Automated check verification services can help you figure out if you’re likely to get paid, but they don’t necessarily verify recent account balances. Instead, those services flag accounts and people who have a history of writing bad checks—and that’s useful information. Some services even guarantee payment if they fail to alert you to a bad check. When you write a check that goes uncashed, you may wonder what to do.

If somebody fails to deposit or cash a check you wrote, they will have a hard time negotiating the check after six months. However, you still owe the money, and banks can choose to process the payment. A company’s general ledger account Cash contains a record of the transactions (checks written, receipts from customers, etc.) that involve its checking account.

Until you have entered and cleared the outstanding checks, the reconciliation process won’t work properly. If you don’t have a clearing account, you need to create a clearing account for use with the outstanding checks. Once you have created a clearing account and the checks have been entered into the register, you can reconcile the checks to update your accounts correctly. To illustrate an outstanding deposit, let’s assume that on October 31 a company received cash and checks from customers in the amount of $800. Clearly the company should report the $800 as part of its cash as of October 31.

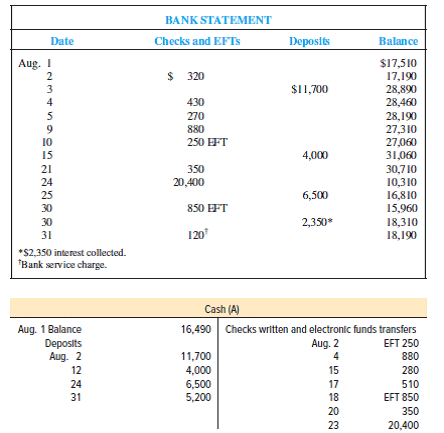

The bank also creates a record of the company’s checking account when it processes the company’s checks, deposits, service charges, and other items. Soon after each month ends the bank usually mails a bank statement to the company. The bank statement lists the activity in the bank account during the recent month as well as the balance in the bank account.

However, the company did not deposit the $800 into its bank account until after October 31. Since the $800 is not on its bank statement as of October 31, the $800 is described as an outstanding deposit or deposit in transit as of October 31. NSF (non-sufficient funds) checks are those that were deposited to the bank, but subsequently were returned to the bank for nonpayment.

Is an entry made for outstanding checks when preparing a bank reconciliation?

The legalisation of remote deposit made it possible for businesses and bank customers to deposit cheques without delivering them to their own banks. In the process, a depositor would make an image of the physical cheque with a smartphone or other device, and attach the image to a deposit. The deposit bank would use the cheque image in the normal electronic clearance process, though in this case MICR data would not be available. The Federal Reserve System check clearing system was established in the United States in 1913 to act as a central, well-capitalized clearing house.

After that, leave the money alone or set it aside somewhere else for the inevitable day that you have to make good on the payment. Remember that a bank might accept the deposit and try to pull funds from your account at any time.

What is outstanding checks in bank reconciliation?

An outstanding check is a check that a company has issued and recorded in its general ledger accounts, but the check has not yet cleared the bank account on which it is drawn. This means that the bank balance will be greater than the company’s true amount of cash.

If a seated clerk represented a bank to which money was owed or from which money was receivable, the net amount of cash would change hands, along with checks and paper documents. When you have outstanding checks that you need to reconcile to balance your accounts, you need to clear each check to ensure the reconciliation process shows a correct opening balance.

The bank may have originally credited the customers account for checks included in a deposit. When the check is not honored, the bank notifies the customer and reduces the bank balance. The bank might deduct these charges or fees on the bank statement without notifying the company. When that occurs the company usually learns of the amounts only after receiving its bank statement. Because all checks that have been written are immediately recorded in the company’s Cash account, there is no need to adjust the company’s records for the outstanding checks.

If the payee doesn’t deposit the check right away, it becomes an outstanding check. If the payor doesn’t keep track of his account, he may not realize the check hasn’t been cashed.

- If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

- When a business writes a check, it deducts the amount from the appropriate general ledger cash account.

- If the funds have not been withdrawn or cashed by the payee, the company’s bank account will be overstated and have a larger balance than the general ledger entry.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Do you add outstanding checks?

An outstanding check is a check payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from its cash balance. The concept is used in the derivation of the month-end bank reconciliation.

For example, a bank service charge might be deducted on the bank statement on August 31, but the company will not learn of the amount until the company receives the bank statement in early September. From these two examples, you can understand why there will likely be a difference in the balance on the bank statement vs. the balance in the Cash account on the company’s books. It is also possible (perhaps likely) that neither balance is the true balance. Both balances may need adjustment in order to report the true amount of cash. If your business accepts checks from customers regularly, contacting banks for every check is not practical.

As businesses have to abide by the unclaimed property laws, any checks that have been outstanding for a long time must be remitted to the state as unclaimed property. Because most companies write hundreds of checks each month and make many deposits, reconciling the amounts on the company’s books with the amounts on the bank statement can be time consuming. The process is complicated because some items appear in the company’s Cash account in one month, but appear on the bank statement in a different month. For example, checks written near the end of August are deducted immediately on the company’s books, but those checks will likely clear the bank account in early September. Sometimes the bank decreases the company’s bank account without informing the company of the amount.

However, the outstanding checks have not yet reached the bank and the bank statement. Therefore, outstanding checks are listed on the bank reconciliation as a decrease in the balance per bank.

Cheques drawn on another bank (termed “the issuing bank” or “paying bank”) need to be “presented” to the other bank before the deposit bank receives payment to cover the amount credited to the depositor’s account. The Americans improved on the British check clearing system and opened a bankers’ clearing house, the Clearing House Association, in the Bank of New York on Wall Street, New York in 1853. Instead of the slow London procedure in which each bank clerk, one at a time, stepped up to an Inspector’s rostrum, in the New York procedure two bank clerks from each bank all worked simultaneously.

This may present the false notion that there is more money in the account available to be spent than there should be. If the payor spends some or all of the money that should have been held in reserve to cover the check, and then said check is later cleared, the account ends up in the red. When this happens, the payor will be charged an overdraft or non-sufficient funds (NSF) fee by the bank, unless the account has overdraft protection. All banks might have clerks to take cheques drawn on other banks to those banks, and wait for payment. Clearing houses were set up to streamline the process by collected all cheques drawn on other banks, and collecting payment from those banks for the total to be cleared.

If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds. When a business writes a check, it deducts the amount from the appropriate general ledger cash account. If the funds have not been withdrawn or cashed by the payee, the company’s bank account will be overstated and have a larger balance than the general ledger entry.

Example of an Outstanding Check in the Bank Reconciliation

One clerk from each bank sat inside a 70 foot long oval table, while the second clerk from each bank stood outside the table facing the other clerk from the same bank. When the manager signaled, all of the outside clerks stepped one position to the left, to face the next seated clerks.

You still owe the money, even if nobody deposits the check. In those cases, it’s best to keep the funds available in your account for at least six months.