There is also the controller track, which requires a combined knowledge of financial and management accounting. Adoption would mean that the SEC sets a specific timetable when publicly listed companies would be required to use IFRS as issued by the IASB. Financial Accounting Standards Board (FASB) and the IASB would continue working together to develop high quality, compatible accounting standards over time. More convergence will make adoption easier and less costly and may even make adoption of IFRS unnecessary. Supporters of adoption, however, believe that convergence alone will never eliminate all of the differences between the two sets of standards.

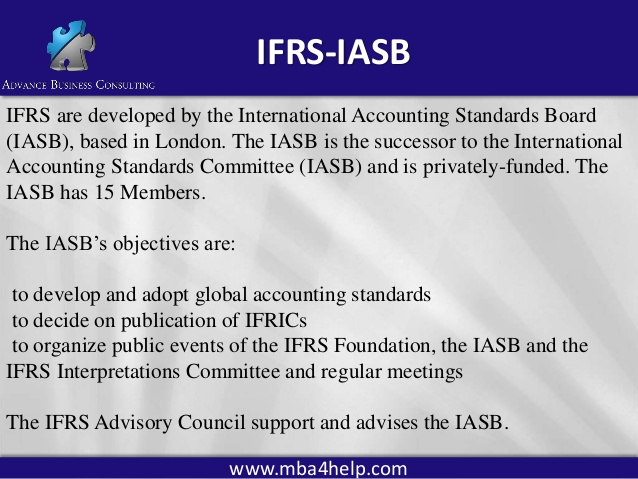

What is the purpose of the International Accounting Standards Board?

The basic purpose of the IASB Framework is to provide assistance and guidance to the IASB in developing new or revised standards in addition to assisting the preparers of financial statements in applying the standards and dealing with issues which are not explicitly dealt with by the standards.

IFRS Foundation seeks IASB Board members

There is currently no estimated date for when such a decision might be made. The international alternative to GAAP is the International Financial Reporting Standards (IFRS), set by the International Accounting Standards Board (IASB). provide a system of rules and principles that prescribe the format and content of financial statements. Through this consistent reporting, a firm’s managers and investors can assess the financial health of the firm.

GAAP is a combination of authoritative standards (set by policy boards) and the commonly accepted ways of recording and reporting accounting information. GAAP aims to improve the clarity, consistency, and comparability of the communication of financial information. An independent nonprofit organization, the Financial Accounting Standards Board (FASB) has the authority to establish and interpret generally accepted accounting principles (GAAP) in the United States for public and private companies and nonprofit organizations. GAAP refers to a set of standards for how companies, nonprofits, and governments should prepare and present their financial statements. GAAP; and the IASB, which is working with the FASB on the convergence of U.S.

There was “little support for the SEC to provide an option allowing U.S. companies to prepare their financial statements under IFRS.” However, there was support for a single set of globally accepted accounting standards. The FASB and IASB planned meetings in 2015 to discuss “business combinations, the disclosure framework, insurance contracts and the conceptual framework.” As of 2017, there were no active bilateral FASB/IASB projects underway. Instead, the FASB participates in the Accounting Standards Advisory Forum, a global grouping of standard-setters, and monitors individual projects to seek comparability. We live in an increasingly global economy, so it’s important for business owners and accounting professionals to be aware of the differences between the two predominant accounting methods used around the world. International Financial Reporting Standards (IFRS) – as the name implies – is an international standard developed by the International Accounting Standards Board (IASB).

However, while the FASB and IASB have issued norms together, the convergence process is taking much longer than was expected—in part because of the complexity of implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Financial Accounting Standards Board (FASB) is a private, non-profit organization standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public’s interest.

The American Institute of Certified Public Accountantsdeveloped, managed and enacted the first set of accounting standards. In 1973, these responsibilities were given to the newly createdFinancial Accounting Standards Board. The Securities and Exchange Commission requires all listed companies to adhere to U.S. GAAP accounting standards in the preparation of their financial statements to be listed on a U.S. securities exchange. Accounting standards ensure the financial statements from multiple companies are comparable.

Generally Accepted Accounting Principles (GAAP) is only used in the United States. GAAP is established by the Financial Accounting Standards Board (FASB).

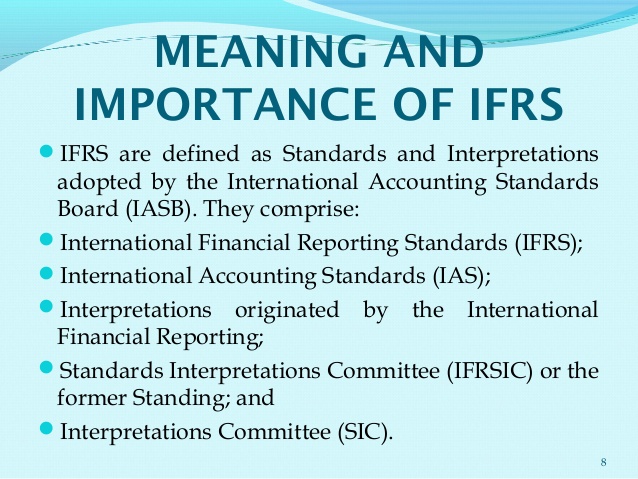

They specify how companies must maintain and report their accounts, defining types of transactions and other events with financial impact. IFRS were established to create a common accounting language, so that businesses and their financial statements can be consistent and reliable from company to company and country to country. An accounting standard is a common set of principles, standards and procedures that define the basis of financial accounting policies and practices. Accounting standards improve the transparency of financial reporting in all countries.

In 2011, SEC staff introduced a possible method of incorporating IFRS into the U.S. financial reporting system that would represent an endorsement and convergence approach for aligning U.S. Ultimately, the expectation is that the SEC will make a determination on whether it will incorporate IFRS into the financial reporting system for U.S. issuers and, if it decides to incorporate IFRS, the method of incorporation. Generally accepted accounting principles (GAAP) refer to a common set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB). Public companies in the United States must follow GAAP when their accountants compile their financial statements.

International Accounting Standards Board (IASB)

The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting standards for public companies in the US. The FASB replaced the American Institute of Certified Public Accountants’ (AICPA) Accounting Principles Board (APB) on July 1, 1973. International Financial Reporting Standards (IFRS) are a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements. IFRS are issued by the International Accounting Standards Board (IASB), and they specify exactly how accountants must maintain and report their accounts.

Pre-meeting summaries for the April IASB meeting

- US firms and any listed on a US stock exchange must prepare financial statements in accordance with the US Financial Accounting Standards Board (FASB) standards, which are known as generally accepted accounting principles (GAAP).

- If different accounting standards are used, however, it’s difficult for investors or lenders to compare two companies or determine their financial condition.

- Historically, countries have followed different accounting standards.

The standards that govern financial reporting and accounting vary from country to country. In the United States, financial reporting practices are set forth by the Financial Accounting Standards Board (FASB) and organized within the framework of the generally accepted accounting principles (GAAP).

IASB publishes proposed amendment regarding COVID-19-related rent concessions

More recently, the SEC has acknowledged that there is no longer a push to move more U.S companies to IFRS so the two sets of standards will “continue to coexist” for the foreseeable future. For many years, the SEC has been expressing its support for a core set of accounting standards that could serve as a framework for financial reporting in cross-border offerings. On February 24, 2010, the SEC issued release Nos. and , Commission Statement in Support of Convergence and Global Accounting Standards. In the release, the SEC stated its continued belief that a single set of high-quality globally accepted accounting standards would benefit U.S. investors and its continued encouragement for the convergence of U.S.

In the United States, the Generally Accepted Accounting Principlesform the set of accounting standards widely accepted for preparing financial statements. International companies follow the International Financial Reporting Standards, which are set by the International Accounting Standards Board and serve as the guideline for non-U.S. This field is concerned with the aggregation of financial information into external reports. Financial accounting requires detailed knowledge of the accounting framework used by the reader of a company’s financial statements, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Or, if a company is publicly-held, it requires a knowledge of the standards issued by the government entity responsible for public company reporting in a specific country (such as the Securities and Exchange Commission in the United States).

Accounting standards cover topics such as how to account for inventories, depreciation, research and development costs, income taxes, investments, intangible assets, and employee benefits. Investors and banks use these financial statements to determine whether to invest in or loan capital to the firm, while governments use the statements to ensure that the companies are paying their fair share of taxes. The SEC staff research included including convergence with IFRS and an alternate IFRS endorsement mechanism. Accounting standards have historically been set by the American Institute of Certified Public Accountants (AICPA) subject to U.S.

The FASB and IASB are working on harmonizing the two accounting standards. The FASB and the IASB issued guidance on recognizing revenue in contracts with customers in 2014, establishing principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from these transactions. In May 2015 the SEC acknowledged that “investors, auditors, regulators and standard-setters” in the United States did not support mandating International Financial Reporting Standards Foundation (IFRS) for all U.S. public companies.

IASB proposes to defer effective date of IAS 1 amendments

The release also called for the development of a work plan (the “Work Plan”) to enhance both the understanding of the SEC’s purpose and public transparency in this area. Execution of the Work Plan, combined with the completion of previously agreed upon convergence projects between the FASB and IASB, will permit the SEC to make a determination. On July 13, 2012 the SEC staff issued the Final Staff Report on the Work Plan for the Consideration of Incorporating International Financial Reporting Standards into the Financial Reporting System for U.S. The final decision regarding whether to incorporate IFRS into the financial reporting system for U.S. issuers now rests with the SEC Commissioners.

The AICPA has provided thought leadership to the IASB and the FASB on financial reporting topics. International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that is becoming the global standard for the preparation of public company financial statements. The United States is exploring adopting international accounting standards. Since 2002, America’s accounting-standards body, the Financial Accounting Standards Board (FASB) and the IASB have collaborated on a project to improve and converge the U.S. generally accepted accounting principles (GAAP) and IFRS.

As of 2010, the convergence project was underway with the FASB meeting routinely with the IASB. The SEC expressed their aim to fully adopt International Financial Reporting Standards in the U.S. by 2014. GAAP and the international IFRS accounting systems, as the highest authority over International Financial Reporting Standards, the International Accounting Standards Board is becoming more important in the United States. International Financial Reporting Standards (IFRS) set common rules so that financial statements can be consistent, transparent and comparable around the world. IFRS are issued by the International Accounting Standards Board (IASB).

Historically, countries have followed different accounting standards. If different accounting standards are used, however, it’s difficult for investors or lenders to compare two companies or determine their financial condition.

There are several career tracks involved in financial accounting. There is a specialty in external reporting, which usually involves a detailed knowledge of accounting standards.

Because all entities follow the same rules, accounting standards make the financial statements credible and allow for more economic decisions based on accurate and consistent information. Generally Accepted Accounting Principles (GAAP or U.S. GAAP) is the accounting standard adopted by the U.S. While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the latter differ considerably from GAAP and progress has been slow and uncertain.

US firms and any listed on a US stock exchange must prepare financial statements in accordance with the US Financial Accounting Standards Board (FASB) standards, which are known as generally accepted accounting principles (GAAP). Firms based in the European Union (EU) follow standards adopted by the International Accounting Standards Board (IASB) known as international financial reporting standards (IFRS). Over one hundred nations have adopted or permit companies to use IFRS to report their financial results. The United States is moving toward adopting IFRS but hasn’t committed to a time frame.