Capital Expenses

Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero. For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). Knowing your monthly operating expenses is crucial to managing your cash flow and budget.

Operating and non-operating expenses are listed in different sections of a firm’s income statement. At the top the income statement, the cost of goods sold is subtracted from revenues to find the gross profit.

What are included in operating expenses?

An expense incurred in carrying out an organization’s day-to-day activities, but not directly associated with production. Operating expenses include such things as payroll, sales commissions, employee benefits and pension contributions, transportation and travel, amortization and depreciation, rent, repairs, and taxes.

What Is Operating Expense?

These expenses, such as staff and advertising, are known as operating expenses. Businesses also have non-operating expenses and perhaps some non-operating revenue as well, such as the cost and possible income stemming from a lawsuit. When you prepare an income statement for a business, it is good accounting practice to distinguish between operating and non-operating expenses and list them separately. Operating Income is located further down the statement after deducting the expenses associated with operating for the year.

Revenue, as we said, refers to earnings before the subtraction of any costs or expenses. In contrast, operating incomeis a company’s profit after subtractingoperating expenses, which are the costs of running the daily business. Operating income helps investors separate out the earnings for the company’s operating performance by excluding interest and taxes. Analyzing operating income is helpful to investors since it doesn’t include taxes and other one-off items that might skew profit or net income. A company that’s generating an increasing amount of operating income is seen as favorable because it means that the company’s management is generating more revenue while controlling expenses, productions costs, and overhead.

However, operating income does not include items such as other income, non-operating income, and non-operating expenses. It is important to understand the behavior of the different types of expenses as production or sales volume increases. Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline.

How do capital and revenue expenditures differ?

The company’s total costs are a combination of the fixed and variable costs. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time.

- When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue.

- The company starts the preparation of its income statement with top-line revenue.

Non-operating expense, like its name implies, is an accounting term used to describe expenses that occur outside of a company’s day-to-day activities. These types of expenses include monthly charges like interest payments on debt but can also include one-off or unusual costs. For example, a company may categorize any costs incurred from restructuring, reorganizing, costs from currency exchange, or charges on obsolete inventory as non-operating expenses.

General and administrative (G&A) expenses are listed below cost of goods sold (COGS) on a company’s income statement. The top section of an income statement always displays the company’s revenues for the given accounting period. COGS is deducted from the net revenue figure to determine the gross margin. The general and administrative expenses are then deducted from the gross margin to arrive at net income. Not all general and administrative expenses are grouped as one line item.

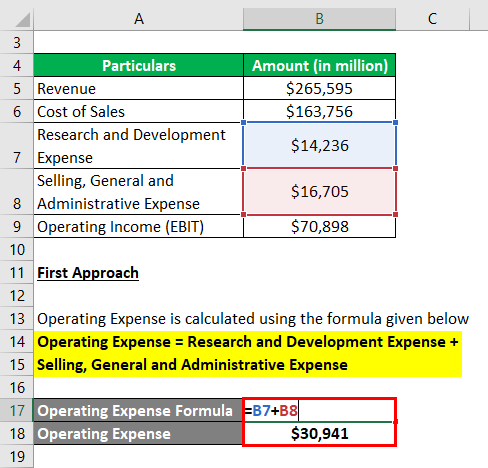

It’s important to note that operating income is different than net income as well as gross profit. Operating income includes more expense line items than gross profit, which primarily includes the costs of production. Operating income includes both COGS or cost of sales as well as operating expenses (highlighted in red above).

Then, after operating profit has been derived, all non-operating expenses are recorded on the financial statement. Non-operating expenses are subtracted from the company’s operating profit to arrive at its earnings before taxes (EBT). Operating expenses include selling, general & administrative expense (SG&A), depreciation and amortization, and other operating expenses. Operating income excludes items such as investments in other firms (non-operating income), taxes, and interest expenses.

Keys to Budgeting Part 1: Three Major Types of Expenses

For example, fees and interest may be classified as their own line item when deducting expenses to arrive at net income. Insert your numbers in the income statement after the heading “gross profit.” Depending on the income statement format, operating expenses are can be classified as selling, administrative or general. For example, commission expense would be listed under selling expenses. When gross profit is subtracted by operating expenses, you get income from operations. Business owners and investors use operating costs presented in the income statement for analysis, such as the operating expense ratio, which is used to verify how well a firm can control its operating costs.

Overhead vs. Operating Expenses: What’s the Difference?

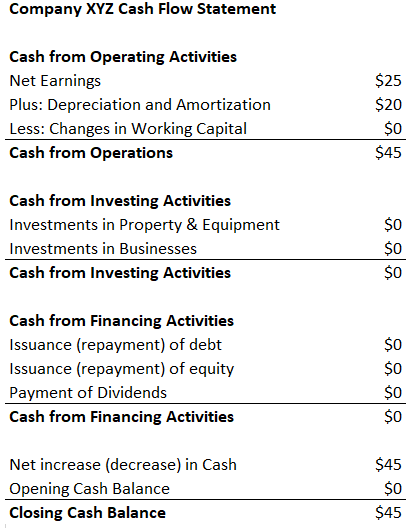

Also, nonrecurring items such as cash paid for a lawsuit settlement are not included. Operating income is also calculated by subtracting operating expenses from gross profit. Operating income–also called income from operations–takes a company’s gross income, which is equivalent to total revenue minus COGS, and subtracts all operating expenses. A business’s operating expenses are costs incurred from normal operating activities and include items such as office supplies and utilities.

When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue. The company starts the preparation of its income statement with top-line revenue. The firm’s cost of goods sold (COGS) is then subtracted from its revenue to arrive at its gross income. After gross income is calculated, all operating costs are then subtracted to get the company’s operating profit, or earnings before interest, tax, depreciation, and amortization (EBITDA).

Operating expenses are listed next and are subtracted fro the gross profit. The amount remaining after all operating expenses are subtracted is called operating income. Not all of the costs a business incurs relate to running the business itself.

For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike. On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100. Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged. For example, if the bicycle company incurred variable costs of $200 per unit, total variable costs would be $200 if only one bike was produced and $2,000 if 10 bikes were produced. However, variable costs applied per unit would be $200 for both the first and the tenth bike.