Profit is a financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity. Excessive carrying costs are a type of expense that can contribute to net losses.

These are the costs a company pays for holding inventory in stock before it is sold to customers. For example, a company that sells frozen foods needs to pay for refrigerated storage facilities, utility costs, taxes, employee expenses, and insurance. If sales are slow, the company will need to hold onto its inventory for a longer time, incurring additional carrying costs which could contribute to a net loss.

A net operating loss (NOL) occurs when a business’s allowable tax deductions are more than the taxable income. In one accounting period, you incur more expenses than earnings. Usually, you can use the net operating loss to cover past tax liabilities. The idea is to give some form of tax relief to companies that suffer a financial loss. Report extraordinary gains and losses separately from regular income and business expenses.

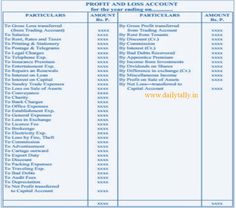

The income statement is often referred to as the profit and loss statement (P&L). An income statement can be run at any time during the fiscal year to determine profitability. An operating loss occurs when operating expenses exceed a manufacturer’s gross profits or a service organization’s revenues.

You would zero out the asset accounts each month into the equity fund account. We are a nonprofit that holds some investment accounts, which have gains/losses. The list of equity account types in QBO doesn’t include anything which fits this purpose. An income statement is used to determine whether a company is showing net income or not.

Is loss an expense?

Definition: In financial accounting, a loss is a decrease in net income that is outside the normal operations of the business. Losses can result from a number of activities such as; sale of an asset for less than its carrying amount, the write-down of assets, or a loss from lawsuits.

An operating loss occurs when a company’s operating expenses exceed gross profits (or revenues in the case of a service-oriented company, generally speaking, instead of a manufacturer). An operating loss does not consider the effects of interest income, interest expense, extraordinary gains or losses, income or losses from equity investments or taxes.

Huntsman Corporation in 2009, the year that the Great Recession took hold, recorded an operating loss of over $71 million. Such expenses in most cases are considered non-recurring, which means that a normalized operating income/loss number would exclude the charge. Instead of the operating loss, then, an “adjusted” result would be an operating profit of $81 million.

AccountingTools

An income statement is comprised of a business’s income and expenses over a period of time. This period is usually a year, or annually, but can also be monthly or quarterly.

That may entail layoffs, office or plant closings, or reductions in marketing spending. An operating loss can be expected for start-up companies that mostly incur high expenses (with little or no revenues) as they attempt to grow quickly. In most other situations, an operating loss, if sustained, is a sign of deteriorating fundamentals of a company’s products or services. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. For a company that manufactures products, gross profit is sales less cost of goods sold (COGS).

- An operating loss occurs when a company’s operating expenses exceed gross profits (or revenues in the case of a service-oriented company, generally speaking, instead of a manufacturer).

- These items are ‘below the line,’ meaning they are added or subtracted after the operating loss (or income, if positive) to arrive at net income.

- An operating loss does not consider the effects of interest income, interest expense, extraordinary gains or losses, income or losses from equity investments or taxes.

Separating unusual items gives a more accurate picture of financial health. You can better see recurring income generated through operations. The separation helps you track profitability during a specific accounting period.

Difference Between Loss and Expense

Even when targeted revenue is earned, and COGS remains within limits, unexpected expenses and overspending in budgeted areas may exceed gross profits. For example, Company A has $200,000 in sales, $140,000 in COGS, and $80,000 in expenses. Subtracting $140,000 COGS from $200,000 in sales results in $60,000 in gross profit. However, because expenses exceed gross profit, a $20,000 net loss results.

If your expenses are greater than the period’s revenue, you record a debit balance in the income summary account, reflecting a net loss. Account for the loss properly to ensure accuracy in your audit trail and tax reporting. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories.

A business loss occurs when your business has more expenses than earnings during an accounting period. The loss means that you spent more than the amount of revenue you made.

Gains and losses on investments should be set up as an OTHER INCOME account called unrealized gains and losses. You adjust a gain by crediting unrealized gain and record a loss by debiting unrealized gain or loss. The opposite side of the transaction would be the asset account for the security. If you are doing fund accounting, each fund should be an equity account.

If revenues and income are larger than expenses and losses, the company will show a net profit, or earnings, and is therefore profitable. Conversely, if revenues and income are less than expenses and losses, the company is operating at a net loss, and is not profitable. Substantial production or purchase costs of products being sold are subtracted from revenue. The remaining money is used for covering expenses and creating profit.

But, a business loss isn’t all bad—you can use the net operating loss to claim tax refunds for past or future tax years. Closing your books for the period means clearing the running balance in your operating accounts by posting the revenue and expense balances to income summary.

These items are ‘below the line,’ meaning they are added or subtracted after the operating loss (or income, if positive) to arrive at net income. An operating loss could indicate that a company’s core operations are not profitable and that changes need to be made either to increase revenues, decrease costs or both. The immediate solution is typically to cut back on expenses, as this is within the control of company management.

What is a Loss?

Strong competition, unsuccessful marketing programs, weak pricing strategies, not keeping up with market demands, and inefficient marketing staff contribute to decreasing revenues. When profits fall below the level of expenses and cost of goods sold(COGS) in a given time, a net loss results.

Because revenues and expenses are matched during a set time, a net loss is an example of the matching principle, which is an integral part of the accrual accounting method. Expenses related to income earned during a set time are included in (or “matched to”) that period regardless of when the expenses are paid.