Cancelled Debt – How Do I Know if I am Insolvent?

This is so because bankruptcy is governed by national law; there exists no entity to take over such a government and distribute assets to creditors. Governments can be insolvent in terms of not having money to pay obligations when they are due.

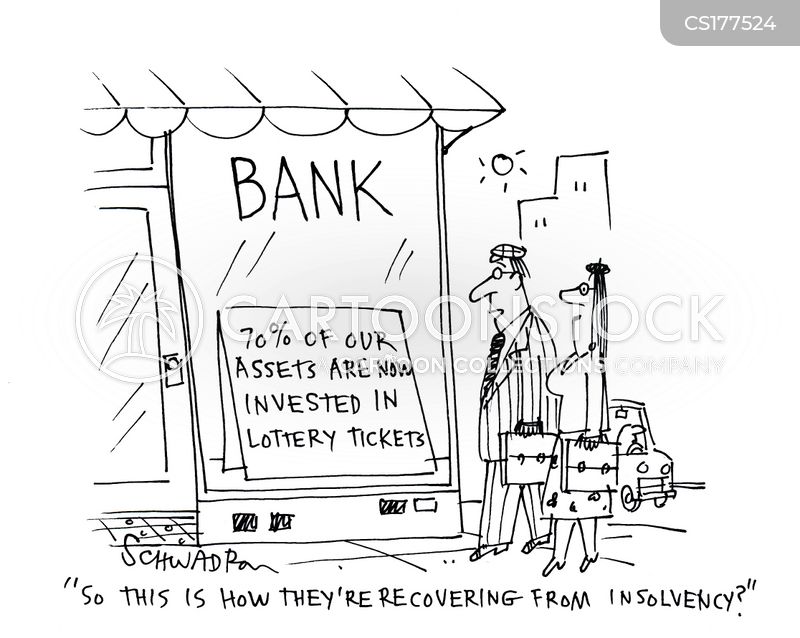

This might give you an edge if you’ve since bounced back from your economic woes – you might not be insolvent in your current financial condition, but you were back when the debt was canceled. A taxpayer is insolvent when his or her total liabilities exceed his or her total assets. The forgiven debt may be excluded as income under the “insolvency” exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent.

Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. Lawsuits from customers or business associates may lead a company to insolvency. The business may end up paying large amounts of money in damages and be unable to continue operations.

Alternatively, a creditor can petition the court for a winding-up order which, if granted, will place the company into what is called compulsory liquidation or winding up by the court. The liquidator realises the assets of the company and distributes funds realised to creditors according to their priorities, after the deduction of costs. In the case of Sole Trader Insolvency, the insolvency options include Individual Voluntary Arrangements and Bankruptcy. Although the term “bankrupt” may be used referring to a government, sovereign states do not go bankrupt.

Creditors are typically amenable to this approach because they desire repayment, even if the repayment is on a delayed schedule. You can determine whether you’re insolvent by adding up all your debts – not the monthly payments but the overall outstanding balances – and totaling the fair market value of all your assets. Don’t neglect to include assets that creditors couldn’t ordinarily touch, such as retirement accounts. You must assess your debts and the value of your property as of the time the debt was forgiven, not at tax time.

Each form of insolvency will last for different periods of time and as such are likely to differ in how long they will affect your ability to take out credit as well. IVAs are usually completed within 5 years, whereas protected trust deeds can be completed as soon as 3 years after the date of insolvency. A personal insolvency agreement is a legal agreement you can reach with your creditors if you can no longer afford to repay the debt.

What happens when you become insolvent?

Insolvency is the inability to pay debts when they are due. The first, called “cash-flow insolvency,” occurs when an insolvent debtor can’t make a payment because he doesn’t have the money. The second, called “balance-sheet insolvency,” results when debts exceed assets.

This option is only available to people who have been struggling with debt for some time. In a personal insolvency agreement, you arrange to pay an agreed amount over a period of time (usually 3 to 5 years). Usually you can settle your debts for less than what is owed, and the balance will be formally written off. Insolvency is a state of economic distress, whereas bankruptcy is a court order that decides how an insolvent debtor will deal with unpaid obligations.

Lack of income results in unpaid bills and creditors requesting money owed to them. An IVA is a formal agreement that you come to with your creditors to pay your unsecured debts off at a lower rate over a certain period of time. As long as everything goes to plan with the arrangement, at the end of the IVA any remaining debts included in it are written off.

However, in most cases, debt in default is refinanced by further borrowing or monetized by issuing more currency (which typically results in inflation and may result in hyperinflation). A bankruptcy, on the other hand, is an actual court order that depicts how an insolvent person or business will pay off his creditors, or how he will sell his assets in order to make the payments. A person or corporation can be insolvent without being bankrupt, even if it’s only a temporary situation. If that does extend longer than anticipated, it can, however, lead to bankruptcy. A company without liabilities to creditors can be closed either through a striking-off at Companies House through Dissolution.

- Insolvency can arise from poor cash management, a reduction in cash inflow, or an increase in expenses.

- Before an insolvent company or person gets involved in insolvency proceedings, it will likely be involved in informal arrangements with creditors, such as setting up alternative payment arrangements.

- Insolvency is a term for when an individual or organization can no longer meet its financial obligations to its lenders as debts become due.

The directors and shareholders can instigate the liquidation process without court involvement by a shareholder resolution and the appointment of a licensed Insolvency Practitioner as liquidator. However, the liquidation will not be effective legally without the convening of a meeting of creditors who have the opportunity to appoint a liquidator of their own choice. This process is known as creditors voluntary liquidation (CVL), as opposed to members voluntary liquidation (MVL) which is for solvent companies.

How do you know if you are insolvent?

You are deemed to be insolvent if your total liabilities (debts) are greater than your total assets. To determine the value of your assets use the fair market value rather than what you paid for them or what you think they are worth. If you are insolvent you need to explain this to the IRS in one of two ways.

That usually involves selling assets to pay the creditors and erasing debts that can’t be paid. Bankruptcy can severely damage a debtor’s credit rating and ability to borrow for years. This is important because certain rights under the code may be invoked against an insolvent party which are otherwise unavailable.

The forgiven debt may also qualify for exclusion if the debt was discharged in a Title 11 bankruptcy proceeding or if the debt is qualified farm indebtedness or qualified real property business indebtedness. If you believe you qualify for any of these exceptions, see the instructions for Form 982. Cash flow, or equitable, insolvency impacts both businesses and individuals. If you have a credit card payment due, you might be able to liquidate an asset like a lawnmower to pay a debt and avoid cash-flow insolvency, at least for the moment. A company which is insolvent may be put into liquidation (sometimes referred to as winding-up).

Insolvency vs. Bankruptcy

If you have liabilities to settle, a Members Voluntary Liquidation (MVL) allows appropriate distribution of the assets in an orderly manner. If the company is insolvent with debts to creditors, and you wish to close the company before it is wound up, you can explore a Creditors Voluntary Liquidation (CVL), with the closure being handled by a licensed insolvency practitioner.

Balance Sheet Insolvency

As governments are sovereign entities, persons who hold debt of the government cannot seize the assets of the government to re-pay the debt. The recourse for the creditor is to request to be repaid at least some of what is owed.

Insolvency is a term for when an individual or organization can no longer meet its financial obligations to its lenders as debts become due. Before an insolvent company or person gets involved in insolvency proceedings, it will likely be involved in informal arrangements with creditors, such as setting up alternative payment arrangements. Insolvency can arise from poor cash management, a reduction in cash inflow, or an increase in expenses. Insolvency is a state of financial distress in which someone is unable to pay their bills.

How do I know if I am insolvent?

It can lead to insolvency proceedings, in which legal action will be taken against the insolvent entity, and assets may be liquidated to pay off outstanding debts. Business owners may contact creditors directly and restructure debts into more manageable installments.