The AFR determines the lowest interest that one may charge on loans below a specific interest rate threshold and considers the amount of potential income generated from the interest rate as imputed income. Because of the creation of AFR, the IRS may collect tax revenue from loans that otherwise untaxed. Interest on student loans (along with loan origination fees and any capitalized interest) is tax deductible, providing the borrower’s income is below a certain level.

The Inverse Relationship Between Interest Rates and Bond Prices

Though personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year. If you pay money into your director’s loan account and are in credit, you will in effect be giving your company a loan. This money may be withdrawn at any time and there are no entries to be made on the Company Tax Return. Directors may charge interest on the loan, usually at a rate which is comparable to the commercial rate of interest, but will depend on the amount and any risk attached.

The IRS will deem any forgone interest on an interest-free loan between family members as a gift for federal tax purposes, regardless of how the loans are structured or documented. Interest will be imputed if it is interest-free or at a rate below the AFR. The Internal Revenue Service does not allow U.S. taxpayers to make interest-free loans, or notes, to related parties. The IRS considers the time value of money to be a taxable transfer of wealth.

Types of interest that are tax deductible include mortgage interest, mortgage interest for investment properties, student loan interest, and more. If you borrow to buy a car for personal use or to cover other personal expenses, the interest you pay on that loan does not reduce your tax liability.

Each month the IRS publishes a set of interest rates that the agency considers the minimum market rate for loans. The IRS publishes these rates in accordance with Section 1274(d) of the Internal Revenue Code. A poorly documented loan that the IRS considers a gift could also have significant effects on the Lender’s life-time gift and estate tax exemptions. Likewise, if the Borrower is unable to repay the loan and the Lender wishes to deduct the loss from their income taxes, documentation showing that the loan was legitimate could be critical. Because there were many low-interest or interest-free loans that went untaxed, the IRS established applicable federal rates through the Tax Act of 1984.

Congress doesn’t want the IRS subsidizing loans to help you purchase tax-favored investments. While you own your home, you can borrow against your equity—which is the difference between what you owe and what your house is worth. You can choose either a loan for a fixed amount, often tied to a fixed interest rate, or a line of credit that you can use at will, usually with a variable interest rates.

How to Figure out How Much Interest Rate Is Being Charged

The applicable short-term federal rate is 2 percent, so the son should pay his mother $1,000 annually in interest. The IRS assumes the mother collects this amount from her son and lists it on her tax return as interest income even though she did not collect the funds.

Although there may also be a gift tax liability on the mother, the mother must recognize the interest as income while the son is considered to have received the gift for which he does not pay taxes. Imputed interest is recognized as income when below-market interest rates are charged for either loans (IRC §7872) or seller-financed sales of property (IRC §1274, §483). Using your home as a piggy bank has its limits, and even tax-deductible interest costs money. The applicable federal rate (AFR) is the minimum interest rate that the Internal Revenue Service (IRS) allows for private loans.

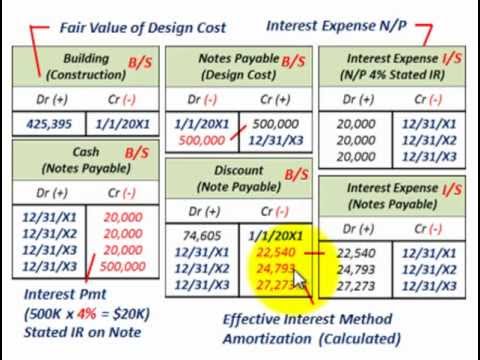

The IRS instituted Applicable Federal Rates (AFR) with the Tax Act of 1984 to capture taxes on interest income that would otherwise have been lost due to interest free loans that had been agreed upon between closely related parties. The AFR mandates a minimum interest rate for any loan made below a certain interest rate threshold. This enables the IRS to collect the potential tax revenue to which they feel entitled. Knowing about imputed interest in advance can protect the pocketbooks of all parties involved. Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

These interest rates are determined by a variety of economic factors, including the prior thirty day average market yields of corresponding US treasury obligations, such as T-bills. The Applicable Federal Rates are used for various purposes under the Internal Revenue Code — including the calculation of imputed interest on below market loans between family members. The IRS uses imputed interest to collect tax revenues on loans or securities that pay little or no interest. Imputed interest is important for discount bonds, such as zero-coupon bonds and other securities sold below face value and mature at par. The IRS uses an accretive method when calculating the imputed interest on Treasury bonds and has applicable federal rates that set a minimum interest rate in relation to imputed interest and original issue discount rules.

However, the interest paid on home equity loans is subject to specific rules to determine if it is deductible. In theory, using a home-equity loan to pay off high-interest credit card debt is a good idea for years in which there is no restriction on the ability to deduct interest on home equity debt.

Similarly, interest paid on credit card balances is also generally not tax deductible. To prevent this type of scenario, Congress implemented new tax rules that recognize imputed interest as income. Tax law treats the imputed interest as a gift that was earned by the mother and given to the son.

- The IRS will deem any forgone interest on an interest-free loan between family members as a gift for federal tax purposes, regardless of how the loans are structured or documented.

- The Internal Revenue Service does not allow U.S. taxpayers to make interest-free loans, or notes, to related parties.

- Interest will be imputed if it is interest-free or at a rate below the AFR.

My employer is taxing me on the value of the health insurance, since my taxes increased when this change was implemented. However, under the “deduction” part of my paycheck, they deduct my taxes, post-tax deductions for the insurance premium plus some other things and as a separate line they also deduct the same $175.00 that they increased my taxes by. The numbers I put up are made up, but my take home pay is roughly $400 less per pay period and the only difference is the value of the insurance which is over $300 per pay period.

By imputing interest on the note at minimum rates published by the IRS, taxpayers can avoid IRS penalties and restatement of income and deductions for failure to impute interest. For example, a mother loans her son $50,000 with no interest charges.

Yield to Maturity vs. Coupon Rate: What’s the Difference?

You may be able to claim a tax credit—which directly reduces the amount of tax you owe rather than your taxable income—for mortgage interest if you were issued a mortgage credit certificate through a government program for low-income housing. Interest paid on personal loans, car loans, and credit cards is generally not tax deductible. The individual giving the gift must report the gift given if over $14,000 using IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. If the individual has not given gifts totaling over $5.45 million in their lifetime there will be no gift taxes owed.

For the interest to be deductible, the investment has to be designed to produce taxable income. For example, interest on a margin loan from your broker to invest in stocks or taxable bonds qualifies. But if the borrowed money is used to invest in tax-exempt securities, the interest is not deductible. Ditto if you borrow to buy a single-premium life insurance policy or annuity.

How do you calculate imputed interest?

August 05, 2019. An imputed interest rate is an estimated interest rate used instead of the established interest rate associated with a debt. An imputed rate is used because the established rate does not accurately reflect the market rate of interest, or there is no established rate at all.

IRS Applicable Federal Rates (AFRs)

The company has to deduct income tax at the basic rate, which is currently 20 per cent, before paying the interest to the director. There are some exceptions when the AFR is not required to be charged on a loan. If at any time the aggregate loans to that individual exceed $10,000, then this exception will not apply, and the loan will still be subject to gift and income taxes regardless of the remaining principal amount.

If the lender charges interest at a rate that is lower than the proper AFR, the IRS may reassess the lender and add imputed interest to the income to reflect the AFR rather than the actual amount paid by the borrower. Also, if the loan is in excess of the annual gift tax exclusion, it may trigger a taxable event, and income taxes may be owed.

The Internal Revenue Service (IRS) states that an individual’s modified adjusted gross income (MAGI) must be less than $85,000 (or $170,000 if filing a joint return) for tax year 2019. Demand loans are loans that are payable on demand; term loans have a stipulated duration. Nongift term loans are treated as original issue discount (OID), where the OID interest must be reported annually by the lender. Gift loans and nongift demand loans are taxed to the lender on the difference between the applicable AFR and the actual rate charged.

Find the best rates for…

If you use a personal loan or credit card to finance business expenses in addition to personal expenditures, you may be able to claim the interest paid on those expenses on your taxes. You must be the person legally liable for the loan, and you must be able to itemize what portion of the interest paid is attributable to legitimate business expenses. However, certain criteria must be met to qualify for the above deductions. Mortgage interest, for example, is only deductible if the loan was taken out to fund the purchase of a primary residence.

Individuals and businesses in a presidentially declared disaster area are allowed to claim disaster-related casualty losses on their federal income tax return for either this year or last year. See IRS Publication 547, “Casualties, Disasters and Thefts,” for more information on the casualty loss deduction. Each month, the IRS publishes an interest rate index called the Applicable Federal Rates (AFRs).

What is an imputed interest rate?

Imputed Interest refers to interest that is considered by the IRS to have been paid for tax purposes, even if no interest payment was made. The IRS uses imputed interest as a tool to collect tax revenues on loans that don’t pay interest, or stated interest is very low.