For that Walmart needs to calculate the cost associated with the Sale of Inventory. Let’s say transportation cost is $500 Mn and legal and registration charges are $100 Mn. The lower of cost or market method is a way to record the value of inventory which places an emphasis on not overstating the value of the assets. Net realizable value (NRV) is the value of an asset that can be realized upon the sale of the asset, less a reasonable estimate of the costs associated with the eventual sale or disposal of the asset. NRV is a common method used to evaluate an asset’s value for inventory accounting.

Examples of Net Realizable Value Formula (With Excel Template)

Every business has to keep a close on its inventory and periodically access its value. The reason for that is there are several negative impacts like damage of inventory, obsolescence, spoilage etc. which can affect the inventory value in a negative way.

Gross profit margin and net profit margin, on the other hand, are two separate profitability ratios used to assess a company’s financial stability and overall health. The lower of cost or market (LCM) method states that when valuing a company’s inventory, it is recorded on the balance sheet at either the historical cost or the market value. Historical cost refers to the cost at which the inventory was purchased.

Let’s say in the Financial year 2018, a market value of Inventory (which is also an asset) for Walmart is around $44 Bn. Let’s say out of it, Walmart is going to sell some part of the inventory to another company for $4 Bn for offloading purposes.

Examples of Uses for Net Realizable Value

The gross profit is the absolute dollar amount of revenue that a company generates beyond its direct production costs. Thus, an alternate rendering of the gross margin equation becomes gross profit divided by total revenues. As shown in the statement above, Apple’s gross profit figurewas $88 billion (or $229 billion minus $141 billion). Here’s a more in-depth look at gross profit margin and net profit margin. A high gross profit margin indicates that a company is successfully producing profit over and above its costs.

It is mainly used in identifying the value of inventory or account receivables. Since in NRV, a firm takes into account the cost also, hence it is known as a conservative approach of the transaction.

Gross profit margin provides a general indication of a company’s profitability, but it is not a precise measurement. The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. The gross margin result is typically multiplied by 100 to show the figure as a percentage.

It is wise to compare the margins of companies within the same industry and over multiple periods to get a sense of any trends. The gross profit figure is of little analytical value because it is a number in isolation rather than a figure calculated in relation to both costs and revenue. Therefore, the gross profit margin (or gross margin) is more significant for market analysts and investors. Profit margin is a percentage measurement of profit that expresses the amount a company earns per dollar of sales. If a company makes more money per sale, it has a higher profit margin.

The COGS is the amount it costs a company to produce the goods or services that it sells. The lower of cost or market method lets companies record losses by writing down the value of the affected inventory items. The amount by which the inventory item was written down is recorded under cost of goods sold on the balance sheet. GAAP rules previously required accountants to use the lower of cost or market (LCM) method to value inventory on the balance sheet.

Gross profit margin is an indication of the financial success and viability of a particular product or service. The higher the percentage, the more the company retains on each dollar of sales to service its other costs and obligations. Gross profit margin is calculated by subtracting cost of goods sold (COGS) from total revenue and dividing that number by total revenue. Net realizable value is the estimated selling price of goods, minus the cost of their sale or disposal.

Obviously, these measurements can be somewhat subjective, and may require the exercise of judgment in their determination. However, at the end of the accounting year the inventory can be sold for only $14,000 after it spends $2,000 for packaging, sales commissions, and shipping. Therefore, the net realizable value of the inventory is $12,000 (selling price of $14,000 minus $2,000 of costs to dispose of the goods). In that situation the inventory must be reported at the lower of 1) the cost of $15,000, or 2) the NRV of $12,000. In this situation, the inventory should be reported on the balance sheet at $12,000, and the income statement should report a loss of $3,000 due to the write-down of inventory.

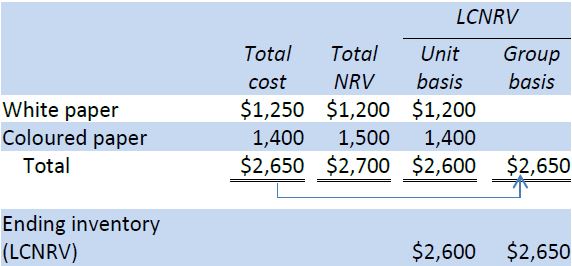

It is used in the determination of the lower of cost or market for on-hand inventory items. The deductions from the estimated selling price are any reasonably predictable costs of completing, transporting, and disposing of inventory. NRV is the total amount which a company can expect while selling its assets.

The lower of cost or market (LCM) method relies on the fact that when investors value a company’s inventory, those assets shall be recorded on the balance sheet at either the market value or the historical cost. If ABC reported $5 million in total revenue for the year and cost of goods sold (cost of materials and direct labor) of $2 million, then we can use the formula above to find ABC’s gross profit margin. NRV, in the context of inventory, is the estimated selling price in the normal course of business, less reasonably predictable costs of completion, disposal, and transportation.

- Net realizable value (NRV) is the value of an asset which can be realized when that asset is sold.

- It is also termed as cash Realizable value since it is the cash amount which one gets for the asset.

How do you calculate net realizable value?

Net realizable value (NRV) is the cash amount that a company expects to receive. In the case of accounts receivable, net realizable value can also be expressed as the debit balance in the asset account Accounts Receivable minus the credit balance in the contra asset account Allowance for Uncollectible Accounts.

The lower of cost or market rule traditionally applies to companies whose products become obsolete. Net realizable value is an important metric that is used in the lower cost or market method of accounting reporting. Under the market method reporting approach, the company’s inventory must be reported on the balance sheet at a lower value than either the historical cost or the market value. If the market value of the inventory is unknown, the net realizable value can be used as an approximation of the market value. Walmart is a US-based retail supermarket chain-based company with around $500Bn of revenue as per the financial year 2018.

Applying the GAAP to Inventory Reserves

The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services. In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved.

So it is better for a business to write off those assets once for all rather than carrying those assets which can increase the losses in the future. To illustrate the difference, consider a company showing a gross profit of $1 million. At first glance, the profit figure may appear impressive, but if the gross margin for the company is only 1%, then a mere 2% increase in production costs is sufficient enough to make the company lose money. In short, gross profit is the total number of gross profit after subtracting revenue from COGS—or $88 billion in the case of Apple. But the gross margin is the percent of profit Apple generated per the cost of producing its goods, or 38%.

If the market price of inventory fell to below the historical cost, the principle of conservatism required accountants to use the market price to value inventory. Market price was defined as the lower of either replacement cost or NRV. Net realizable value (NRV) is a conservative method for valuing assets because it estimates the true amount the seller would receive net of costs if the asset were to be sold. Two of the largest assets that a company may list on a balance sheet are accounts receivable and inventory.

NRV is a valuation method used in both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). The gross margin represents the amount of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services sold by the company. Smart investors and analystscompare one company with similar companies within their industry to get a guage on what a good gross profit margin ratio or percentage actually is for a truer apples-to-apples comparison. While both are estimates of an asset’s value, net present value better represents how much a business will profit on a transaction, while fair value describes what revenue a business will generate by selling a good. Net Realizable is a value of an asset at which it can be sold, after deducting the cost in selling or disposing of the asset.

Understanding Net Realizable Value (NRV)

Net realizable value (NRV) is the value of an asset which can be realized when that asset is sold. It is also termed as cash Realizable value since it is the cash amount which one gets for the asset. All the related cost like disposal cost, transportation cost etc. should be subtracted while calculating a net realizable value. So during inventory valuation, NRV is the price cap for the asset if we use a market method of accounting.

A conservative approach meaning that the firm should not overstate the profit by showing a lesser value of its assets. Net realizable value, as discussed above can be calculated by deducting the selling cost from the expected market price of the asset and plays a key role in inventory valuation.

The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue. This means that for every dollar Apple generated in sales, the company generated 38 cents in gross profit before other business expenses were paid. A higher ratio is usually preferred, as this would indicate that the company is selling inventory for a higher profit.

It is used by businesses to value their inventory and it uses a conservative approach while valuing the inventory. Analysts, who are analyzing companies financial can also check if the company is valuing its assets following proper accounting method. NRV helps businesses to assess the correct value of inventory and see if there is any negative impact on valuation. This approach expects the businesses to value their inventory at a conservative value and avoid overstating it.

In that method, inventory is valued at either historical cost or market value, whichever is lower. If we are not able to determine the market value, NRV can be used as a proxy for that. Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS).