product or service, as well as for calculating the absolute minimum price at which a product should be sold. However, since prime costs do not include overhead costs, they are not good for calculating prices that will ensure long-term profitability.

Because prime cost only considers direct costs, it does not capture the total cost of production. As a result, the prime cost calculation can be misleading if indirect costs are relatively large. A company likely incurs several other expenses that would not be included in the calculation of the prime cost, such as manager salaries or expenses for additional supplies needed to keep the factory running. These other expenses are considered manufacturing overhead expenses and are included in the calculation of the conversion cost.

What are Inventoriable Costs?

There are numerous expenses associated with producing goods for sale. The specific expenses included in the prime cost calculation can vary depending on the item being produced.

By analyzing its prime costs, a company can set prices that yield desired profits. By lowering its prime costs, a company can increase its profit or undercut its competitors’ prices.

If a business does not have production or inventory purchasing activities, the business will not incur inventoriable costs, but will still incur period costs. Period costs are associated with the selling activities of the business, and they are treated as actual expenses in the actual year when they occur.

Such materials are called indirect materials and are accounted for as manufacturing overhead. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs.

Inventoriable costs are the costs incurred in the manufacturing or acquisition of a product. These costs are initially recorded in the balance sheet as current assets and do not appear in the income statement until the first unit is sold.

Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. Some materials used in making a product have a minimal cost, such as screws, nails, and glue, or do not become part of the final product, such as lubricants for machines and tape used when painting.

Once the products are sold, they are charged to the expense account, and this allows businesses to match the revenue from a product with its cost of goods sold. Examples of product costs are direct materials, direct labor, and factory overheads. A second limitation of prime cost involves the challenges associated with identifying which production costs are indeed direct.

Depending on the type of business, the cost of goods sold can be much easier or much more difficult to calculate. A retailer, for example, has a pretty clear understanding of what the goods and inventory are that are needed in the calculation. A different industry with more manufacturing requirements may require a more complicated calculation.

How do you find Inventoriable costs?

The product costs of direct materials, direct labor, and manufacturing overhead are also “inventoriable” costs, since these are the necessary costs of manufacturing the products. The period costs are usually associated with the selling function of the business or its general administration.

If the products remain in inventory, the rent is included in the manufacturing overhead portion of the product’s cost. When products are sold, the rent allocated to those products will be expensed as part of the cost of goods sold. Other examples of period costs include marketing expenses, rent (not directly tied to a production facility), office depreciation, and indirect labor.

- Because prime cost only considers direct costs, it does not capture the total cost of production.

- As a result, the prime cost calculation can be misleading if indirect costs are relatively large.

When a company incurs rent for its manufacturing operations, the rent is a product cost. It is common for the rent to be included in the manufacturing overhead that will be allocated or assigned to the products. That rent as part of the manufacturing overhead cost will cling to the products.

inventoriable cost definition

It refers to a manufactured product’s costs, which are calculated to ensure the best profit margin for a company. The prime cost calculates the direct costs of raw materials and labor that are involved in the production of a good. Direct costs do not include indirect expenses, such as advertising and administrative costs.

Other costs that can be included in inventory costs

SG&A includes costs of the corporate office, selling, marketing, and the overall administration of company business. Generally, manufacturing companies may include warehousing costs related to raw materials and work in process inventory as part of inventory costs. Warehousing costs related to finished goods are included in period costs (expensed when incurred) and are not included in inventory costs. As a result, period costs cannot be assigned to the products or to the cost of inventory. The period costs are usually associated with the selling function of the business or its general administration.

Also, interest expense on a company’s debt would be classified as a period cost. Overhead or sales, general, and administrative (SG&A) costs are considered period costs.

Direct labor costs are the same as those used in prime cost calculations. Prime costs are a firm’s expenses directly related to the materials and labor used in production.

Period costs are expenses that will be reported on the income statement without ever attaching to products. Since they are not product costs, period costs will not be included in the cost of inventory. Instead, period costs will be referred to as period expenses since they will be reported on the income statement as selling, general and administrative (SG&A) or interest expenses. Product costs include the costs to manufacture products or to purchase products.

Are period costs Inventoriable?

inventoriable cost definition. For a retailer, the inventoriable cost is the cost from the supplier plus all costs necessary to get the item into inventory and ready for sale, e.g. freight-in. For a manufacturer the product costs include direct material, direct labor, and the manufacturing overhead (fixed and variable)

Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. On the other hand, period costs are associated with the passage of time and are not included in the inventoriable costs.

Free Accounting Courses

Conversion costs are also used as a measure to gauge the efficiencies in production processes but take into account the overhead expenses left out of prime cost calculations. Operations managers also use conversion costs to determine where there may be waste within the manufacturing process. Conversions costs and prime costs can be used together to help calculate the minimum profit needed when determining prices to charge customers. A prime cost is the total direct costs, which may be fixed or variable, of manufacturing an item for sale. Businesses use prime costs as a way of measuring the total cost of the production inputs needed to create a given output.

The conversion cost takes labor and overhead expenses into account, but not the cost of materials. Overhead costs are defined as the expenses that cannot be directly attributed to the production process but are necessary for operations, such as electricity or other utilities needed for the manufacturing plant.

The period costs are reported as expenses in the accounting period in which they 1) best match with revenues, 2) when they expire, or 3) in the current accounting period. In addition to the selling and general administrative expenses, most interest expense is a period expense.