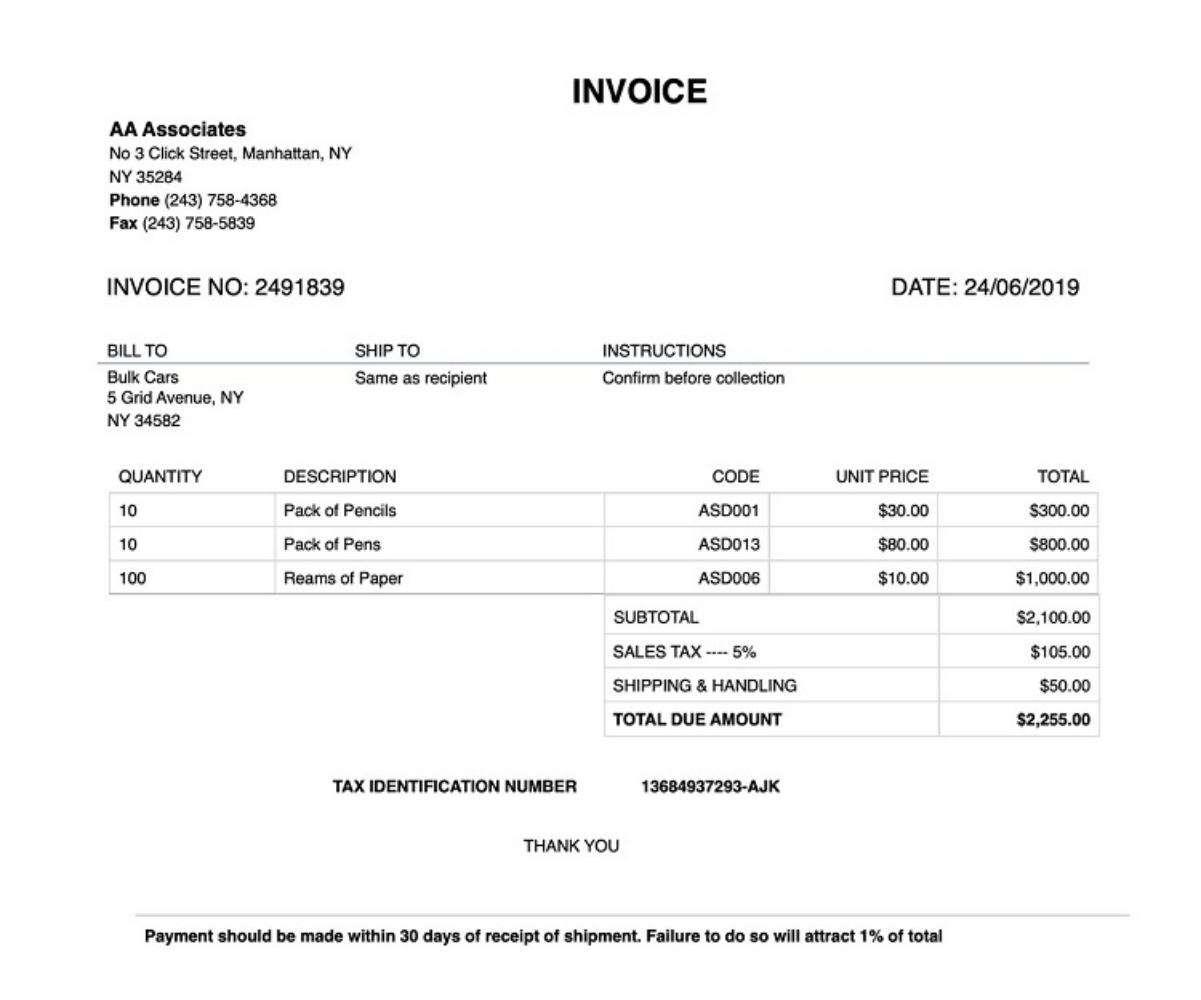

You have already agreed with your client what services you are going to provide and the price for these services. Have you agreed, though, on the payment terms? An invoice is basically a demand for payment and it’s the most common method of requesting payment from the customer. When submitting an invoice to a customer, it is important that the invoice indicates when payment should be made.

In challenging economic times, it is more important than ever for businesses to assess and review their invoice payment terms to ensure that they do not get caught doing work for free. These are terms on which the company provides goods or services to a customer. Are you new to negotiating payment terms with suppliers and customers or have you been struggling with any of these? In this article, we are going to review common invoice payment terms.

Common Invoice Payment Terms

Invoice payment terms are indicated on the invoice and can be categorized into several main categories depending on the length of the period during which the payment is expected to arrive, and depending on the conditions for granting a discount for payment (if any).

- Payment at the time of delivery (COD – cash on delivery) and payment before delivery (CBD – cash before delivery). With COD, the only risk the seller is exposed to is that the buyer may refuse the delivered goods, and the seller has to bear the transportation costs. Sometimes, in order to avoid this risk, the seller can set a payment before delivery (CBD) condition.

- Net period, no discount. If a sale is made, the seller indicates the period of time within which the payment must be made. Traditionally, many businesses operate on 30-day payment terms. That means that they would get paid 30 days after their invoice has been issued. Other popular terms are Net 15, Net 30, and Net 60.

- Net period, with a discount. In addition to the ability to pay later, the seller can also offer customers a discount, provided that the invoice payment is made within a specified period. For example, the conditions “2/10, net 30” mean that this seller offers a 2% discount if the invoice is paid within 10 days; otherwise, the buyer will have to pay the full amount within 30 days. Typically, this discount is provided to encourage buyers to pay their bills as quickly as possible.

- Seasonal dates. Sellers who work with seasonal items often use seasonal dating to encourage their customers to place orders before the peak in seasonal and to defer payment until after the peak sales period. This allows the seller to avoid carrying excess inventory and the associated carrying costs. For example, seasonal dating is often used by lawnmower manufacturers who indicate that any supply to buyers during winter or spring may not be billed until summer.

Avoiding and Dealing with Late Payments

Freelancers, consultants, small and even large businesses have to face unpaid invoices and late payments often on regular basis. If this problem is hurting your business’s cash flow and ultimately the bottom line, consider the following ways of dealing with late payments.

- Send your invoices right away. The first strategy is to send your invoices to your clients immediately after providing the goods or services that you are charging for. It is one of the best ways to get paid right away by a client. Research shows that you can reduce overdue invoices by as much as 70% by just sending them early. Using invoicing software makes it easier to get your invoices to your clients as soon as possible.

- Ask for an upfront deposit. Asking for even a small amount upfront will mean that your client will be much more likely to be committed to paying the rest. It gets them not only financially, but also emotionally invested in the work that you have done for them. It is also a good way to determine the professionalism of a client before you even start working with them.

- Let your clients pay you online. The easier you make it for your clients to pay the invoice, the sooner you will see their payment make it to your bank account. Once again, modern bookkeeping software allows accepting online payments in a simple, fast, and convenient way because all your clients would need to do is follow a link provided in the invoice to make a payment online.

- Provide early payment discounts and charge fees for late payments. Setting your invoice payment terms in such a way that your clients can get early payment discounts has proven a very effective strategy in avoiding late payments. Many clients find this to be an opportunity they cannot miss and will pay you on time to earn the discounts, which is beneficial for your company’s cash flow. Penalties for paying late might also be an effective way to make your clients pay your business for the work or goods you provided on time.