AccountingTools

For example – adding a new business, buying new inputs, processing products, etc. Change in output due to change in process, product or investment is considered as incremental change. You simply divide the change in cost by the change in quantity. Determining these costs is done according to your own overhead structure and price for raw materials and labor.

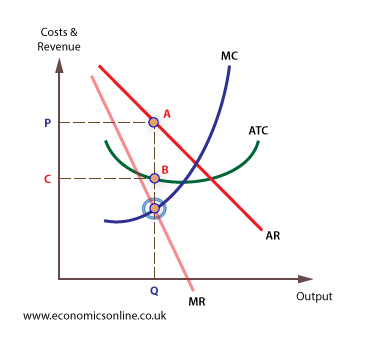

Marginal Revenue and Marginal Cost of Production

Whether the business executive decides to continue with the project or cancel it, the costs spent for the nine months of operation cannot be retrieved. This should be irrelevant to the decision because only future costs and potential revenues should be considered.

If you manufacture an additional five units, the incremental cost calculations shows the change. The calculation is critical for financial planning, accounting and understanding your costs, margins and profitability at different levels of production.

For this reason, the incremental concept is sometimes violated in practice. For example, a firm may refuse to sublet excess warehouse space for $5000 per month because it figures its cost as $7500 per month -a price paid for a long-term lease on the facility. However, if the warehouse space represents excess capacity with no current value to the company, its historical cost of $7500 per month is irrelevant and should be disregarded. The firm would forego $5000 in profits by turning down the offer to sublet the excess warehouse space.

Incremental Cost vs. Incremental Revenue

Similarly, any firm that adds a standard allocated charge for fixed costs and overhead to the true incremental cost of production runs the risk of turning down profitable business. A fixed building lease for example, does not change in price when you increase production. The fixed cost will reduce against the cost of each unit manufactured, thus increasing your profit margin for that product. A specific material used in production is a variable cost because the price changes as you order more.

Marginal analysis implies judging the impact of a unit change in one variable on the other. Marginal revenue is change in total revenue per unit change in output sold. Marginal cost refers to change in total costs per unit change in output produced (While incremental cost refers to change in total costs due to change in total output). The decision of a firm to change the price would depend upon the resulting impact/change in marginal revenue and marginal cost. If the marginal revenue is greater than the marginal cost, then the firm should bring about the change in price.

- Understanding incremental costs can help a company improve its efficiency and save money.

- Understanding the additional costs of increasing production of a good is helpful when determining the retail price of the product.

Suppose a company paid $50000 to purchase machinery five years back. The machine was used to produce for last few years and now it is obsolete and no longer can be sold .The amount paid is already incurred and cannot be recovered. So the cost of the obsolete machine will not be considered in making managerial decisions. It refers to changes in cost and revenue due to a policy change.

If the executive cancels the project, the company would incur a $5.25 million loss and have revenues of $0. If the executive continues with the project, the future revenue for the company is $10 million, and future costs are only $2.75 million. It’s never coming back, regardless of whether you continue or cancel the project.

In other words, incremental costs are solely dependent on production volume. Conversely, fixed costs, such as rent and overhead, are omitted from incremental cost analysis because these costs typically don’t change with production volumes. Also, fixed costs can be difficult to attribute to any one business segment.

What is an incremental cost?

Definition of Incremental Cost An incremental cost is the difference in total costs as the result of a change in some activity. Incremental costs are also referred to as the differential costs and they may be the relevant costs for certain short run decisions involving two alternatives.

Only the relevant incremental costs that can be directly tied to the business segment are considered when evaluating the profitability of a business segment. (a)Incremental costs are closely related to the concept of marginal cost but with a relatively wider connotation.

Understanding incremental costs can help a company improve its efficiency and save money. Incremental costs are also useful for deciding whether to manufacture a good or purchase it elsewhere. Understanding the additional costs of increasing production of a good is helpful when determining the retail price of the product. Companies look to analyze the incremental costs of production to maximize production levels and profitability.

Bulk orders are often at a reduced rate, creating a variable to factor into your incremental calculation. Alternatively, once incremental costs exceed incremental revenue for a unit, the company takes a loss for each item produced. Therefore, knowing the incremental cost of additional units of production and comparing it to the selling price of these goods assists in meeting profit goals. A sunk cost is a cost which a business has already incurred and which cannot be recovered in the future.

What Is Incremental Cost?

What is incremental cost example?

Incremental cost. For example, if a company has room for 10 additional units in its production schedule and the variable cost of those units (that is, their incremental cost) is a total of $100, then any price charged that exceeds $100 will generate a profit for the company.

Figure out fixed costs then set variables costs according to different levels of production. Divide the cost by the units manufactured and the result is your incremental or marginal cost.

Incremental cost is an important calculation for understanding numbers at different levels of scale. The calculation is used to display change in cost as production rises.

As these historical costs cannot change, they should not be taken into account when making future decisions, and are not relevant to the incremental analysis approach. (b)A sunk cost is a cost that has been already incurred and cannot be changed or altered by any decision made now or in future. For example , once it is decided to make incremental investment expenditure and funds are allocated and spent, all preceding cost are considered as sunk cost. Such cost are based on prior commitment and cannot be revised or recovered when there is a change in market condition or in business decision makings. The sunk cost are ignored in managerial decision making as they are irrelevant costs which will not affect the decision.