Merchandise may need to be returned to the seller for a variety of reasons. Expense accounts – expense accounts such as Cost of Sales, Salaries Expense, Rent Expense, Interest Expense, Delivery Expense, Utilities Expense, and all other expenses are temporary accounts.

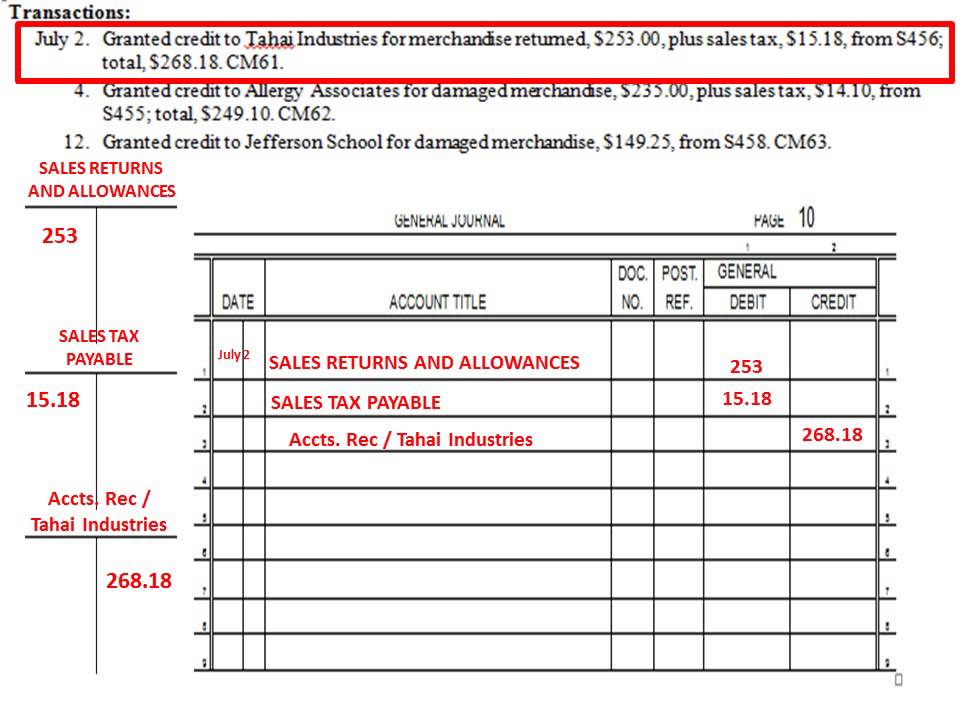

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back. The same debit and credit entries are made when allowances are granted to customers for defective merchandise that the customer keeps. When a purchaser receives defective, damaged, or otherwise undesirable merchandise, the purchaser prepares a debit memorandum that identifies the items in question and the cost of those items.

Purchase Return & Allowances Journal Entries

They can often be factored into the reporting of top line revenues reported on the income statement. Revenue accounts – all revenue or income accounts are temporary accounts. These accounts include Sales, Service Revenue, Interest Income, Rent Income, Royalty Income, Dividend Income, Gain on Sale of Equipment, etc. Contra-revenue accounts such as Sales Discounts, and Sales Returns and Allowances, are also temporary accounts.

Unlock Your Education

He also needs to debit accounts payable to reduce the amount owed the supplier by the amount that was returned. Debit the appropriate tax liability account by the taxes collected on the original sale. Credit cash or accounts receivable by the full amount of the original sales transaction.

Is a purchase return a debit or credit?

Purchase returns and allowances. Purchase returns and allowances is an account that is paired with and offsets the purchases account in a periodic inventory system. The account contains deductions from purchases for items returned to suppliers, as well as deductions allowed by suppliers for goods that are not returned.

All three costs generally must be expensed after a company books revenue. As such, each of these types of costs will need to be accounted for across a company’s financial reporting in order to ensure proper performance analysis. The sales returns and allowances account is known as a contra revenue account. When items are returned or allowances granted, it allows management to track the amounts and look for trends.

Purchases, Purchase Discounts, and Purchase Returns and Allowances (under periodic inventory method) are also temporary accounts. A seller will debit discounts as a liability and credit assets. The expense then lowers the gross revenue already booked on the income statement by the amount of the discount. Companies may not provide a lot of external transparency in the area of net sales. Net sales may also not apply to every company and industry because of the distinct components of its calculation.

You debit accounts payable for $10,000, credit cash for $9,800 and credit purchase discounts for $9,800. You must credit your inventory account for $200 and debit your cost of goods sold account for $200.

Net sales is the result of gross revenue minus applicable sales returns, allowances, and discounts. Debits increase asset and expense accounts, and decrease revenue, liability and shareholders’ equity accounts. Credits decrease asset and expense accounts, and increase revenue, liability and shareholders’ equity accounts. Debits and credits increase and decrease the “sales returns and allowances” account, respectively, because it is a contra account that reduces the sales amount on the income statement.

Purchase returns and allowances

- For companies using cash accounting they are booked when cash is received.

- For companies using accrual accounting, they are booked when a transaction takes place.

Allowances are less common than returns but may arise if a company negotiates to lower an already booked revenue. If a buyer complains that goods were damaged in transportation or the wrong goods were sent in an order, a seller may provide the buyer with a partial refund. In this case, the same types of notations would be required. A seller would need to debit an expense account and credit an asset account. This expense carries over to the income statement to reduce the value of revenue.

Research Schools, Degrees & Careers

Accounts receivable is a current asset included on the company’s balance sheet. “Sales Returns and Allowances” is a contra-revenue account. It is deducted from “Sales” (or “Gross Sales”) in the income statement.

Net sales is the sum of a company’s gross sales minus its returns, allowances, and discounts. Net sales calculations are not always transparent externally.

Sales returns refer to actual returns of goods from customers because defective or wrong products were delivered. Sales allowance arises when the customer agrees to keep the products at a price lower than the original price. Purchases will normally have a debit balance since it represents additions to the inventory, an asset. The contra account purchases returns and allowances will have a credit balance to offset it. Bill uses the purchases returns and allowances account because he likes to keep tabs on the amount as a percentage of purchases.

On the income statement, the purchases returns and allowances account is subtracted from purchases. If a business has any returns, allowances, or discounts then adjustments are made to identify and report net sales.

Therefore, you might need to adjust your inventory cost to reflect the discount. You record the purchase by debiting your inventory account $10,000 and crediting accounts payable $10,000.

Allowances are a reduction in price for purchased items that are unsatisfactory in some way but are kept by the purchaser. If the merchandise you purchase is for inventory, you might need to make an additional entry. Your inventory value should be the net cost; typically, this is the cost of the merchandise and freight, less your cash discount.

What is a purchase allowance?

The journal entries are to debit accounts payable to reduce the amount owed to the supplier by the amount of the allowance, and a credit to purchase returns and allowances to reduce the amount the unsatisfactory items will add to the inventory.

For companies using accrual accounting, they are booked when a transaction takes place. For companies using cash accounting they are booked when cash is received. Some companies may not have any costs that will require a net sales calculation but many companies do. Sales returns, allowances, and discounts are the three main costs that can affect net sales.

Net sales do not account for cost of goods sold, general expenses, and administrative expenses which are analyzed with different effects on income statement margins. The first section of an income statement reports a company’s sales revenue, purchase discounts, sales returns and cost of goods sold. This information directly affects a company’s gross and operating profit. A purchase discount is a small percentage discount a company offers to a buyer to induce early payment of goods sold on account.

Once you get the hang of which accounts to increase and decrease, you will be able to record purchase returns and allowances in your books. Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. The difference between the two results in net sales revenue.

As you sell the merchandise, you credit inventory and debit cost of goods sold for the amount equivalent to the number of units sold. Your supplier offers a 2 percent discount if paid by the 10th, which would save you $200.