Record a prepaid expense in your business financial records and adjust entries as you use the item. A common prepaid expense is the six-month insurance premium that is paid in advance for insurance coverage on a company’s vehicles. The amount paid is often recorded in the current asset account Prepaid Insurance. If the company issues monthly financial statements, its income statement will report Insurance Expense which is one-sixth of the six-month premium. The balance in the account Prepaid Insurance will be the amount that is still prepaid as of the date of the balance sheet.

Example of Insurance Expense

A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

Insurance Expense

Journal entries that recognize expenses related to previously recorded prepaids are called adjusting entries. They do not record new business transactions but simply adjust previously recorded transactions. Adjusting entries for prepaid expenses are necessary to ensure that expenses are recognized in the period in which they are incurred. Instead, they provide value over time—generally over multiple accounting periods. Because the expense expires as you use it, you can’t expense the entire value of the item immediately.

In accounting, every financial transaction is recorded by two entries on the company’s books. These two transactions are called a “debit” and a “credit,” and together, they form the foundation of modern accounting. For example, assume ABC Company purchases insurance for the upcoming twelve month period. ABC Company will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash.

Basically, the cash discount received journal entry is a credit entry because it represents a reduction in expenses. When the insurance premiums are paid in advance, they are referred to as prepaid. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance.

This is accomplished with a debit of $1,000 to Insurance Expense and a credit of $1,000 to Prepaid Insurance. This same adjusting entry will be prepared at the end of each of the next 11 months. At the end of each month, an adjusting entry of $400 will be recorded to debit Insurance Expense and credit Prepaid Insurance. DateAccountNotesDebitCreditX/XX/XXXXExpenseXPrepaid ExpenseXLet’s say you prepay six month’s worth of rent, which adds up to $6,000. When you prepay rent, you record the entire $6,000 as an asset on the balance sheet.

Every two weeks, the company must pay its employees’ salaries with cash, reducing its cash balance on the asset side of the balance sheet. A decrease on the asset side of the balance sheet is a credit. If the balance sheet entry is a credit, then the company must show the salaries expense as a debit on the income statement. Remember, every credit must be balanced by an equal debit — in this case a credit to cash and a debit to salaries expense.

Another item commonly found in the prepaid expenses account is prepaid rent. On December 31, the company writes an adjusting entry to record the insurance expense that was used up (expired) and to reduce the amount that remains prepaid.

- A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future.

Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use. Therefore, it should be recorded as a prepaid expense and allocated out to expense over the full twelve months.

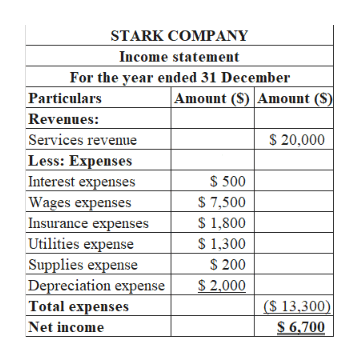

Elements of the Income Statement

The discount allowed journal entry will be treated as an expense, and it’s not accounted for as a deduction from total sales revenue. The process of recording prepaid expenses only takes place in accrual accounting. If you use cash-basis accounting, you only record transactions when money physically changes hands. Prepaid expenses refers to payments made in advance and part of the amount will become an expense in a future accounting period. A common example is paying a 6-month insurance premium in December that provides coverage from December 1 through May 31.

If you’re new to accounting, you may wonder how to record discounts allowed. Cash discounts will go under Debit in the Profit and Loss account. Trade discounts are not recorded in the financial statement.

Each month, you reduce the asset account by the portion you use. You decrease the asset account by $1,000 ($6,000 / 6 months) and record the expense of $1,000. Prepaid expenses only turn into expenses when you actually use them. The value of the asset is then replaced with an actual expense recorded on the income statement.

As the prepaid amount expires, the balance in Prepaid Insurance is reduced by a credit to Prepaid Insurance and a debit to Insurance Expense. This is done with an adjusting entry at the end of each accounting period (e.g. monthly). One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement. To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. This account is an asset account, and assets are increased by debits.

Where does insurance expense go on income statement?

The costs that have expired should be reported in income statement accounts such as Insurance Expense, Fringe Benefits Expense, etc. Expired insurance premiums are reported as Insurance Expense. Unexpired insurance premiums are reported as Prepaid Insurance (an asset account).

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

In accounting, an expense is the recognition of a period cost. Companies expend cash on items necessary to run a business, such as utilities, wages, maintenance, office supplies and other items. Journal entries typically follow the same format to record transactions in a company’s general ledger. Double-entry accounting requires both a debit and credit in each expense accounting entry. Companies may incur expenses through cash or credit purchases.

Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense. In the twelfth month, the final $10,000 will be fully expensed and the prepaid account will be zero. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset. For example, if a large Xerox machine is leased by a company for a period of twelve months, the company benefits from its use over the full time period.

The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses. As the amount of prepaid insurance expires, the expired portion is moved from the current asset account Prepaid Insurance to the income statement account Insurance Expense. This is usually done at the end of each accounting period through an adjusting entry.

Credit the corresponding account you used to make the payment, like a Cash or Checking account. Crediting the account decreases your Cash or Checking account. Expenditures are recorded as prepaid expenses in order to more closely match their recognition as expenses with the periods in which they are actually consumed.

If a business were to not use the prepaids concept, their assets would be somewhat understated in the short term, as would their profits. The prepaids concept is not used under the cash basis of accounting, which is commonly used by smaller organizations. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Except for trade discounts — which are not recorded in the financial statements, these discounts appear as a credit on the income statement in the Profit and Loss Account.