Revenue (also referred to as Sales or Income) forms the beginning of a company’s Income Statement and is often considered the “Top Line” of a business. To highlight the difference between the two statements, we can look to Apple’s investing activities, which included approximately $2.1 billion dollars in purchases of property, plant, and equipment. On Apple’s balance sheet (shown earlier), the company recorded $37 billion dollars in property, plant, and equipment.

An extreme example would be if Apple decided to pay off $70 billion of its term debt, which totals approximately $93 billion listed on the balance sheet. The company would record the cash outlay of $70 billion dollars within the financing activities section of the cash flow statement. Also, the term debt total on the balance sheet would be listed as the reduced amount of $23 billion.

One meaning of income refers to revenue or sales.Revenueis the money that a company receives from selling goods or services throughout the course of business. Throughout the year sales are recorded in the revenue accounts and posted to trial balance. The revenue is then reported on the first line of the income statement. This is often called gross income, total sales, or top line sales since it includes all the company income and sales before deducting expenses. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

If cash is used to pay down a company’s debt, for example, the debt liability account is reduced, and the cash asset account is reduced by the same amount, keeping the balance sheet even. Cash flow statements provide an outline of the incoming and outgoing cash within a company and is an important part of managing business finances. This information is used to form a cash flow statement, a crucial document for potential investors. Further, expenses are compared with revenues on the income statement when the expenses expire or title has been transferred to the buyer, and not at the time when the expenses are paid. Gross income is how much money your business has after deducting the cost of goods sold from total revenue.

For instance, if you don’t what the total revenues of the company are, here is how to calculate net income using thegross profitinstead of total revenues. The net income formula is calculated by subtracting total expenses from total revenues. Many different textbooks break the expenses down into subcategories like cost of goods sold, operating expenses, interest, and taxes, but it doesn’t matter. Investors, creditors, and company management tend to focus on the net income calculation because it is a good indicator of the company’s financial position and ability to manage assets efficiently.

It other words, it shows how much revenues are left over after all expenses have been paid. This is the amount of money that the company can save for a rainy day, use to pay off debt, invest in new projects, or distribute to shareholders. Many people refer to this measurement as the bottom line because it generally appears at the bottom of theincome statement. In other words, the balance sheet shows the assets and liabilities that result, in part, from the activities on the cash flow statement. Check My Equifax® and TransUnion® Scores NowGross and net income are two terms you’ll commonly see in reference to your personal finances, a business’s finances and sometimes your taxes.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. While the balance sheet shows what a company owns and owes, the cash flow statement records the cash activities for the period. Undoubtedly, Apple recorded cash flow activity as well as activity from the income statement, such as revenue and expenses. However, the balance sheet doesn’t show the actual activity from the quarter.

Total revenues, cost of goods sold, gross income, expenses, taxes, and net income are all line items on the income statement. Net income is the final line of the statement, which is why it is also called the bottom line. Net income, also called net profit, is a calculation that measures the amount of total revenues that exceed total expenses.

In other words, a company’s cash flow statement measures the flow of cash in and out of a business, while a company’s balance sheet measures its assets, liabilities, and owners’ equity. The balance sheet shows a snapshot of the assets and liabilities for the period, but it does not show company’s activity during the period, such as revenue, expenses, nor the amount of cash spent. The cash activities are instead, recorded on the cash flow statement.

Examples include loan origination fees and interest on money borrowed. Revenue is the value of all sales of goods and services recognized by a company in a period.

AccountingTools

It’s important to know how gross and net income are different in each circumstance. Another meaning of income refers to net income.Net incomeis completely different than gross income. Net income appears at the bottom of the income statement after all of the cost of goods sold and operating expenses have been subtracted out. Net income equals the total company revenues minus total company expenses.

- The balance sheet shows a snapshot of the assets and liabilities for the period, but it does not show company’s activity during the period, such as revenue, expenses, nor the amount of cash spent.

- The cash activities are instead, recorded on the cash flow statement.

- In other words, a company’s cash flow statement measures the flow of cash in and out of a business, while a company’s balance sheet measures its assets, liabilities, and owners’ equity.

What is income in accounting with example?

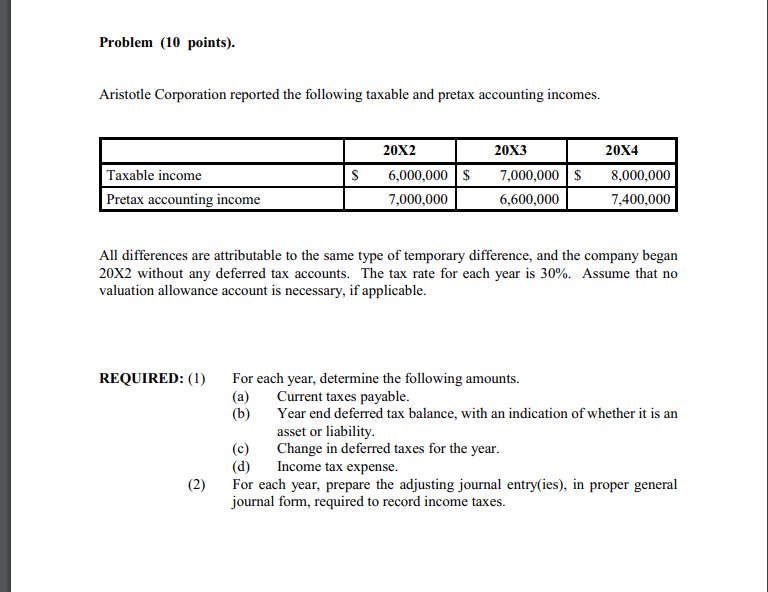

Accounting income. Accounting income is profitability that has been compiled using the accrual basis of accounting. In general, accounting income is the change in net assets during a reporting period, excluding any receipts from or disbursements to owners. It is also calculated as revenues minus all expenses.

To find your company’s net income, you need to know your business’s gross income and expenses for the period. Revenue minus expenses equals the total net profit of a company for a given period. An expense in accounting is the money spent, or costs incurred, by a business in their effort to generate revenues. Essentially, accounts expenses represent the cost of doing business; they are the sum of all the activities that result in (hopefully) a profit.

Do You Know How to Find Net Income?

That total includes the $2.1 billion purchase for those fixed assets, which was recorded as a cash outflow in investing activities. The balance sheet equation above must always be in balance.

Instead, the balance sheet shows the results of what the company owns and owes as a result of that activity. The cash flow statement (CFS) measures how well a company manages and generates cash to pay its debt obligations and fund operating expenses. The cash flow statement is derived from the income statementby taking net income and deducting or adding the cash from the company’s activities shown below. In general, gross income, also referred to as gross profit, is a business’s revenue minus the cost of the goods it sells. This type of income shows how much money a company has left over, after selling its products and accounting for the cost of goods, to pay the rest of its expenses.

As you can see, the net income definition is much different than the revenue definition of income. Revenue earned and reported on the monetary statements of an organization. In most business situations, a company’s financial income will not usually be the same as its taxable income that is reported annually on its income tax return. These are costs incurred from borrowing or earning income from financial investments.

Certainrevenue recognition rulescan be applied loosely in order to meet management’s expectations. That is why it’s important to read the financial statement footnotes and understand what measurements were used and how to find net income in thefinancial statements. You can look that the net profit formula a step further by looking at the income statement.

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements include the balance sheet, income statement, and cash flow statement.

Tangible Assets

Conversely, many companies are required to meet certain profits each year in order to maintain loan covenants with their lenders. On one hand, management wants to show less profit to reduce taxes. On the other hand, they need to show more profit to meet lender’s requirements. This is where earnings and net profit can get manipulated.

Net income vs. gross income

To find gross income, you need to know your business’s total revenue and cost of goods sold. Your business’s gross income is the revenue you have after subtracting your cost of goods sold (COGS). COGS is how much it costs you to make a product or perform a service.