However, companies may capitalize some software research and development, or R&D, costs. FASB defines research as a planned search or investigation to discover new knowledge; it defines development as the translation of research findings into a plan or design.

The goal is typically to take new products and services to market and add to the company’s bottom line. R&D may be beneficial to a company’s bottom line, but it is considered an expense. After all, companies spend substantial amounts on research and trying to develop new products and services. Any basic and applied research costs are recorded as they are incurred.

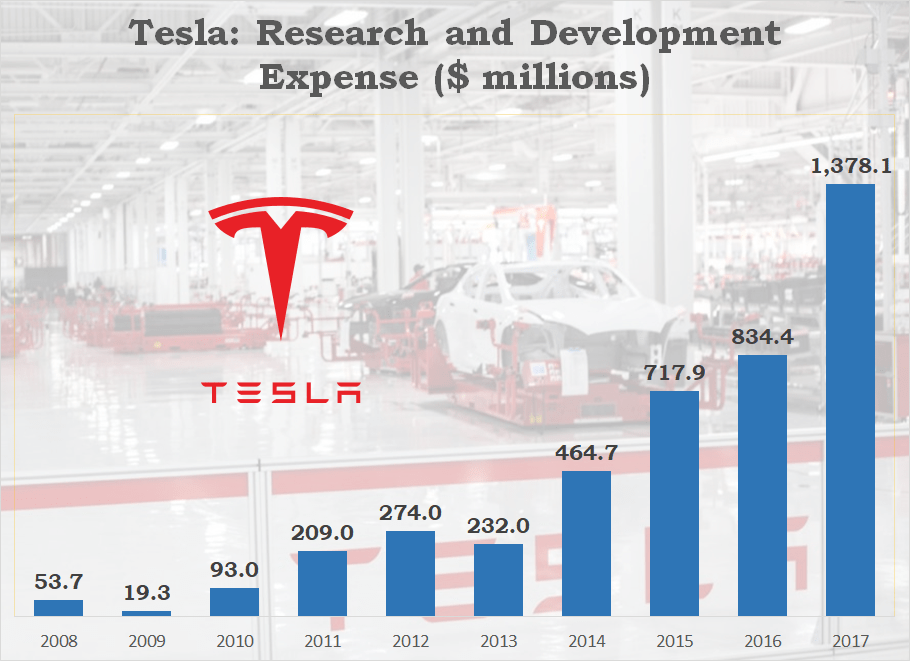

Research and Development (R&D)

Similarly, the company amortizes capitalized costs that relate to intangible assets, such as patents and trademarks. Some development expenses, such as those for market research and consumer testing, do not count as R&D costs.

According to the Financial Accounting Standards Board, the rule-making body for U.S. business accounting, the answer lies in the difficulty of quantifying those future benefits. Research and development (R&D) includes activities that companies undertake to innovate and introduce new products and services.

They are responsible for research, planning, and implementing new programs and protocols into their company or organization and overseeing the development of new products. The types of products produced by a pharmaceutical company are likely to be different from those produced by a technical company, so R&D managers have the ability to specialize according to their interests. Thus, research and development costs no longer appear as intangible assets on the balance sheet. The Board applies the same line of reasoning to other costs associated with internally generated intangible assets, such as the internal costs of developing a patent. These activities come under the Research and Development (R&D) umbrella.

Accounting for R&D

R&D activities are carried out by corporate and governmental entities. You will need to keep track of all the costs related to the creation of these new products and decide what ideas are worth pursuing.

The R&D manager should also stay informed on what is happening in the research and development field at large in order to make sure their company is up-to-date and current with the most advanced R&D developments. There’s one exception to the rule against capitalizing research and development costs.

Research and development costs are costs incurred in a planned search for new knowledge and in translating such knowledge into new products or processes. The term R&D or research and development refers to a specific group of activities within a business. The activities that are classified as R&D differ from company to company, but there are two primary models. The first model of R&D is generally staffed by engineers while the second model may be staffed with industrial scientists.

Research and development costs are the costs incurred in a planned search for new knowledge and in translating such knowledge into new products or processes. Prior to 1975, businesses often capitalized research and development costs as intangible assets when future benefits were expected from their incurrence. Due to the difficulty of determining the costs applicable to future benefits, many companies expensed all such costs as incurred. Other companies capitalized those costs that related to proven products and expensed the rest as incurred.

- Due to the difficulty of determining the costs applicable to future benefits, many companies expensed all such costs as incurred.

- Research and development costs are the costs incurred in a planned search for new knowledge and in translating such knowledge into new products or processes.

Capitalized Costs

Businesses conduct R&D for many reasons, the first and foremost being new product research and development. Before any new product is released into the marketplace, it goes through significant research and development phases, which include a product’s market opportunity, cost, and production timeline. After adequate research, a new product enters the development phase, where a company creates the product or service using the concept laid out during the research phase. A research and development (R&D) manager performs a number of highly important roles within an organization.

If your business buys another company, you must capitalize any “in process” R&D projects that come with the purchase. The rationale behind this exception is that some portion of the price you paid to acquire the company was allocated to those projects, so the projects have a definable value that you can list as an asset. The main reason companies aren’t allowed to capitalize their research and development costs is that there’s no way to reliably measure the future economic benefits of those costs. After all, the whole purpose of “R&D” is to realize future economic benefit.

What are research and development costs?

According to the Financial Accounting Standards Board, or FASB, generally accepted accounting principles, or GAAP, require that most research and development costs be expensed in the current period. However, companies may capitalize some software research and development, or R&D, costs.

Research and development especially affects investors in technology or pharmaceutical companies. Therefore, investors need to pay attention to research and development news, because the discovery and development of better technology begins with having a successful R&D department. These are costs incurred to develop new products or processes that may or may not result in commercially viable items. The general rule is that research and development costs are to be expensed immediately when the costs are incurred. According to the Financial Accounting Standards Board, or FASB, generally accepted accounting principles, or GAAP, require that most research and development costs be expensed in the current period.

In many companies, the research and development team handles the quality checks on products created by the company. The department has an intimate knowledge of the requirements and specifications of a particular project. This allows team members to ensure the products meet those standards so the company puts out quality products. If the company also has a quality assurance team, it may collaborate with research and development on quality checks.

The purest form of financial assets is cash and cash equivalents—checking accounts, savings accounts, and money market accounts. Liquid accounts are easily turned into funds for paying bills and covering financial emergencies or pressing demands.

Why Does Research and Development (R&D) Matter?

In certain situations, a company can treat some of its R&D costs as noncurrent assets. This process is called capitalization and requires the costs to be expensed over a set number of years. If the costs relate to tangible assets that have an alternative future use, the company depreciates the costs over the assets’ projected lifetimes.

In the case of an investment or asset management company, the financial assets include the money in the portfolios firm handles for clients, called assets under management (AUM). For example, BlackRock Inc. is the largest investment manager in the U.S. and in the world, judging by its $6.5 trillion in AUM (as of March 31, 2019).

How are R&D costs accounted for?

research and development costs definition. R & D costs. These are costs incurred to develop new products or processes that may or may not result in commercially viable items. The general rule is that research and development costs are to be expensed immediately when the costs are incurred.