Indirect labor is classed as a fixed cost since it tens to stay constant even when factory output changes. The cost of security, for example, is likely to stay constant even if the factory shuts down temporarily. Employees or workers (such as accountants, supervisors, security guards) who do not directly produce goods or services, but who make their production possible or more efficient.

Indirect costs are those for activities or services that benefit more than one project. Their precise benefits to a specific project are often difficult or impossible to trace. For example, it may be difficult to determine precisely how the activities of the director of an organization benefit a specific project. Indirect costs do not vary substantially within certain production volumes or other indicators of activity, and so they may sometimes be considered to be fixed costs. Direct labor includes the hourly wages paid to a production or service employee, and payroll taxes and expenses for which you are responsible.

THE ROLE OF DIRECT AND INDIRECT LABOR COSTS

While direct labor comprises work done on certain products or services, indirect labor is employee work that can’t be traced back or billed to services or goods produced. The cost of these types of indirect labor are charged to factory overhead, and from there to the units of production manufactured during the reporting period. This means that the cost of indirect labor related to the production process ends up in either ending inventory or the cost of goods sold.

Indirect labor costs are not readily identifiable with a specific task or work order. They are termed indirect costs and are charged to overhead accounts.

What cost is indirect labor?

Indirect labor is the cost of any labor that supports the production process, but which is not directly involved in the active conversion of materials into finished products. Examples of indirect labor positions are: Production supervisor.

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs.

What is direct labor and indirect labor?

Indirect labor cost is the cost of labor that is not directly related to the production of goods and the performance of services. It refers to the wages paid to workers whose duties enable others to produce goods and perform services.

Gross income is a measure of the amount of money a company takes in during a certain period of time. Gross income is equal to total sales minus the company’s cost of goods sold. Cost of goods sold includes all costs that are directly related to production, such as direct labor costs and the cost of raw materials and parts used to produce goods. Net income or profit is the total amount of sales a company makes during a certain period of time minus its total expenses. Net income takes account of the cost of goods sold and all other costs including indirect labor costs, taxes and insurance.

A company with high indirect labor costs could potentially have high gross income, but a low or even negative net income. If a company has negative net income it means it lost money over the period in question. Reducing indirect labor costs by laying off support workers is a way that companies can attempt to increase net income. Businesses incur a wide variety of expenses to fund their operations, which often includes paying wages to employees who perform services for the business. For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together.

Examples include production-line employees, roofers and lawn-mowing staff members. All others, including administrative, custodial and warehouse staff, are indirect labor and classified as overhead. GAAP matching guidelines require that both be absorbed into the cost of the product or service to allow for recording the costs of doing business in the same period as the revenue they generate. Direct labor, along with direct materials, is a prime or direct production cost, while indirect labor is an overhead expense. Direct labor is one component of the total manufacturing cost of a product, along with direct materials and manufacturing overhead.

- Gross income is a measure of the amount of money a company takes in during a certain period of time.

- Gross income is equal to total sales minus the company’s cost of goods sold.

- Cost of goods sold includes all costs that are directly related to production, such as direct labor costs and the cost of raw materials and parts used to produce goods.

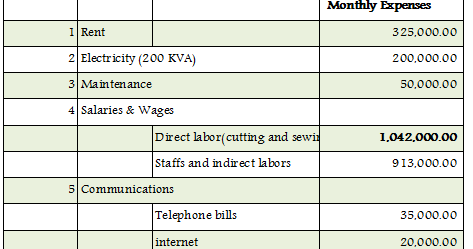

These workers represent the indirect labor, with the total cost comprising the total indirect labor costs for the factory payroll period. As a small business owner, it’s important to set the prices of your services and product high enough to cover your production costs, turn a profit, and still remain competitive. Keeping a tab on the direct and indirect labor costs will help you exercise a strict control over labor cost and identify potential areas for cost improvement. Direct labor describes workers that are directly involved in the production of goods or the performance of services. For example, workers at a factory who assemble, machine, paint or otherwise help to physically produce products perform direct labor.

Similarly, workers at a salon who actually perform haircuts, treatments and other services are involved in direct labor. The cost of paying wages to workers involved in production is a business’s direct labor cost. Direct labor costs are most commonly associated with products in a job costing environment, where the production staff is expected to record the time they spend working on various jobs. This can be a substantial chore if employees work on a multitude of different products.

The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. Because direct labor must follow costs from the start of production until the time of sale, it is vital to the work-in-process, finished goods and the cost-of-goods-sold accounts. Accounting starts with a debit to the work-in-process inventory account and a credit to wages payable. The balance sheet includes work-in-process and finished goods inventory amounts, and the income statement includes the cost of goods sold. Direct labor refers to employees personally involved in manufacturing a product or performing a service.

IS INDIRECT LABOR A FIXED COST?

Costs of revenueexist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however. The IRS website even lists some examples of “personal service businesses” that do not calculate COGS on their income statements. Add to together the salaries of those workers in the production category.

Make sure that you include any taxes or employment benefits such as unemployment insurance or retirement plan payments paid by the company for each employee. These are the direct labor workers, and the result is the direct labor costs for the factory payroll period. Indirect costs are, but not necessarily, not directly attributable to a cost object. Indirect costs are typically allocated to a cost object on some basis. In construction, all costs which are required for completion of the installation, but are not directly attributable to the cost object are indirect, such as overhead.

Add the salaries of the rest of the workers in the factory, including taxes and benefits. These workers include administration, janitorial staff, maintenance workers and any other position not directly involved in the production process.

Indirect labor

Direct materials means the materials actually used to make a product. Manufacturing overhead refers to other expenses necessary for the item to be produced such as factory rent and depreciation. That is, manufacturing overhead is the indirect costs of production, including indirect labor. Direct labor is considered a variable cost because it changes depending on the number of units produced.

What Is Indirect Labor?

In manufacturing, costs not directly assignable to the end product or process are indirect. These may be costs for management, insurance, taxes, or maintenance, for example.

This includes Social Security, unemployment tax, Medicare and worker’s compensation insurance. In addition, this includes your part of health insurance premiums and any contributions you make to an employee’s retirement plan. Although not required, you can also include employee training and development costs in a wage calculation. In accounting, indirect labor costs are treated like other indirect costs, as overheads. They are either expensed in the period in which they are incurred or allocated to a cost object via a predetermined overhead rate.

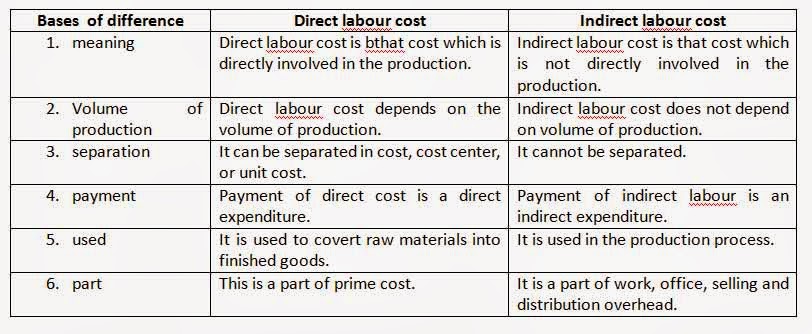

GAAP guidelines provide options for allocating overhead expenses using direct labor hours. Dividing total overhead costs by direct labor cost is the most common and easiest. Once allocated, overhead — which includes indirect labor — follows costs through production the same as direct labor. They are usually split into direct and indirect labor costs, based on the worker’s contribution to the production process.