Invoices are like individual sales transactions that are designed to comprise statements of customers’ accounts partially. This differs to the Sales Batch Entry option where the Gross figure was required to be entered. Figure 11 is the Requisitions List with a bill-only requisition that has been entered and is awaiting approval. When this field is unselected, the requisition line and its associated purchase order line are bill-only.

The Basics of an Invoice

On the other hand, when a company makes a payment for items purchased on credit, this results in a debit to accounts payable (decrease). A report that lists the accounts and amounts that are debited for a group of invoices entered into the accounting software is known as the accounts payable distribution. A bill or invoice from a supplier of goods or services on credit is often referred to as a vendor invoice.

Log in to your account

It is, in its purest form, a list that might have details that are not as important for invoicing purposes. In most cases, the demand is for immediate payment though it may be otherwise as well. In general, the bill invoice is dispatched before, along with, or after the buyers have received the products. They are usually sent once the goods/ services have been shipped/performed. These days, it is commonplace to find paper-based invoices being replaced by electronic ones.

Alternatively, an invoice is matched to a purchase order, and upon reconciling the information, payment is made for approved transactions. An auditing firm ensures invoices are entered into the appropriate accounting period when testing for expense cutoff. In Summary, every accounting transaction, for example a sales invoice, is a mixture of debits and credits, and at least one of each.

An invoice, on the other hand, records the receipt of the product or service and, as noted above, the terms of payment. Purchase orders are used by many companies as part of an approval process.

If you wish to create a bill-and-replace requisition line, select Receipts Required. Notice that the field Receipts Required is unselected, by default. For receiptless PO lines, the application normally creates a receipt during invoicing. The auto-receiving feature lets you automatically receive bill-only receiptless lines so that no receipt is created for the invoice, but is instead created when the PO is authorized. You can add missing lines to bill-only invoices created from bill-only POs.

In other words, sales receipts are presented to customers after a “point of sale” purchase or in case the buyers make immediate payment. A bill best describes transactions for goods/ services and the amount owed to vendors. In most cases, it is in the form of an invoice that a customer is expected to pay as soon as the same is presented to him or her, for example, the bill served to customers after the meal has been consumed.

The Importance of Invoice Date

The vendor invoices are entered as credits in the Accounts Payable account, thereby increasing the credit balance in Accounts Payable. When a company pays a vendor, it will reduce Accounts Payable with a debit amount.

For example, a device may be provided by a manufacturer whose representative brings the item to the hospital and works with the surgeons who implant it. “Bill-only” requisitions and POs are designed to accommodate this situation. Bill-only requisitions go through any normal approval processes set up for the hospital, then flow to bill-only POs, and to vendors. It can be used in the same format for different business transactions.

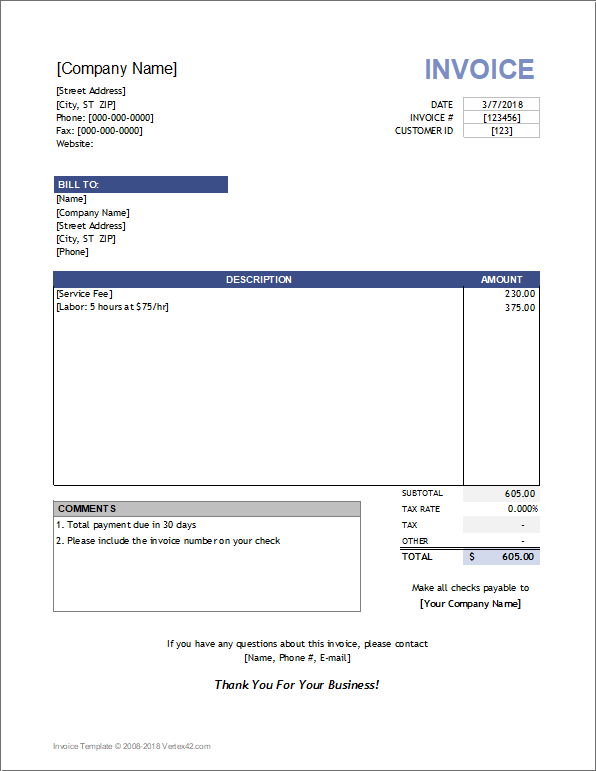

An invoice is a commercial document that itemizes and records a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal and provides information on the available methods of payment.

Types of invoices may include a receipt, a bill of sale,debit note, or sales invoice. Bill-only requisitions and POs can contain true “bill-only” lines or “bill-and-replace” lines. When an invoice is created for the associated bill-only PO line, Supply Chain make a receipt available for matching. Once the journal entry is completed, the amounts need to be posted to the respective general ledger accounts. Each account has a ledger account that keeps a running total of the account.

When a customer pays, the invoice number should be noted on the sales receipt and matched to the sales receipt in your accounting software, so it’s clear that the invoice has been paid. The payment takes the outstanding amount out of your accounts receivable account. Charges on an invoice must be approved by the responsible management personnel.

There’s a specific account, referred to as Bad Debt Expense which is used to record transactions that are the result of unpaid invoices. The Bad Debt Expense account is debited $500 and the Accounts Receivable account is credited $500. This removed the receivable out of your accounts and therefore doesn’t falsely inflate your total assets. Purchase orders (POs) are before the transaction, and invoices are after the transaction. Purchase orders record an order by a customer to a vendor or supplier.

- If goods or services were purchased on credit, the invoice usually specifies the terms of the deal and provides information on the available methods of payment.

- An invoice is a commercial document that itemizes and records a transaction between a buyer and a seller.

- Types of invoices may include a receipt, a bill of sale,debit note, or sales invoice.

If a customer bought $1,000 worth of goods with an invoice, the initial journal entry would be a debit to Accounts Receivable for $1,000 and a credit to Revenues for $1,000. The memo portion of the journal entry should include the customer’s name, a reminder of what was purchased and the invoice number. As per Quickbooks, accounting software, an invoice is used by corporations and businesses that are desirous of collecting customer payments. The invoices are sent out to buyers so that they can be made accountable for the products and services sold to them. It is quite common or the recipients of invoices to refer to them as bills, though they are necessary records of payments.

Accounting terms

Statements are usually sent to customers on a consistent and regular basis. The Net amount (excl. VAT) is posted as the actual P&L income and the VAT element (balance) is posted to the VAT account (B/S) as a credit meaning it is payable to the Revenue. The field Receipts Required is unselected, by default (Figure 15, purple arrow). When this field is unselected, the purchase order line is bill-only.

What is an invoice accounting?

An invoice is a payment request sent by the supplier that lists the goods or services provided to the buyer. An invoice is a legally-binding document (assuming both sides have agreed to the payment and other terms) that a supplier sends to the buyer after the goods or services have been provided.

As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded but have not yet been paid. A statement depicts the status of a specific customer’s account at any particular point in time.

If you wish to create a bill-and-replace PO line, select Receipts Required. Bill-only requisitions are used for items that are not procured through the usual process.

What is invoice in Accounting with example?

An invoice is a commercial document that itemizes and records a transaction between a buyer and seller. A paper receipt from a store is a common consumer invoice. Invoices are a critical element of accounting internal controls and audits.

the debits and credits must balance in value for every transaction. An invoice, as received from suppliers, would showcase the items purchased, cost per unit, total cost/extension of things individually, as well as the total of all things as listed on the invoice’s face. On the other hand, a statement is a document from a supplier that contains the amounts owed on a specified date in past invoices as well.

For instance, a statement might indicate that as on a specific date, a company owes the vendor payment for six invoices along with a small amount carried forward from an earlier invoice. A sales receipt is issued for the goods/services rendered right at the time of their purchase taking place.

To help ensure clients pay in full and on time, small businesses should create professional contracts which, unlike invoices, can serve as legally binding agreements. This is something you’ll want to try to avoid, but it is one of the costs of doing business. If the customer from above never makes another payment, that means you did not receive $500 owed to you. You can pursue collections, but first, you’ll want to close it off your accounting books.

For example, ABC International issues 20 invoices to its customers over a one-week period, for which the totals in the sales subledger are for sales of $300,000. ABC’s controller creates a posting entry to move the total of these sales into the general ledger with a $300,000 debit to the accounts receivable account and a $300,000 credit to the revenue account. While invoicing is an important accounting practice for businesses, invoices do not serve as a legally binding agreement between the business and its client. That’s because an invoice leaves too much room for manipulation to serve as a legal document. There is no proof on the invoice itself that both parties have agreed to its terms.

The statement is used for representing sales transactions, payments, credits in every line item for any given period. Though a statement is not as detailed as an individual sales transaction document, it is still quite useful for recording transactions for accounting purposes. A statement notifies customers about their standing and whether they still owe the seller any money or not.

Some companies require purchase orders for products or services over a specific amount. Thus, accounts payable is credited when goods/services are purchased on credit because the liability increases.

For this transaction, the Accounts Receivable account would be created for this customer, and the ledger would be debited $1,000. Journal entries consist of at least one debit and one credit, and the amounts of the debits and credits should match.