Why keep financial records?

In business, there are numerous reports. Accounting reports are created to be submitted to the tax office and help to see the real situation with money in business and make decisions. Often, the owner prepares financial statements independently or together with a bookkeeper.

An entrepreneur always has tasks more important than reporting. You need to sign a new contract, negotiate with a supplier or go to production. Therefore, reporting is often carried out on case-to-case basis, expenses and revenues are forgotten, indicators are not calculated, and costs are not classified.

This approach works as long as the entrepreneur does not face serious financial problems – a cash gap, unprofitable key customers, or late payments. Accurate and timely bookkeeping and reporting help you avoid mistakes, make informed decisions and gain a deeper understanding of the current situation.

What is the Income Statement?

When the entrepreneur understands the money coming into the business and payments made by the company, the question of the profitability of the entire business will arise. Profit is what most people start their own business for. If the company doesn’t make money, then you would not want to develop it. The Income statement will help to understand the company’s profitability. This report is also called P&L or Profit & loss statement.

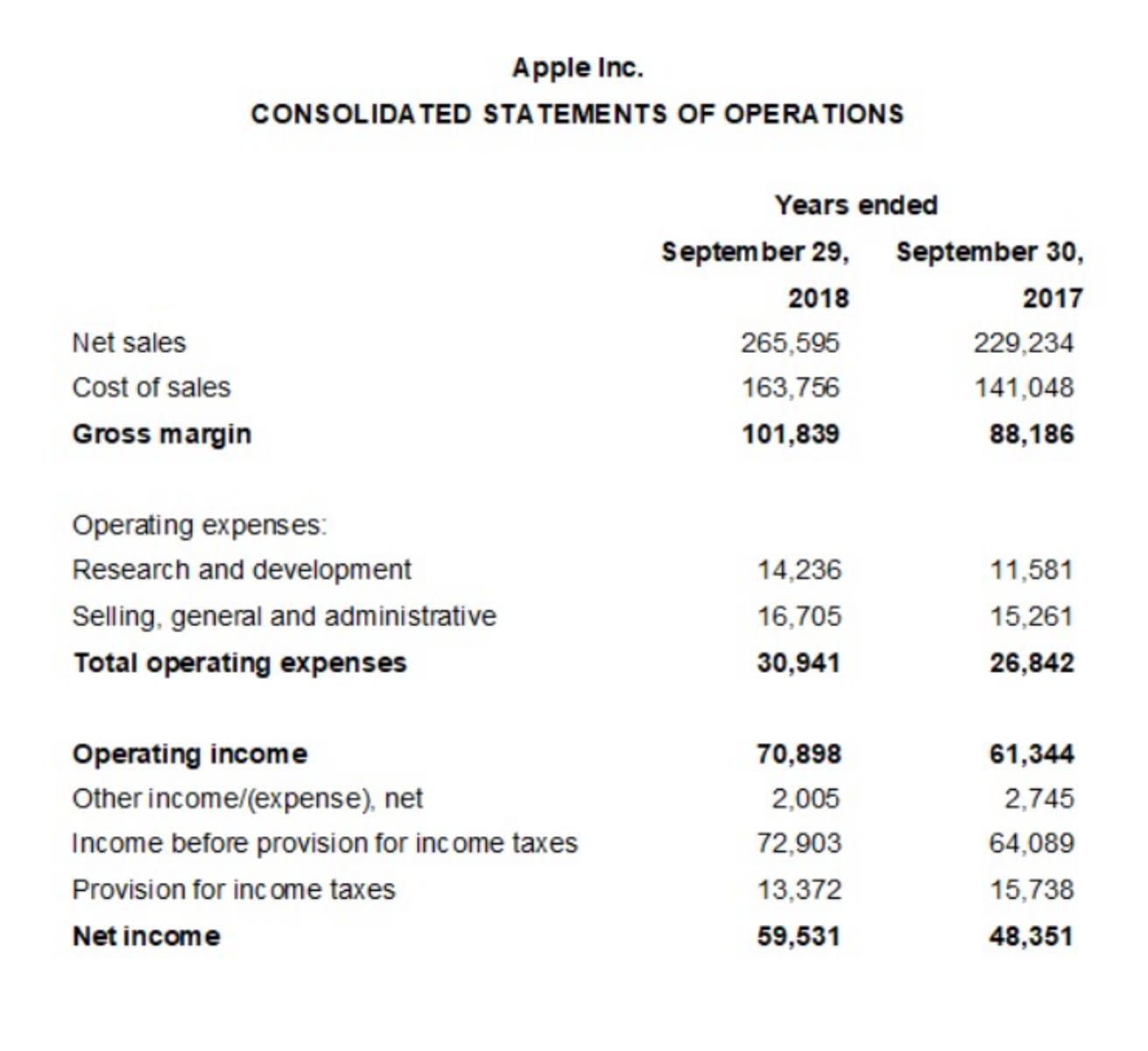

You can see in the illustration above what basic elements go into a typical Income Statement. It should contain revenues and expenses. Revenue is an increase in sales or a decrease in its liabilities, as a result of which an increase in equity capital, excluding an increase associated with contributions from shareholders. Expense is an outflow of funds or amortization of assets or incurrence of liabilities or losses, resulting in a decrease in equity, excluding the decrease associated with payments to shareholders.

This financial document makes it clear what is happening with the money invested into the business. Without this report, a company is like a black box because it is not clear what the investments lead to and where the money goes. The report helps to analyze the company’s obligations. If buyers and other parties owe it more than it owes others, then everything is going well. If not, it’s time to change something.

The value of the Income statement

The Profit and loss statement characterizes the results of all the activities of a business for the reporting period and shows how it received profits and losses (by comparing income and expenses). The Income statement together with the Balance sheet is an important source of information for a comprehensive analysis of profit-making.

The information presented in the report allows you to assess the change in the income and expenses of the organization in the reporting period compared to the previous one, to analyze the composition, structure, and dynamics of gross profit, profit from sales, net profit, and also to identify the factors of formation of the final financial result.

By summarizing the results of the analysis, it is possible to identify untapped opportunities for increasing the level of its profitability or reducing expenses. For example, Kathy’s Bookstore is growing. The owner sees that the revenue and the number of customers increase every month, but the money does not increase.

To figure out what is happening, she compiled an Income Statement. Based on it, she found out that most of the income is consumed by renting a store and a warehouse. Therefore, she transferred her bookstore online and thereby increased the company’s margins.

The information presented in the Income statement allows all interested users to make a conclusion about how effective the activities of this organization are and how justified and profitable investments in its assets would be.

It is useful to consider all the financial reports together. The Cash Flow report shows the actual movement of funds, while the Profit and Loss shows the commitments that the business has undertaken. If you do not go into details, then the Cash Flow Statement reflects what is happening with the money now, and the Income Statement tells what will happen to them next. To make informed decisions, it is important to see both.