Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000. The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000.

MANAGE YOUR BUSINESS

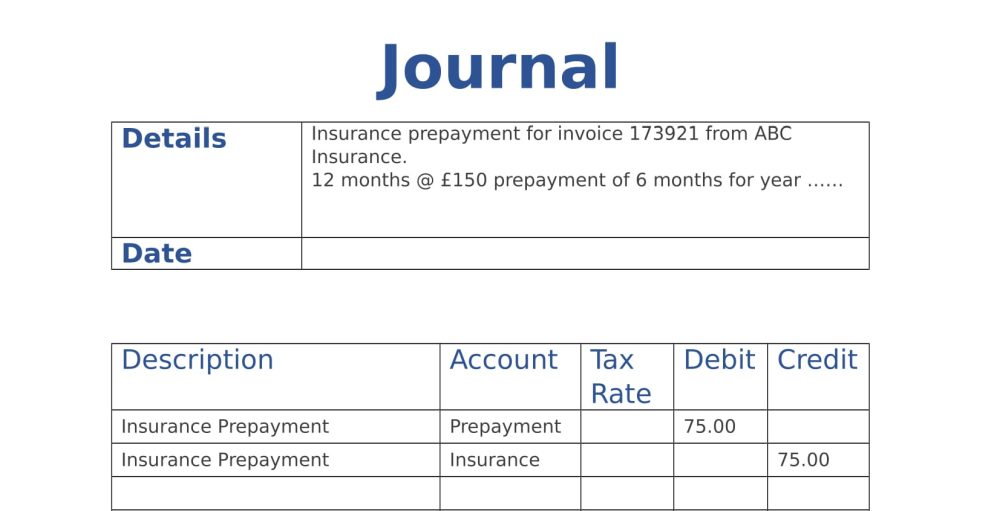

The payment of the insurance expense is similar to money in the bank, and the money will be withdrawn from the account as the insurance is “used up” each month or each accounting period. Prepaid insurance is usually considered a current asset, as it will be converted to cash or used within a fairly short time.

Definition of Insurance Expense

Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon.

Accountants must look past the form and focus on the substance of the transaction. Revenue is only increased when receivables are converted into cash inflows through the collection.

Current liabilities are short-term liabilities of a company, typically less than 90 days. Prepaid insurance is considered a business asset, and is listed as an asset account on the left side of the balance sheet.

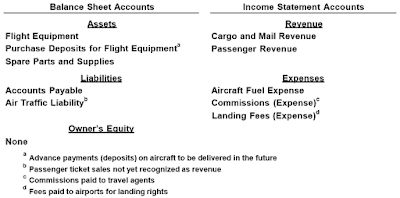

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. The leasing of a certain asset may—on the surface—appear to be a rental of the asset, but in substance it may involve a binding agreement to purchase the asset and to finance it through monthly payments.

What type of account is insurance?

Under the accrual basis of accounting, insurance expense is the cost of insurance that has been incurred, has expired, or has been used up during the current accounting period for the nonmanufacturing functions of a business. Any prepaid insurance costs are to be reported as a current asset.

What Is Prepaid Insurance?

Revenue represents the total income of a company before deducting expenses. Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

- Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

Typical business expenses include salaries, utilities, depreciation of capital assets, and interest expense for loans. The purchase of a capital asset such as a building or equipment is not an expense.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions. Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities.

BUSINESS IDEAS

Balance sheets show a company’s assets and liabilities as of a particular date, rather than breaking down the expenses of a company over time. Since an insurance expense isn’t an asset or liability, it doesn’t show up separately on the balance sheet. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses.

The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level under current liabilities.

With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories. Accounts payable is considered a current liability, not an asset, on the balance sheet.

Is insurance an asset?

Prepaid insurance is considered a business asset, and is listed as an asset account on the left side of the balance sheet. The payment of the insurance expense is similar to money in the bank, and the money will be withdrawn from the account as the insurance is “used up” each month or each accounting period.

ACCOUNTING

Individual transactions should be kept in theaccounts payable subsidiary ledger. Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources. Accounting gives a business a way to keep track of its liabilities and expenses.

A liability refers to a financial obligation, or upcoming duty to pay. An expense refers to money spent by the company, or a cost incurred by the company, in an effort to generate revenue for that company. A company may have both a liability account and an expense account, but each serves a very different purpose. The higher the expense, the lower the company’s cash will be on the balance sheet.