Property tax is an operating expense, but your personal income-tax liability generated by the property is not. Your mortgage interest may be a deductible expense, but it is not an operating expense.

With regard to investment real estate, however, the term, “Net Operating Income” is a minor variation on this theme and has a very specific meaning. By more formal definition, it is a property’s Gross Operating Income less the sum of all operating expenses. For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company. In the scenario of a company in a high-risk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk. Accounts receivable and accounts payable are essentially opposites.

Accounts payable is the money a company owes its vendors, while accounts receivable is the money that is owed to the company, typically by customers. When one company transacts with another on credit, one will record an entry to accounts payable on their books while the other records an entry to accounts receivable. Management can use AP to manipulate the company’s cash flow to a certain extent. For example, if management wants to increase cash reserves for a certain period, they can extend the time the business takes to pay all outstanding accounts in AP.

When the bill is paid, the accountant debits accounts payable to decrease the liability balance. The offsetting credit is made to the cash account, which also decreases the cash balance. Your company makes principal and interest payments on its outstanding mortgage.

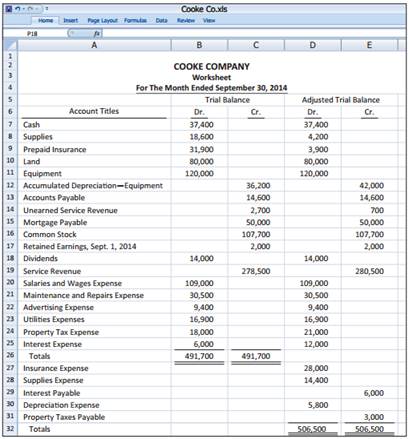

Balance Sheet

Where does mortgage payable go on the balance sheet?

mortgage loan payable definition. A liability account whose balance is the unpaid principal balance as of the balance sheet date. The amount of principal required to be paid within 12 months of the balance sheet date is reported as a current liability.

The interest expense on the debt is an operating expense and therefore appears on the income statement. The principal payments that reduce the mortgage appear on the cash flow statement in the financing section as a reduction in cash flow. On the balance sheet, the mortgage balance shown on the balance sheet shrinks by the amount of the principal payment. Accounts payable (AP) is an account within the general ledger that represents a company’s obligation to pay off a short-term debt to its creditors or suppliers. Another common usage of “AP” refers to the business department or division that is responsible for making payments owed by the company to suppliers and other creditors.

Accounts receivablesare money owed to the company from its customers. As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. A small business depreciates a building to account for using it in its operations.

Because all balance sheets must adhere to this equation, what your company owns needs to equal what it owes to creditors and owners. The assets section of a balance sheet shows the resources a company owns, such as vehicles, equipment or buildings. The liabilities portion of the balance sheet includes any debt used to finance those assets. If your small business owns a facility with a mortgage, such as an office building, list it among the assets and include the mortgage under liabilities.

Is a Home Loan an Asset or a Liability?

A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity.

The debit offset for this entry is typically to an expense account for the good or service that was purchased on credit. The debit could also be to an asset account if the item purchased was a capitalizable asset.

Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses. Companies looking to increase profits want to increase their receivables by selling their goods or services. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company.

- Accounts payable are debts that must be paid off within a given period to avoid default.

- A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section.

Mortgage Interest Expense

The other party would record the transaction as an increase to its accounts receivable in the same amount. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days. A company may have many open payments due to vendors at any one time.

You do this by transferring a portion of the building’s initial cost from the balance sheet to an expense on the income statement each year of the structure’s useful life. This transfer gradually reduces the building’s value on the balance sheet. For example, if you depreciate a building by $10,000 annually, you would reduce the building’s value in the asset’s section by $10,000 a year.

However, this flexibility to pay later must be weighed against the ongoing relationships the company has with its vendors. It’s always good business practice to pay bills by their due dates.

The $500 debit to office supply expense flows through to the income statement at this point, so the company has recorded the purchase transaction even though cash has not been paid out. This is in line with accrual accounting, where expenses are recognized when incurred rather than when cash changes hands. The company then pays the bill, and the accountant enters a $500 credit to the cash account and a debit for $500 to accounts payable. Your company’s financial statements are relevant to you, your investors and your lenders.

For example, utilities, supplies, snow removal and property management are all operating expenses. Repairs and maintenance are operating expenses, but improvements and additions are not – they are capital expenditures.

To record a periodic loan payment, a business first applies the payment toward interest expense and then debits the remaining amount to the loan account to reduce its outstanding balance. Unamortized loans are repaid at once in the amount of the loan principal at maturity. To record the loan payment, a business debits the loan account to remove the loan liability from the books, and credits the cash account for the payment.

You may need a mortgage to afford the property, but not to operate it. Although some people use the phrases “accounts payable” and “trade payables” interchangeably, the phrases refer to similar but slightly different situations. Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory. Accounts payable include all of the company’s short-term debts or obligations.

Your company’s balance sheet provides you with a picture of its assets, liabilities and equity at a specific moment, usually the end of a quarter or year. On the balance sheet, assets equal liabilities plus owner’s equity — or shareholders’ equity if your company is a corporation.

mortgage loan payable definition

All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders. For example, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in accounts payable and a $500 debit to office supply expense.

The income statement shows the revenues, expenses and profits your company generates over a given period. The balance sheet shows what your company owns and owes at a specific moment. Mortgage interest expense, the interest expense paid on a mortgage, does not appear on the balance sheet; it appears on the income statement. Proper double entry bookkeeping requires that there must always be an offsetting debit and credit for all entries made into the general ledger. To record accounts payable, the accountantcredits accounts payable when the bill or invoice is received.