The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory. A change is reported to stockholder’s equity for the amount of the net income earned. In principle, this transaction should be recorded when the customer takes possession of the goods and assumes ownership.

Also, there may be production-related expenses (such as facility rent) even when there is no production at all, as would be the case when there is a union walkout. In these cases, it is possible for there to be a cost of goods sold expense even in the absence of sales. A credit sale doesn’t directly affect a statement of cash flows because it involves no monetary element. However, a liquidity report – an identical term for a statement of cash flows – prepared under the indirect method touches on credit sales and accounts receivable. To calculate cash flows from operating activities, financial managers add a decrease in customer receivables back to net income, doing the opposite for an increase in the accounts’ value.

Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price.

Credit sales are thus reported on both the income statement and the company’s balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses.

AccountingTools

The rest is added to deferred income (liability) on the balance sheet for that year. This means that for every dollar Apple generated in sales, the company generated 38 cents in gross profit before other business expenses were paid.

Along with merchandise and cash, accounts receivable represent resources a business will use in the next 12 months. Long-term assets are those that will not be liquidate for at least 52 weeks. Examples include real property, production equipment, manufacturing plants and computer gear, all of which go under the “property, plant and equipment” section of a balance sheet. If there are no sales of goods or services, then there should theoretically be no cost of goods sold. Instead, the costs associated with goods and services are recorded in the inventory asset account, which appears in the balance sheet as a current asset.

Where do you find credit sales on financial statements?

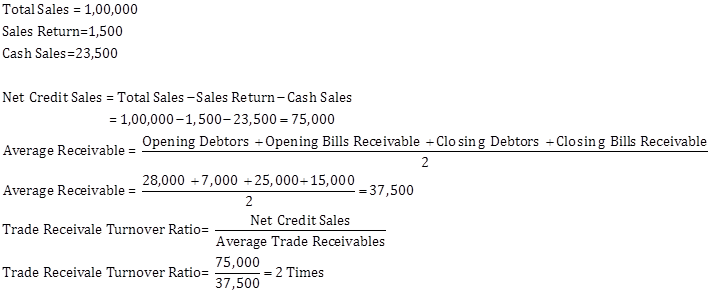

The formula for net credit sales is = Sales on credit – Sales returns – Sales allowances. Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.

Free Accounting Courses

- The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory.

- On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses.

- Credit sales are thus reported on both the income statement and the company’s balance sheet.

This makes sense, because a decrease in accounts receivable means more money coming in corporate coffers. Credit sales flow into the top-line section of a statement of profit and loss – the other name for an income statement, or statement of income. In the top-line category you also find merchandise expense, also known as cost of sale or cost of goods sold. Total sales minus merchandise expense equals gross profit, a measure of top-line growth.

Thus, if a company is working only on one project, its income statement will show $0 revenues and $0 construction-related costs until the final year. However, expected loss should be recognized fully and immediately due to conservatism constraint. For example, a company receives an annual software license fee paid out by a customer upfront on the January 1. So, the company using accrual accounting adds only five months worth (5/12) of the fee to its revenues in profit and loss for the fiscal year the fee was received.

Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. Cash sales information can be found in the “accounts receivable” column of some financial statements. However, some accounts receivable don’t represent cash sales, but rather cash owed by customers. Most American financial statements track receivables on an accrual basis, meaning that transactions are recorded when the sale is made, not when cash is received. The accrual basis of the statements means credit and not-yet-received accounts receivable must be removed from the accounts receivable column to extract cash sales from the statement.

Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS). The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services. In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved. A company’s revenue usually includes income from both cash and credit sales.

How do you calculate net credit sales?

Net credit sales. January 03, 2019. Net credit sales are those revenues generated by an entity that it allows to customers on credit, less all sales returns and sales allowances. Net credit sales do not include any sales for which payment is made immediately in cash.

Don’t mistake this for the bottom line, which is the net performance result an organization publishes at the end of a given period – say, a month or fiscal quarter. Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon. The collection period for a specific bill is not a calculation, but rather is simply the amount of time between the sale and the payment of the bill.

A higher ratio is usually preferred, as this would indicate that the company is selling inventory for a higher profit. Gross profit margin provides a general indication of a company’s profitability, but it is not a precise measurement.

Cash sales may be calculated from balance sheets, income statements and retained earnings statements. For statements of cash flows, cash sales must be figured out to create the statement. Credit sales interact with a balance sheet through the customer receivables account, which is a short-term asset.

Accounts Receivable Turnover Ratio Formula

Cost of sales does not include indirect expenses such as distribution costs and marketing costs. It appears on the income statement and is deducted from the sales revenue for the calculation of gross profit (or gross margin). Since issuing an invoice does not involve any change in cash, there is no record of accounts receivable in the accounting records.

Accounts Receivable Turnover Ratio Template

Calculating the average collection period for a segment of time, such as a month or a year, requires first finding the receivable turnover, or RT. To find the RT, divide the total of credit sales by the accounts receivable, which are the sales that have not yet been paid for. Now calculate the average collection period by dividing the days in the relevant accounting period by the RT. The completed-contract method should be used only if percentage-of-completion is not applicable or the contract involves extremely high risks. Under this method, revenues, costs, and gross profit are recognized only after the project is fully completed.