If you’re wondering how to double $100 (and then some), look no further than the bank. The easiest way to invest $100 is to put it into a high-interest savings account. The secret is not to touch that money and let the interest accumulate. It will take time for your bank balance to really grow, but it’s one of the surest ways to earn money while you sleep.

The rule of 72 teaches you how to double your money, but it’s up to you to take action. Invest in the broad market, stay patient through volatile upward and downward swings, and reinvest your gains. The 25-year average annualized return for the S&P 500 from 1994 through 2018 was 8.52%. In other words, if you had invested in an index fund that tracks the S&P 500 in 1994 and you never withdrew the money, you would have average returns of 8.52% per year.

For instance, if the interest rate is 12 per cent, Rs 10,000 becomes Rs 40,000 in 12 years. Rule of 72, 114 and 144 gives you the nearest figure and can little bit vary as compared with formula.

At that rate, you should expect to double your money about every 8.45 years. For example, if you want to double your money fast, you’d better be willing to put in a lot of hard work or have a lucrative and in-demand skill. If you don’t want to put in a lot of work, you need to let time and compound interest do it’s thing with a more passive investment strategy.

How do you calculate Rule of 72?

The rule says that to find the number of years required to double your money at a given interest rate, you just divide the interest rate into 72. For example, if you want to know how long it will take to double your money at eight percent interest, divide 8 into 72 and get 9 years.

Examples of How to Use the Rule of 72

Good Financial Cents points out that once you’ve grown your money to $1000 in this way, you’ll have many more investment options to choose from. The Rule of 72 is a simple equation to help you determine how long an investment will take to double given a fixed interest rate. It’s a shortcut that investors use to estimate if an investment will double your money quickly enough to be worth pursuing.

Using the Rule of 72 is a great way to help people understand how much compound interest can help accelerate their savings. It also helps to show the value of starting to save for retirement earlier. If your money could double every 10 years, you’ll have much more time to grow it if you start investing sooner rather than later. The Rule of 72 is a rule of thumb that says how long it will take to double your money given a fixed interest rate.

The rule of 70 is used to determine the number of years it takes for a variable to double by dividing the number 70 by the variable’s growth rate. The rule of 70 is generally used to determine how long it would take for an investment to double given the annual rate of return. The effective annual interest rate is the real return on an investment, accounting for the effect of compounding over a given period of time. With regards to the fee that eats into investment gains, the Rule of 72 can be used to demonstrate the long-term effects of these costs. A mutual fund that charges 3% inannual expense feeswill reduce the investment principal to half in around 24 years.

A borrower who pays 12% interest on his credit card (or any other form of loans which is charging compound interest) will double the amount he owes in six years. Some high-yield savings accounts will give you one percent annual percentage yield (or higher), which is awesome… for a savings account. You’re better off, however, putting your money in the stock market, taking on a little more risk for a higher potential reward. This is a place for people who are or want to become Financially Independent (FI), which means not having to work for money.

How do I calculate how long it takes an investment to double (AKA ‘The Rule of 72’) in Excel?

What is the rule of 72 examples?

The rule of 72 is a method used in finance to quickly estimate the doubling or halving time through compound interest or inflation, respectively. For example, using the rule of 72, an investor who invests $1,000 at an interest rate of 4% per year, will double their money in approximately 18 years.

- If your money could double every 10 years, you’ll have much more time to grow it if you start investing sooner rather than later.

- It also helps to show the value of starting to save for retirement earlier.

- Using the Rule of 72 is a great way to help people understand how much compound interest can help accelerate their savings.

Investors can use the rule of 70 to evaluate various investments including mutual fund returns and the growth rate for a retirement portfolio. The Rule of 72 is a quick, useful formula that is popularly used to estimate the number of years required to double the invested money at a given annual rate of return. I would feel completely comfortable investing $20k with a robo-advisor, knowing that my money is going to be well-diversified. Just make sure you mix up the type of accounts you have (i.e. retirement vs. regular investment accounts).

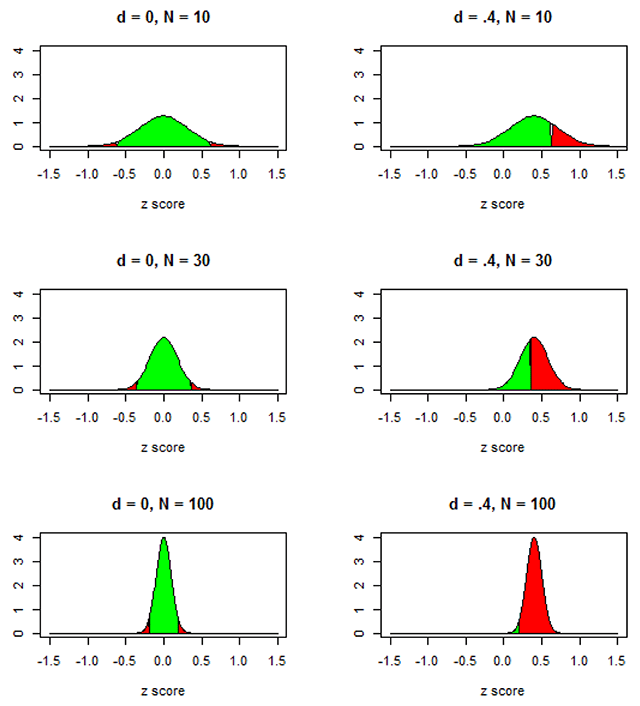

When dealing with low rates of return, the rule of 72 is a fairly accurate predictor. This chart compares the numbers given by the rule of 72 and the actual number of years it would take these investments to double in value.

The Rule of 72 is an easy calculation to determine how long it’ll take you to double your money. You simply divide the number 72 by the expected return of your investment and THAT is how many years it’ll take to double. If you want to double your money, the rule of 72 shows you how to do so in about seven years without taking on too much risk. The rule states that the amount of time required to double your money can be estimated by dividing 72 by your rate of return.

The Formula for the Rule of 72 Is

The Rule of 72 is defined as a shortcut or rule of thumb used to estimate the number of years required to double your money at a given annual rate of return, and vice versa. The rule of 70 is a calculation to determine how many years it’ll take for your money to double given a specified rate of return.

The rule of 72 is a famous shortcut for calculating how long it will take for an investment to double if its growth compounds. The result is the number of years it will take to double your money. The last few years have seen the rise of many online-only banks such as Ally or CIT Bank that pay 10X or more interest compared to a big bank like Chase or Wells Fargo. The rule of 72 is a simple method to determine the amount of time investment would take to double, given a fixed annual interest rate.

For example, assume an investor invests $20,000 at a 10% fixed annual interest rate. He wants to estimate the number of years it would take for his investment to double. Instead of using the rule of 70, he uses the rule of 72 and determines it would take approximately 7.2 (72/10) years for his investment to double.

The Rule of 72 offers a useful shortcut since the equations related tocompound interestare too complicated for most people to do without a calculator. Alternatively, it can compute the annual rate of compounded return from an investment given how many years it will take to double the investment. It won’t double in a year, but it should, eventually, given the old rule of 72.

If you divide 72 by the annual rate of return, it will tell you how many years it will take to double your investment. People love money, and they love it more to see the money getting double. Getting a rough estimate of how much time it will take to double the money also helps the average Joe to compare investments.

Financial Independence is closely related to the concept of Early Retirement/Retiring Early (RE) – quitting your job/career and pursuing other activities with your time. At its core, FI/RE is about maximizing your savings rate (through less spending and/or higher income) to achieve FI and have the freedom to RE as fast as possible. An individual retirement account (IRA) is an investing tool individuals use to earn and earmark funds for retirement savings.

The reason Money Under 30 recommends only putting up to 50 percent of your money in a high-yield savings account is because the return on investment won’t be great. If you absolutely know you’ll need the money in a very short period of time, you should feel comfortable going over that 50 percent mark, but I would think about it first.

Making Sense of the Rule of 72

To use the rule of 72, divide 72 by the annual rate of return. A Roth IRA is a stable, long-term account in which you pay taxes ahead of time. “If time is on your hands, then I would strongly think about investing in a Roth IRA account,” notes Solari.

This may not be a new idea, but investing in the stock market is still a great way to double your money. However, using online companies like Ally Invest and ETrade make investing affordable. Like the above two rules, the rule of 144 tell investors in how much time their money or investment will quadruple.