What belongs to fixed assets

Fixed asset accounting involves assets that belong to the company and meet these specifications:

- The object is intended for use in production, when performing work or providing services, for management needs, or rent.

- The asset is intended to be used over an extended period of time.

- Subsequent resale of the property is not expected.

- The object can bring economic benefits in the future.

A company’s capitalization policy greatly affects what is considered a fixed asset. For example, if you buy a stapler that costs $20, it is not considered to be a fixed asset. However, your company can set a rule that everything that costs over $2,000 will be considered a fixed asset.

Fixed asset accounting is done for buildings and structures, power machines, equipment, computers, vehicles, tools, household equipment, breeding stock, etc. In addition, fixed assets include land plots, water, subsoil, and other natural resources, as well as capital investments in leased property and the fundamental improvement of land. All of these items appear on the asset side of the Balance sheet as Fixed assets.

What does not belong to fixed assets?

Items that are listed as finished goods in the manufacturer’s warehouse or as goods in the warehouse of a trading company do not belong in this category of assets. Such property is intended for resale, therefore it cannot be regarded as a fixed asset.

In addition, fixed assets are not materials and objects that are in transit or transferred for installation, capital, and financial investments (except for capital investments in leased fixed assets and for the drastic improvement of land).

Fixed asset accounting

When we are talking about fixed assets, we are talking about items the cost of which is spread out over multiple years. In fixed asset accounting this is better known as depreciation. As a business owner, you want to track this. Depending on the type of a fixed asset, you will record a depreciation expense for a different number of years.

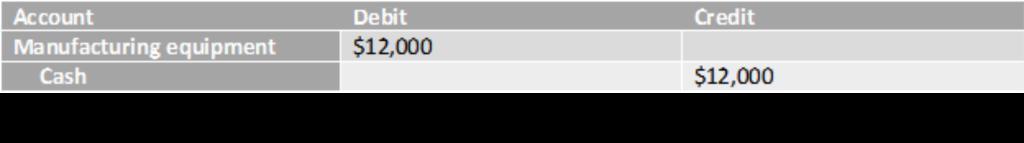

Let’s look at the journal entries made throughout the lifecycle of a fixed asset in a business. It all starts with the acquisition of a fixed asset. Let’s assume it was acquired with cash.

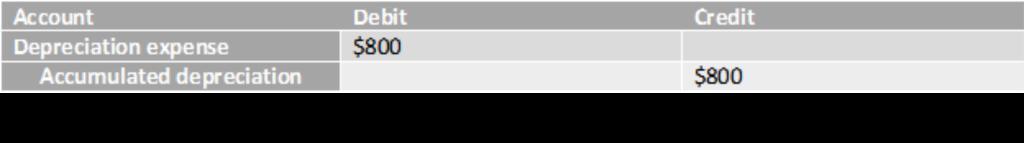

Every single year, the equipment wears down and the company needs to record a depreciation expense. We are not going to dive into the methods of depreciation calculation, so let’s just assume it is $800 a year. At the end of the year, the following journal entry is made.

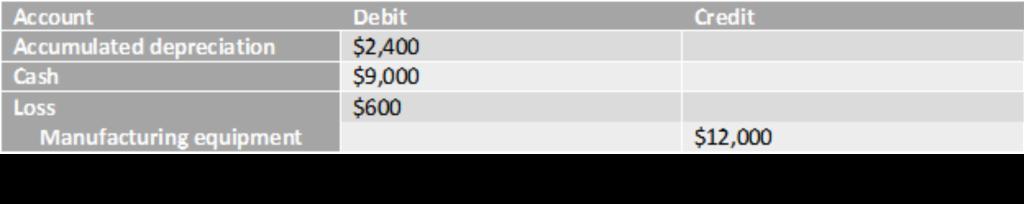

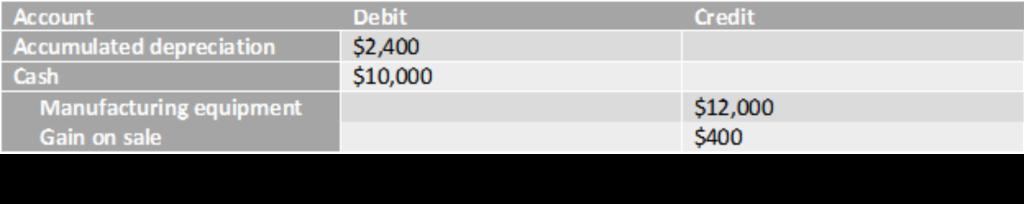

Three years late, the company sold the equipment for $10,000. During these years it has accumulated $2,400 ($800 x 3 years) in depreciation expense. The company was able to cover the depreciation and receive a gain from the sale equal to $400.

Alternatively, the company was able to sell this equipment only for $9,000. In this case, it did not use the equipment’s resources for equal to $3,000 of its cost and had accumulated depreciation of only $2,400. Thus, it sold at a loss of $600.