Indirect costs do not vary substantially within certain production volumes or other indicators of activity, and so they may sometimes be considered to be fixed costs. In cost accounting, the manufacturing process will have two main types of costs, direct and indirect.

For example, a manufacturing department that molds plastic has some costs that are directly traceable to it, such as the wages and fringe benefits of the direct labor working exclusively in that department. However, the heat for the entire building appears only on one utility bill. Generally it will be assigned to all departments based on the number of square feet each department occupies. Fixed indirect costs include things like the rent paid for the building in which a company operates. Direct costs are expenses that a company can easily connect to a specific “cost object,” which may be a product, department or project.

Although direct costs are typically variable costs, they can also include fixed costs. Rent for a factory, for example, could be tied directly to the production facility.

But some overhead costs can be directly attributed to a project and are direct costs. Examples of direct costs are direct labor, direct materials, commissions, piece rate wages, and manufacturing supplies.

Examples of indirect costs are production supervision salaries, quality control costs, insurance, and depreciation. Indirect costs are usually allocated to cost objects based on a pro rata basis. For instance, factory overhead can be allocated to each product produced by the total number of products or based on the total number of hours it took to manufacture each product.

Indirect costs are, but not necessarily, not directly attributable to a cost object. In construction, all costs which are required for completion of the installation, but are not directly attributable to the cost object are indirect, such as overhead. In manufacturing, costs not directly assignable to the end product or process are indirect. These may be costs for management, insurance, taxes, or maintenance, for example. Indirect costs are those for activities or services that benefit more than one project.

What are examples of indirect cost?

The difference between direct costs and indirect costs. Examples of direct costs are direct labor, direct materials, commissions, piece rate wages, and manufacturing supplies. Examples of indirect costs are production supervision salaries, quality control costs, insurance, and depreciation.

Their precise benefits to a specific project are often difficult or impossible to trace. For example, it may be difficult to determine precisely how the activities of the director of an organization benefit a specific project.

Indirect costs go beyond the expenses associated with creating a particular product to include the price of maintaining the entire company. These overhead costs are the ones left over after direct costs have been computed, and are sometimes referred to as the “real” costs of doing business. Direct costs are traceable to the production of a specific good or service.

Difference Between Direct and Indirect Speech

The treatment of depreciation as an indirect cost is the most common treatment within a business. Direct costs are directly attributable to the object and it is financially feasible to do so. In manufacturing or other non-construction industries the portion of operating costs that is directly assignable to a specific product or process is a direct cost. Direct costs are those for activities or services that benefit specific projects, for example salaries for project staff and materials required for a particular project. Because these activities are easily traced to projects, their costs are usually charged to projects on an item-by-item basis.

AccountingTools

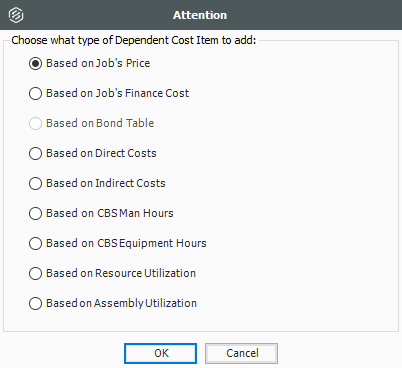

The allocation base utilized for distributing indirect expenses is the method that allocates costs most equitably to the primary cost objective. The allocation base selected could be other than a monetary cost such as square feet, labor hours, or machine hours. The pool should represent indirect costs accumulated by logical groups and distributed on the basis of benefits accruing to the several cost objectives. This means that the existence of the base and the employment of the base activities creates the pool of expenses over a period of time. Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product).

- Indirect costs are, but not necessarily, not directly attributable to a cost object.

- In construction, all costs which are required for completion of the installation, but are not directly attributable to the cost object are indirect, such as overhead.

The operative word is “specific.” Indirect costs may be necessary to production, but they are not traceable to the act of production. Think of them as the prerequisites for the production of any specific good or service. These can include rent or mortgage payments, depreciation of assets, salaries and payroll, membership and subscription dues, legal fees and accounting costs. Fixed expense amounts stay the same regardless if a business earns more — or loses more — in revenue that month.

Organizing business expenses as either direct costs or indirect costs is a matter that goes beyond simple product pricing – it affects your tax payments, too. Overhead expenses, such as the utilities that power equipment and the inventory needed to manage the office, are tax-deductible. In some cases, even the costs of goods sold qualify for deductions; they reflect expenses incurred from selling products. It can be tempting to misclassify direct costs as indirect, but this can get you in a lot of trouble if you’re audited by the IRS. The materials and supplies needed for the company’s day-to-day operations are examples of indirect costs.

A direct cost is one that is directly associated with the production and manufacturing of a product. An indirect cost is a cost that does not have an association to the product, but is still taken by the company. An example of a direct cost is the wages of employees on the assembly line.

Staff training costs and support

Associated payroll costs, including outsourcing payroll services, are included in the fixed expense category. Labor costs, such as employee time, that are not chargeable to a direct manufacturing or production activity also fall under fixed expenses.

Direct costs are easy to find because they will normally encompass only direct materials and direct labor. A direct cost is a price that can be directly tied to the production of specific goods or services. A direct cost can be traced to the cost object, which can be a service, product, or department. Direct and indirect costs are the two major types of expenses or costs that companies can incur.

Indirect costs

Direct costs are often variable costs, meaning they fluctuate with production levels such as inventory. However, some costs, such as indirect costs are more difficult to assign to a specific product. Examples of indirect costs include depreciation and administrative expenses. The indirect cost rate is simply an arithmetic calculation of dividing a pool of expenses (numerator) by an allocation base (denominator) such as direct labor cost or total direct costs plus overhead.

What is direct and indirect cost?

INDIRECT COST POOL Indirect Cost Allocation Base. An indirect cost pool is a logical grouping of indirect costs with a similar relationship to the cost objectives. For example, engineering overhead pools include indirect costs that are associated with engineering effort.

However, companies can sometimes tie fixed costs to the units produced in a particular facility. For example, an overhead center will accumulate a pool of expenses that are related to the work activity of the direct labor employees.

This way the indirect costs are apportioned to the cost objects in a meaningful way. A cost or expense that is not directly traceable to a department, product, activity, customer, etc. As a result indirect costs and expenses are often allocated to the department, product, etc.

It can also include labor, assuming the labor is specific to the product, department or project. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor.

Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Overheads are also very important cost element along with direct materials and direct labor.