The cost of labor is broken into direct and indirect (overhead) costs. Direct labor costs are those expenses that are directly related to product production. Direct costs include the wages of employees who directly make the product. Indirect labor costs are those expenses related to supporting product production. Indirect costs would include the wages of office workers, security personnel, or employees who maintain factory equipment.

The work they provide isn’t directly related to producing a product. Many employees receive fringe benefits—employers pay for payroll taxes, pension costs, and paid vacations. These fringe benefit costs can significantly increase the direct labor hourly wage rate. Other companies include fringe benefit costs in overhead if they can be traced to the product only with great difficulty and effort. Fixed expenses are those that will remain same despite any change in the sales amount, production or some other activity.

Variable expenses are those expenses that change with each unit of production and it is directly proportional to the level of production. When there is an increase in production of goods, then the variable costs will also increase and vice-versa. For example expenses like variable, production wages, raw materials, sales commission, shipping costs etc. are examples of variable expense. Since fixed costs are more challenging to bring down (for example, reducing rent may entail the company moving to a cheaper location), most businesses seek to reduce their variable costs.

A cleaning business uses detergents, sponges and cloths to provide services, so the products consumed in a month contribute to selling expenses. COGS may include raw materials, direct labor, packaging and shipping. If you require help determining your small business’s payroll expenses and cost of labor, contact The Payroll Department, located in Brownsburg, Indiana.

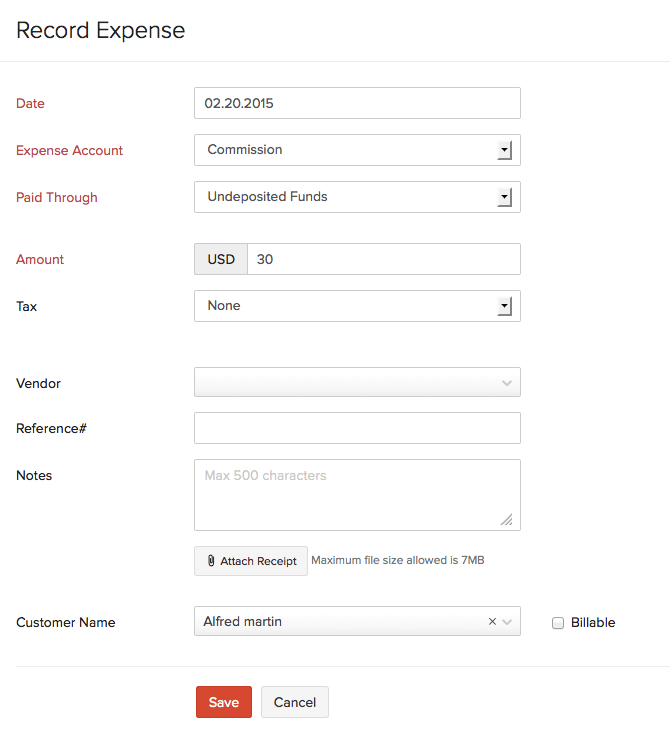

You must report sales commissions as part of the operating expenses on your income statement. Based on accrual accounting, you must report all commissions in the period in which the related sales occur, even though you might pay some commissions to your employees in a later period.

What is sales commission in accounting?

A commission is a fee that a business pays to a salesperson in exchange for his or her services in either facilitating, supervising, or completing a sale. You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services.

You would normally report selling expenses in the income statement within the operating expenses section, which is located below the cost of goods sold. Let us assume that the cost the company spends on manufacturing 100 packets of chips per month is Rs. 1000.(Assume that the cost of a packet is Rs 10). Rs. 1000 includes Rs. 500 on administration, insurance and marketing expenses that are usually variable and fixed expenses. Even though the company total cost increases from Rs. 1000 to Rs. 1500, the individual packets of chips will become less expensive to produce and hence the profit increases.

Definition of Commissions

So if the company has to hold off on booking the revenue, then they also need to hold off on booking the expenses. Determine from your company’s accounting records the total amount of sales commissions expense your small business incurred during an accounting period, regardless of when you will pay your employees. For example, assume your small business incurred $100,000 in sales commissions expense during the year.

Why Data-driven Sales Leadership Matters

A variable cost is a cost that changes in relation to variations in an activity. In a business, the “activity” is frequently production volume, with sales volume being another likely triggering event.

How do commission expenses get classified?

They are expenses that will have to be paid by the company even though there are any changes in business activities. They remain constant for a specific level of production over a certain period of time. However, it may change if the production level increases beyond a limit.

A company that has focused on a quite large amount of variable expense will predict more profit per unit in comparison to a company with a large amount of fixed expenses. This implies that if a firm has more fixed expenses, profit margin will be held when there is a fall in sales which is likely to add a level of risk to the companies’ stocks. Equally fixed costs will also allow a company to experience the increase in profit as and when the income increases, they are applied at a constant cost level. A company that seeks to increase its profit by decreasing variable costs may need to cut down on fluctuating costs for raw materials, direct labor, and advertising. However, the cost cut should not affect product or service quality as this would have an adverse effect on sales.

- This implies that if a firm has more fixed expenses, profit margin will be held when there is a fall in sales which is likely to add a level of risk to the companies’ stocks.

- A company that has focused on a quite large amount of variable expense will predict more profit per unit in comparison to a company with a large amount of fixed expenses.

- Equally fixed costs will also allow a company to experience the increase in profit as and when the income increases, they are applied at a constant cost level.

For example, a company that manufactures bolts spends more on raw materials and labor when producing 10,000 units compared to producing 5,000. However, salespeople work 40 hour weeks, so their salaries are paid regardless of sales level for a period.

The total variable cost is simply the quantity of output multiplied by the variable cost per unit of output. The total expenses incurred by any business consist of fixed costs and variable costs. Fixed costs are expenses that remain the same regardless of production output. Whether a firm makes sales or not, it must pay its fixed costs, as these costs are independent of output.

Some materials used in making a product have a minimal cost, such as screws, nails, and glue, or do not become part of the final product, such as lubricants for machines and tape used when painting. Such materials are called indirect materials and are accounted for as manufacturing overhead. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs.

The portion of the sales commissions expense that you have yet to pay your employees is money you owe, which you must report as a liability on your balance sheet. Some fixed expenses like advertising and promotional expense are assumed or incurred at the decisions of the management of the company. It is understood that all reserved fixed expenses will suffer even if the sales fall zero.

Managing Commissions Under the New Revenue Recognition Standard

A variable cost is a corporate expense that changes in proportion to production output. Variable costs increase or decrease depending on a company’s production volume; they rise as production increases and fall as production decreases.

Cost Capitalization of Commissions Under ASC 606

Thus, the materials used as the components in a product are considered variable costs, because they vary directly with the number of units of product manufactured. Selling expenses, often called cost of goods sold, refer to costs and purchases needed to create products or deliver services for which consumers pay your small business money. The difference between sales revenue and sales expenses determine gross profit, from which overhead is deducted to calculate net profit. Most businesses figure out selling expenses monthly, but it can also be done weekly or quarterly. Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product.

What is a commission expense?

Sales commissions are considered to be operating expenses and are presented on the income statement as SG&A expenses. Sales commissions are not part of the cost of a product. Therefore, sales commissions are not assigned to the cost of goods held in inventory or to the cost of goods sold.

The proportions of costs incurred can vary dramatically by business, depending upon the sales model used. For example, a customized product will require considerable in-person staff time to obtain sales leads and develop quotes, and so will require a large compensation and travel cost. Alternatively, if most sales are handed off to outside salespeople, commissions may be the largest component of selling expense.

By reducing its variable costs, a business increases its gross profit margin or contribution margin. Conversely, when fewer products are produced, the variable costs associated with production will consequently decrease. Examples of variable costs are sales commissions, direct labor costs, cost of raw materials used in production, and utility costs.

Examples of variable costs include the costs of raw materials and packaging. Another reason is your cost of labor (plus your material and overhead costs) needs to be factored into your product prices. If you don’t include the total costs incurred by your company in your sales price, the amount of profit you make will be lower than you expect. Also, if customer demand for your products declines, or a competitor forces you to cut your prices, you will have to reduce your cost of labor if you want to stay profitable. A sales commission is money your small business pays an employee when she sells your products or services to customers.

Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. The cost of labor is the total amount of all salaries, wages, and other forms of income paid to employees. It also includes the total amounts of all employee benefits and federal, state, and local payroll taxes that your business has paid (not the portion your employees paid). Accounting for sales commissions requires companies to book the commission expenses when the company books the revenue from the deal the rep closed.