Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. These applications are tied to databases which archive transaction information between trading partners. (US Bank, Scott Hesse, 2010) The invoices may be submitted in a number of ways, including EDI, CSV, or XML uploads, PDF files, or online invoice templates.

Examples of accounts payable include accounting services, legal services, supplies, and utilities. Accounts payable are usually reported in a business’ balance sheet under short-term liabilities.

They are listed on the balance sheet under current liabilities and on the cash flow statement under operating activities. Accounts payable are monies that are owed to outside individuals and other businesses for goods and services provided. Accounts payable are usually a short-term liability, and are listed on a company’s balance sheet.

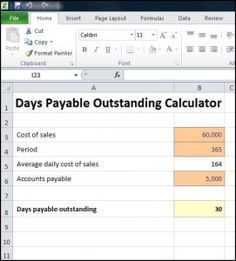

Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is made within 30 days. If the payment is made on Day 31 then the full amount is paid. Accrued payables is not a generally accepted accounting term but a combination of the terms accounts payable and accrued expense. Accounts payable are funds owed to suppliers for goods or services.

An Account Payable Is Another Company’s Account Receivable

The other party would record the transaction as an increase to its accounts receivable in the same amount. Accounts payable automation or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments. The accounts payable department’s main responsibility is to process and review transactions between the company and its suppliers. In other words, it is the accounts payable department’s job to make sure all outstanding invoices from their suppliers are approved, processed, and paid.

This short-term liability due to the suppliers, vendors, and others is called accounts payable. Once the payment is made to the vendor for the unpaid purchases, the corresponding amount is reduced from the accounts payable balance. A company may have many open payments due to vendors at any one time. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders.

Q&As

What is journal entry for accounts payable?

Accounts Payable Journal Entries refers to the amount payable accounting entries to the creditors of the company for the purchase of goods or services and are reported under the head current liabilities on the balance sheet and this account debited whenever any payment is been made.

An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding, or open, liability because it has not been paid. Common examples of Expense Payables are advertising, travel, entertainment, office supplies and utilities. AP is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received.

What is accounts payable?

How do you account for accounts payable?

To record accounts payable, the accountant credits accounts payable when the bill or invoice is received. The debit offset for this entry is typically to an expense account for the good or service that was purchased on credit. The debit could also be to an asset account if the item purchased was a capitalizable asset.

- Accounts payable and its management is a critical business process through which an entity manages its payable obligations effectively.

- Accounts payable is the amount owed by an entity to its vendors/suppliers for the goods and services received.

This removed the receivable out of your accounts and therefore doesn’t falsely inflate your total assets. Accounts payable are short-term liabilities relating to the purchases of goods and services incurred by a business. They generally are due within 30 to 60 days of invoicing, and businesses are usually not charged interest on the balance if payment is made in a timely fashion.

Processing an invoice includes recording important data from the invoice and inputting it into the company’s financial, or bookkeeping, system. After this is accomplished, the invoices must go through the company’s respective business process in order to be paid. Householders usually track and pay on a monthly basis by hand using cheques, credit cards or internet banking. Increasingly, large firms are using specialized Accounts Payable automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization’s invoices.

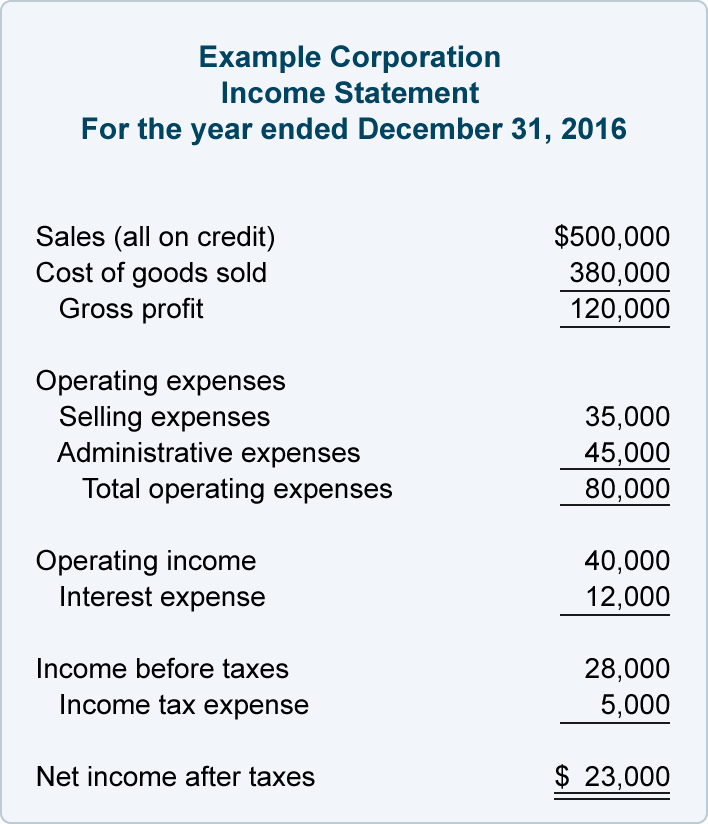

For example, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in accounts payable and a $500 debit to office supply expense. The $500 debit to office supply expense flows through to the income statement at this point, so the company has recorded the purchase transaction even though cash has not been paid out. This is in line with accrual accounting, where expenses are recognized when incurred rather than when cash changes hands.

Accounts Payable Journal Entries

A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity.

Because E-invoicing includes so many different technologies and entry options, it is an umbrella category for any method by which an invoice is electronically presented to a customer for payment. Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.

Accounts payable are usually due in 30 to 60 days, and companies are usually not charged interest on the balance if paid on time. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days. Electronic Invoicing can be a very useful tool for the AP department.

Accounts payable and its management is a critical business process through which an entity manages its payable obligations effectively. Accounts payable is the amount owed by an entity to its vendors/suppliers for the goods and services received. To elaborate, once an entity orders goods and receives before making the payment for it, it should record a liability in its books of accounts based on the invoice amount.

You can pursue collections, but first, you’ll want to close it off your accounting books. There’s a specific account, referred to as Bad Debt Expense which is used to record transactions that are the result of unpaid invoices. The Bad Debt Expense account is debited $500 and the Accounts Receivable account is credited $500.

This is something you’ll want to try to avoid, but it is one of the costs of doing business. If the customer from above never makes another payment, that means you did not receive $500 owed to you.