A rebuttal to this might be that as nonprofit organizations grow and seek larger donations, the degree of scrutiny increases, including expectations of audited financial statements. A further rebuttal might be that NPOs are constrained, by their choice of legal structure, from financial benefit as far as distribution of profit to members and directors is concerned. A second misconception is that nonprofit organizations may not make a profit. Although the goal of nonprofits isn’t specifically to maximize profits, they still have to operate as a fiscally responsible business.

Related Articles

The exemption does not apply to other federal taxes such as employment taxes. Additionally, a tax-exempt organization must pay federal tax on income that is unrelated to their exempt purpose. Failure to maintain operations in conformity to the laws may result in the loss of tax-exempt status.

What does non profit organization mean?

Nonprofit organization. Nonprofits are tax-exempt or charitable, meaning they do not pay income tax on the money that they receive for their organization. They can operate in religious, scientific, research, or educational settings.

Nonprofit vs. not-for-profit

Any money earned must be retained by the organization, and used for its own expenses, operations, and programs. A few well known non-profit organizations include Habitat for Humanity, Red Cross, and United Way. There are many types of not-for-profit organizations, however, the most common is a 501(c)3. Just like any other business, a nonprofit organization must generate revenue to cover various expenses, such as utility bills, employees’ salary, and operating costs.

United States

The two major types of nonprofit organization are membership and board-only. A membership organization elects the board and has regular meetings and the power to amend the bylaws. A board-only organization typically has a self-selected board and a membership whose powers are limited to those delegated to it by the board. The Model Nonprofit Corporation Act imposes many complexities and requirements on membership decision-making.

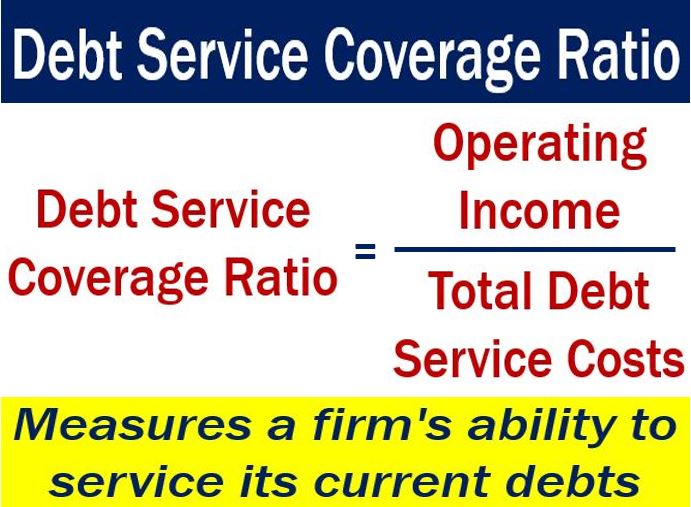

Income statements are prepared in order to assess a company’s financial performance four times each year. Instead of income statements, nonprofit organizations will typically provide its donors and the general public a statement of activities which will include all revenues, expenses, and plus net assets. The other resource a nonprofit depends on is a quarterly balance sheet listing the owner’s equity.

Nonprofit organizations return any extra income to the organization. Not-for-profits use their excess money to pay their members who do work for them.

A non-profit business, also known as a not-for-profit organization, is a tax-exempt organization formed for religious, charitable, literary, artistic, scientific, or educational purposes. It is an incorporated business from which its shareholders or trustees do not benefit financially.

Sometimes, nonprofit organizations may earn profit from activities not related to their mission. For example, an organization engaged in providing clothes to street kids may set up its own facility for conducting charity events.

- Unlike for-profit companies, which exist, in part, to make a profit for the owners and shareholders, non-profit organizations don’t have owners, and so they rely heavily on charitable contributions, funds, memberships and service fees.

- Non-profit organizations exist to provide services for society and are thus exempt from income taxes if they are approved by the Internal Revenue Service (IRS).

Since nonprofit organizations do not operate with owners at the helm, they will typically produce a document which shows the organization’s liabilities and assets known as a statement of financial position. After a nonprofit organization has been formed at the state level, the organization may seek recognition of tax-exempt status with respect to U.S. federal income tax. That is done typically by applying to the Internal Revenue Service (IRS), although statutory exemptions exist for limited types of nonprofit organization.

Unlike for-profit companies, which exist, in part, to make a profit for the owners and shareholders, non-profit organizations don’t have owners, and so they rely heavily on charitable contributions, funds, memberships and service fees. Some nonprofit organizations, such as the Girl Scouts of America, earn a significant amount of their revenue by selling certain products, such as their Girl Scout cookies. Non-profit organizations exist to provide services for society and are thus exempt from income taxes if they are approved by the Internal Revenue Service (IRS).

A nonprofit organization (NPO), also known as a non-business entity, not-for-profit organization, or nonprofit institution, is an organization dedicated to furthering a particular social cause or advocating for a shared point of view. In economic terms, it is an organization using its surplus of the revenues to further achieve its ultimate objective, rather than distributing its income to the organization’s shareholders, leaders, or members. Nonprofits are tax-exempt or charitable, meaning they do not pay income tax on the money that they receive for their organization. They can operate in religious, scientific, research, or educational settings.

When it’s not using the facility for its own events, it rents the space to others, earning rental income in the process. Since such profit is not associated with the main purpose of the organization, it would be taxed like any other business income. Besides these basic differences in organization and purpose, there are several more technical areas worth mentioning when discussing the differences between nonprofits and their for-profit counterparts.

Individuals and businesses who make donations to a nonprofit organization can deduct the number of donations while calculating their taxable income. However, nonprofit organizations must disclose their operational and financial information to the public in order to assure donors that their contributions are used properly. Another difference between a nonprofit and for-profit organization is that a for-profit will put together an income statement each quarter.

What’s the difference between a nonprofit and a not for profit?

While for-profit organizations are responsible for paying taxes based on their net income, nonprofit organizations are exempt from paying income tax. Another difference between a nonprofit and for-profit organization is that a for-profit will put together an income statement each quarter.

Nonprofit and not-for-profit are terms that are used similarly, but do not mean the same thing. Both are organizations that do not make a profit, but may receive an income to sustain their missions. The income that nonprofit and not-for-profit organizations generate is used differently.

Sometimes the amount of revenue generated may be more than the expenses, resulting in a surplus revenue or profit. Nonprofit organizations do not pay taxes on such profit if it is generated from activities related to the mission or purpose of such an organization. A non-profit business is a tax-exempt organization formed for religious, charitable, literary, artistic, scientific, or educational purposes. Any money earned must be retained by the organization and used for its own expenses, operations, and programs. There are several benefits to becoming a non-profit, including exemption from federal income taxes, the ability to accept contributions that are tax-deductible to the donor, and eligibility for government and foundation grants.

Often, both will use the corporate form for their day-to-day operations, and many have similar business activities. From a practical standpoint, there is no real difference between a nonprofit organization operating a concession stand at your local hockey rink and a small restaurant that is run by a private for-profit company.

Republic of Ireland

Accordingly, many organizations, such as the Wikimedia Foundation, have formed board-only structures. The National Association of Parliamentarians has generated concerns about the implications of this trend for the future of openness, accountability, and understanding of public concerns in nonprofit organizations.

Another difference between nonprofit organizations and not-for-profit organizations is their membership. Nonprofits have volunteers or employees who do not receive any money from the organization’s fundraising efforts. They may earn a salary for their work that is independent from the money the organization has fundraised. Not-for-profit members have the opportunity to benefit from the organization’s fundraising efforts. In many ways, small businesses and nonprofit organizations are similar.

Unlike for-profit businesses that make profits to create wealth for their owners, nonprofit organizations mainly get their revenue from donations, contributions, and membership fees. Some nonprofit organizations may earn revenue by selling products. For example, an organization against animal cruelty may sell T-shirts printed with messages to promote its campaign. IRS-approved nonprofit organizations are exempt from paying income tax.

They must manage their income (both grants and donations and income from services) and expenses so as to remain a fiscally viable entity. Nonprofits have the responsibility of focusing on being professional, financially responsible, replacing self-interest and profit motive with mission motive.