Understanding Mortgage Bonds

A mortgage-backed security (MBS) is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them. Investors in MBS receive periodic payments similar to bond coupon payments.

Investors purchase securitiesbacked by the value of the home loans—so-calledmortgage-backed securities. When Treasury yields rise, investors in mortgage-backed securities demand higher rates. Ultimately, the mortgage-backed securities industry provides lenders with more cash to make more mortgage loans.

What is a mortgage bond for dummies?

A mortgage bond is a bond backed by real estate holdings or real property. In the event of a default situation, mortgage bondholders could sell off the underlying property backing a bond to compensate for the default.

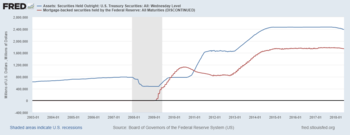

Fannie Mae, Freddie Mac, and Ginnie Mae purchase mortgages and issue and/or guarantee MBS as part of their efforts to support the MBS industry and make homeownership possible for more people. In the United States, the most common securitization trusts are sponsored by Fannie Mae and Freddie Mac, US government-sponsored enterprises. Ginnie Mae, a US government-sponsored enterprise backed by the full faith and credit of the US government, guarantees that its investors receive timely payments but buys limited numbers of mortgage notes. Some private institutions also securitize mortgages, known as “private-label” mortgage securities.

Issuances of private-label mortgage-backed securities increased dramatically from 2001 to 2007 and then ended abruptly in 2008, when real estate markets began to falter. An example of a private-label issuer is the real estate mortgage investment conduit (REMIC), a tax-structure entity usually used for CMOs; among other things, a REMIC structure avoids so-called double taxation. One major exception to the general rule that mortgage bonds represent a safe investment became evident during the financial crisis of the late 2000s.

Special Considerations for Mortgage Bonds

Investors who want a steady and safe return compare the interest rates of allfixed-incomeproducts. They compare yields on short-term Treasurys tocertificates of depositandmoney market funds. They compare yields on long-term Treasurys tomortgage-backed securities andcorporate bonds.

This steady supply of mortgage funds keeps mortgage rates competitive and mortgages readily available. Also, banks that are averse to mortgage lending or are worried about losing money if borrowers prepay their mortgages can mit risks by selling their mortgages, and thus transferring these risks, to MBS issuers.

Low interest rates are not attractive to investment banks and agencies. High interest rates signal to investment banks that loans are offered to borrowers with blemished credit. Mortgage-backed securities have changed the banking and housing industry, making it easier to buy real estate. Before the global financial crisis, many financial institutions offered zero down payment to borrowers who proved unable to meet their monthly payments.

Treasuries, but they also carry reinvestment risks, prepayment risk, and the risk of negative convexity. A collateralized mortgage obligation, or “pay-through bond”, is a debt obligation of a legal entity that is collateralized by the assets it owns. Pay-through bonds are typically divided into classes that have different maturities and different priorities for the receipt of principal and in some cases of interest. They often contain a sequential pay security structure, with at least two classes of mortgage-backed securities issued, with one class receiving scheduled principal payments and prepayments before any other class. Pay-through securities are classified as debt for income tax purposes.

The risk for investors is lower than with RMBSs because of the set term. It is important to note that the U.S. government does not guarantee Freddie Mac or Fannie Mae.

- Quasi-government agencies and investment banks that buy loans offer cash to financial institutions.

- Other advantages include transfer of risk, efficiency, and liquidity.

- Investors usually buy mortgage-backed securities because they offer an attractive rate of return.

When homeowners make the interest and principal payments, those cash flows pass through the MBS and through to bondholders (minus a fee for the entity that originates the mortgages). Mortgage-backed securities generally offer higher yields than U.S.

Lenders sold risky loans to pooling agencies, thus contributing to the subprime mortgage crisis. Everyone was affected because many financial entities, pension funds, and investors held MBSs. While selling home loans is a way to gain access to funds and offer new loans, banks did not pay the consequences for offering bad loans.

Investors usually buy mortgage-backed securities because they offer an attractive rate of return. Other advantages include transfer of risk, efficiency, and liquidity. Quasi-government agencies and investment banks that buy loans offer cash to financial institutions. The money is used to offer loans to individual borrowers and businesses and make profits.

Then the profits from the sale of securities are used by agencies to offer subsidized loans to low-income families. Second, MBSs are efficient in that it is cheaper to hold securities than lines of credit and home loans.

All bond yields are affected by Treasury yields because they compete for the same type of investor. Whenever a bank makes a mortgage loan, it assumes risk of non-payment (default). If it sells the loan, it can transfer risk to the buyer, which is normally an investment bank. The investment bank understands that some mortgages are going to default, so it packages like mortgages into pools. In exchange for this risk, investors receive interest payments on the mortgage debt.

Basic Things to Know About Bonds

A mortgage-backed security (MBS) is a type of asset-backed security (an ‘instrument’) which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Mortgages act similarly to bonds in that when rates go up, prices go down. However, mortgage-backed securities prices tend to increase at a decreasing rate when bond rates are falling; in turn, their prices tend to decrease at an increasing rate when rates are rising. This is known as negative convexity and is one reason why MBSs offer higher yields than U.S.

This is also a safer investment instrument than non-secured bonds. When it comes to risk transfer, financial institutions that sell home loans to investment banks transfer the risk of a borrower’s default. This is a way to ensure that the bank has a low risk profile. Loan securitization is also beneficial because it regulates interest rates. It stops financial institutions from over- and undercharging for loans.

They extended loans to borrowers with poor credit and low or no down payment. Finally, mortgage-back securities were not regulated which contributed to the asset bubble. In 1983 the Federal Reserve Board amended Regulation T to allow broker-dealers to use pass-throughs as margin collateral, equivalent to over-the-counter non-convertible bonds.

Residential mortgage-backed securities are another variety. The cash flow is derived from a subprime mortgage, home equity loan, or another form of residential debt. The holders are entitled to interest and principal payments. Commercial mortgage-backed securities are different in that they are linked to commercial debt.