In the par value method, you carry treasury shares at par or stated value, which might be a very small amount. You charge the difference between the reacquisition price and par value to the additional paid-in capital account. If you exhaust that account, you charge the balance to retained earnings, which are the accumulated profits of the company.

Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholder’s equity by the amount paid for the stock. You can also issue a repurchase tender offer to buy up shares at a stated price. Some companies issue callable shares that they can forcibly redeem at a set price. Your company may want to keep treasury stock as a way to soak up excess cash, especially if you feel your stock is underpriced. You also may accumulate treasury shares to use later for employee stock options or restricted share bonuses.

How do you record the sale of treasury stock?

When a company resells its treasury stock for more than it originally paid, any excess goes into additional paid-in capital. If it resells the stock for less than it paid, the difference comes out of additional paid-in capital.

For buybacks, the common stock account isn’t directly affected; some of its value is simply offset by the increase in treasury stock. Treasury stock is a company’s own stock that it has reacquired from shareholders. When a company buys back shares, the expenditure to repurchase the stock is recorded in a contra equity account. Thus, the effect of recording a treasury stock transaction is to reduce the total amount of equity recorded in a company’s balance sheet. The common stock APIC account is also debited to decrease it by the amount originally paid in excess of par value by the shareholders.

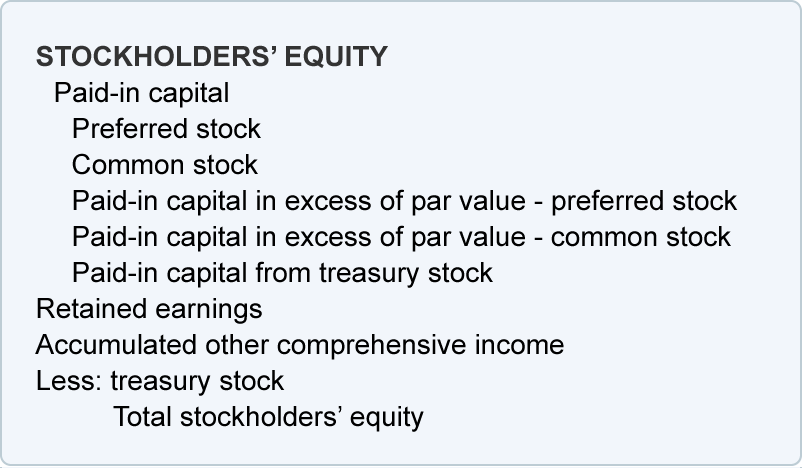

Treasury stock is the name for previously sold shares that are reacquired by the issuing company. When a corporation buys back some of its issued and outstanding stock, the transaction affects retained earnings indirectly. Since both retained earnings and treasury stock are reported in the stockholders’ equity section of the balance sheet, amounts available to pay dividends decline.

Does Treasury Stock affect paid in capital?

paid-in capital from treasury stock definition. A stockholders’ equity account with a credit balance. The credit balance results when a corporation sells some of its treasury stock for an amount that exceeds the corporation’s cost of the treasury stock that was sold.

Resales of Treasury Stock

If the stock is undervalued, the company can buy it back for lower-than-true-value prices. Senior management may believe the company’s stock is undervalued in the market as reflected by its selling price. By reacquiring its own stock, if it’s truly undervalued, the company helps its remaining shareholders by removing some available stock from the market. Supply and demand theory states that if demand for something remains constant and the supply of something decreases, the price will increase.

If the initial repurchase price of the treasury stock was higher than the amount of paid-in capital related to the number of shares retired, then the loss reduces the company’s retained earnings. Now imagine that the company sells those same shares out of treasury stock. The first thing it does is increase the cash balance on the asset side by $3,500. First, it reduces treasury stock, but only by $3, not the full $3,500.

The cash account is credited in the total amount paid out by the company for the share repurchase. The net amount is included as either a debit or credit to the treasury APIC account, depending on whether the company paid more when repurchasing the stock than the shareholders did originally.

– For example, if 1,000 shares of $10 par value common stock are issued by at a price of $12 per share, the additional paid-in capital is $2,000 (1,000 shares x $2). Additional paid-in capital is shown in the Shareholders’s Equity section of the balance sheet. The constructive retirement method considers a reacquired share to be a retired share. Therefore, you do not carry reacquired shares in a treasury stock account. Instead, you directly reduce the number of issued shares carried on the balance sheet.

If the treasury stock is resold at a later date, offset the sale price against the treasury stock account, and credit any sales exceeding the repurchase cost to the additional paid-in capital account. To track what happens to the balance sheet during a share buyback, imagine a company that repurchases 100 of its own shares for $30 a share.

This is a contra-equity account — its balance reduces the net amount of outstanding stock without changing the balance of the stock account. You charge the money you spent reacquiring shares to the treasury stock account. If you do so for more than the cost of reacquisition, you book the gain to paid-in capital.

When a company initially issues stock, the equity section of the balance sheet is increased through a credit to the common stock and the additional paid-in capital (APIC) accounts. The common stock account reflects the par value of the shares, while the APIC account shows the excess value received over the par value.

paid-in capital from treasury stock definition

Treasury stock, while decreasing stockholders’ equity and retained earnings, can generate a stock price increase in the market. Conversely, treasury stock is the number of shares issued less the number of outstanding shares. Shares of treasury stock may be from a stock buyback or from when the issuing company is unable to sell all of the shares it issued. Unlike common and preferred stock, they do not offer any voting rights. Treasury stock is a contra equity account recorded in the shareholder’s equity section of the balance sheet.

- When a company initially issues stock, the equity section of the balance sheet is increased through a credit to the common stock and the additional paid-in capital (APIC) accounts.

Because treasury stock is stated as a minus, subtractions from stockholders’ equity indirectly lower retained earnings, along with overall capital. However, treasury stock does directly affect retained earnings when a company considers authorizing and paying dividends, lowering the amount available. Many states require publicly issued stock to carry a par, or stated, value. Other states allow for no-par stock, but these shares can still have a stated value.

If you reacquire a substantial number of shares, you might raise earnings per share and stock prices. Companies may buy back shares and return some capital to shareholders from time to time.

The company starts by reducing the cash balance on the asset side of the balance sheet by $3,000. In the stockholders’ equity section, it increases the treasury stock account by $3,000, which has the effect of reducing equity $3,000. The total amount on each side has declined by $3,000, so the balance sheet is back in balance.

Under the cash method, at the time of the share repurchase, the treasury stock account is debited to decrease total shareholder’s equity. The cash account is credited to record the expenditure of company cash. If the treasury stock is later resold, the cash account is increased through a debit and the treasury stock account is decreased, increasing total shareholder’s equity, through a credit. In addition, a treasury paid-in capital account is either debited or credited depending on whether the stock was resold at a loss or a gain.

Due to double-entry bookkeeping, the offset of this journal entry is a debit to increase cash (or other asset) in the amount of the consideration received by the shareholders. Treasury stock shows up as a debit, or minus, in stockholders’ equity on the corporate balance sheet.

When shares come out of treasury stock, the effect on the account balance has to be the same as when they went in, which in this case was $3,000. The company accounts for the rest of the $3,500 sale by increasing the common stock account by $500.

For common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value. In contrast, additional paid-in capital refers only to the amount of capital in excess of par value or the premium paid by investors in return for the shares issued to them. Preferred shares sometimes have par values that are more than marginal, but most common shares today have par values of just a few pennies. Because of this, “additional paid-in capital” tends to be essentially representative of the total paid-in capital figure and is sometimes shown by itself on the balance sheet. Equity is the funding a business receives from the owners or shareholders of the company.

The cost of treasury stock must be subtracted from retained earnings, reducing amounts the company can distribute to stockholders as dividends. In both the cash method and the par value method, the total shareholder’s equity is decreased by $50,000. Assume the total sum of ABC Company’s equity accounts including common stock, APIC, and retained earnings was $500,000 prior to the share buyback. The repurchase brings the total shareholder’s equity down to $450,000.

For example, suppose you repurchase 100,000 shares of $1 par common stock, originally issued for $12 each, or $1.2 million. You book the par amount, $100,000, against the common stock account and $1.1 million against additional paid in capital. These are all debit transactions — they lower the balance of equity accounts. If the treasury stock is sold at equal to its repurchase price, the removal of the treasury stock simply restores shareholders’ equity to its pre-buyback level.

It includes share capital (capital stock) as well as additional paid-in capital. Companies wishing to increase incentives by offering stock options often buy back some of their outstanding shares, creating treasury stock. Stockholders benefit, as they can purchase more shares — typically below current market prices. Corporations can also use treasury stock to offer employee stock options as part of their compensation packages. Although this effectively lowers dividends, by subtracting treasury stock costs from retained earnings, share prices may increase for stockholders.

AccountingTools

If you reissue at a loss, you book the loss first to paid-in capital and, if necessary, to retained earnings. You might choose the cost method if you don’t plan to retire the treasury shares. In the journal entry, the controller is eliminating the $100,000 originally credited to the common stock account and associated with its par value. There is also an elimination from the additional paid-in capital account of the $1,100,000 originally paid into that account. The excess expenditure over the original proceeds is charged to the retained earnings account.