But if the retained earnings category is disproportionately large, and especially if it is held in cash, the shareholders may ask for a dividend to be paid. Retained earnings refer to the amount of net income that a business has after it has paid out dividends to its shareholders. Positive earnings are more commonly referred to as profits, while negative earnings are more commonly referred to as losses.

This statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement. The statement is a financial document that includes information regarding a firm’s retained earnings, along with the net income and amounts distributed to stockholders in the form of dividends. An organization’s net income is noted, showing the amount that will be set aside to handle certain obligations outside of shareholder dividend payments, as well as any amount directed to cover any losses. Another thing that affects retained earnings is the payout of dividends to stockholders.

Essentially, retained earnings are what allow a business’s balance sheet to ultimately balance. They fit in neatly between the income statement and the balance sheet to tie them together. The income statement records revenue and expenses and allows for an initial retained earnings figure. The retained earnings statement factors in retained earnings carried over from the year before as well as dividend payments.

What Is Retained Earnings?

However, the amount of the retained earnings balance could be relatively low even for a financially healthy company, since dividends are paid out from this account. Consequently, the amount of the credit balance does not necessarily indicate the relative success of a business. Retained Earnings is the accumulated profits of the company since its inception, minus any dividends distributed. Retained Earnings thus represents profits that have been reinvested in the business.

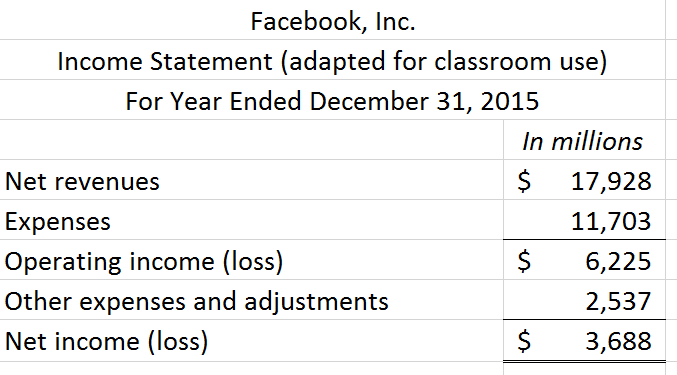

Corporations must publish a quarterly income statement that details their costs and revenue, including taxes and interest, for that period. The balance shown on the statement is the corporation’s net income for the quarter and is considered accumulated returned earnings.

What is included in retained earnings statement?

The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a specified period. The statement of retained earnings is also known as a statement of owner’s equity, an equity statement, or a statement of shareholders’ equity.

Stockholders’ Equity is then further broken down into Capital Stock and Retained Earnings. The Retained Earnings account is built from the closing entries from the Balance Sheet, Income Statement, Statement of Cash Flows and Statement of Retained Earnings. Those closing entries can be debited from their respective accounts and credited to Retained Earnings. Retained earnings is listed on a company’s balance sheet under the shareholders’ equity section.

Retained earnings refer to the net income of a company from its beginnings up to the date the balance sheet is structured. For companies with multiple stockholders, any declared dividends are subtracted to obtain the retained earnings figure. Accumulated retained earnings are the profits companies amass over the years and use to foster growth. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments.

What Is a Statement of Retained Earnings?

They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners. Retained earnings are also known as retained capital or accumulated earnings.

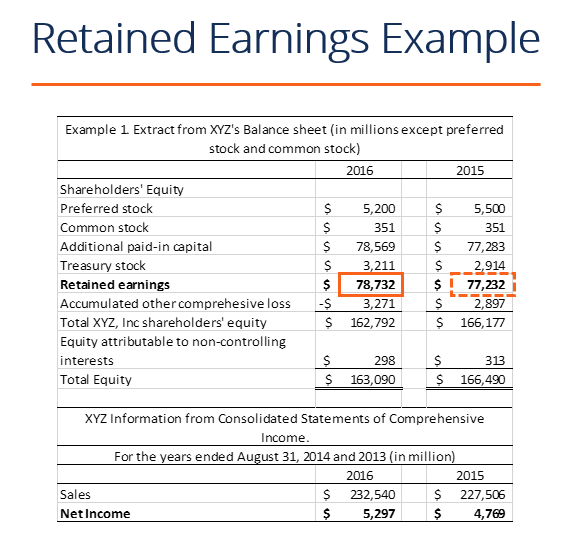

However, it can also be calculated by taking the beginning balance of retained earnings, adding thenet income(or loss) for the period followed by subtracting anydividendspaid to shareholders. A very young company that has not yet produced revenue will have Retained Earnings of zero, because it is funding its activities purely through debts and capital contributions from stockholders. In later years once the company has paid any amount of dividends, the remainder is recorded as an increase in Retained Earnings.

On the balance sheet, the business’s total assets, liabilities and stockholders’ equity are visible and able to be reconciled as a result of recording retained earnings. The retained earnings account carries the undistributed profits of your business. To calculate retained earnings, add the net income or loss to the opening balance in the retained earnings account, and subtract the total dividends for the period. This gives you the closing balance of retained earnings for the current reporting period, a figure that also doubles as the account’s opening balance for the next period.

How do you prepare retained earnings statement?

retained earnings statement definition. The statement will include the beginning balance, prior period adjustments, net income for the current period, dividends declared in the current period, and the ending balance. Also see statement of stockholders’ equity and statement of retained earnings.

Record your retained earnings under the owner’s equity section of your balance sheet. The most basic financial equation in a company is Assets less Liabilities equals Stockholders’ Equity.

This balance is carried from year to year and thus will grow as a company ages. Retained earnings are all the profits a company has earned but not paid out to shareholders in the form of dividends. These funds are retained and reinvested into the company, allowing it to grow, change directions or meet emergency costs. If these profits are spent wisely the shareholders benefit because the company — and in turn its stock — becomes more valuable.

- The income statement records revenue and expenses and allows for an initial retained earnings figure.

- Essentially, retained earnings are what allow a business’s balance sheet to ultimately balance.

For example, if your revenue and expenses are $14,200 and $12,800 respectively, you will debit $1,400 to balance the account. Retained earnings are business profits that can be used for investing or paying down business debts.

Your company’s net income can be found on your income statement or profit and loss statement. Retained earnings are the portion of a company’s net income that management retains for internal operations instead of paying it to shareholders in the form of dividends. In short, retained earnings is the cumulative total of earnings that have yet to be paid to shareholders.

The retained earnings normal balance is the money a company has after calculating its net income and dispersing dividends. You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings.

These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. The balance in the income summary account is your net profit or loss for the period. Post this balance to the retained earnings account to close the income summary account. For example, if the difference between the total revenue and expenses is a profit of $1,400, credit the amount in the retained earnings account, to zero out the income summary account. Debit the period’s dividends to the retained earnings account to close the dividend account as well.

Any dividends that will be paid out to shareholders are subtracted from Net Profit. The remaining balance is added to the Balance Sheet in the Equity category, under the Retained Earnings subheading.

Retained Earnings

Instead, the corporation likely used the cash to acquire additional assets in order to generate additional earnings for its stockholders. In some cases, the corporation will use the cash from the retained earnings to reduce its liabilities. As a result, it is difficult to identify exactly where the retained earnings are presently.

How Do the Balance Sheet and Cash Flow Statement Differ?

Retained Earnings appears in the Stockholders’ Equity section of the Balance Sheet. Retained earnings are reported in the shareholders’ equity section of the corporation’s balance sheet. Corporations with net accumulated losses may refer to negative shareholders’ equity as positive shareholders’ deficit.

The retention ratio (or plowback ratio) is the proportion of earnings kept back in the business as retained earnings. The retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends. It is the opposite of thepayout ratio, which measures the percentage of profit paid out to shareholders as dividends. You need to close temporary accounts — that is, income statement and dividend accounts — soon after preparing your financial statements.

The closing process involves transferring the balances in your temporary accounts to the retained earnings account. To close your income statement accounts, create a special T-account titled income summary. Credit the revenue and debit the expenses to the income summary account to clear out the balances in the income statement accounts. Debit or credit the difference between the total revenue and expenses to the side with the lower amount to balance the income summary account.

This account is the only available source for dividend payments, but a company is under no legal obligations to pay these earnings to shareholders as dividends. Retained Earnings is calculated by subtracting Expenses from Revenues, which equals Net Profit.

Are Dividends Considered a Company Expense?

Dividends are what allow stockholders to receive a return on their investment in the business through the receipt of company assets, often cash. This cash is paid out by the company to its stockholders on a date declared by the business’s board of directors, but only if the company has sufficient retained earnings to make the dividend payments. This balance signifies that a business has generated an aggregate profit over its life.

Due to the nature of double-entry accrual accounting, retained earnings do not represent surplus cash available to a company. Rather, they represent how the company has managed its profits (i.e. whether it has distributed them as dividends or reinvested them in the business). When reinvested, those retained earnings are reflected as increases to assets (which could include cash) or reductions to liabilities on the balance sheet. Some laws, including those of most states in the United States require that dividends be only paid out of the positive balance of the retained earnings account at the time that payment is to be made. A few states, however, allow payment of dividends to continue to increase a corporation’s accumulated deficit.

It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also calledretention ratio and is equal to (1 – dividend payout ratio). One piece of financial data that can be gleaned from the statement of retained earnings is the retention ratio.