It’s not a big deal if this isn’t perfect, but with some deposits—especially large ones—tellers might require that you have all of your commas and decimals in the right place. For example, if you’re a credit union member using a different credit union’s branch (via shared branching), you’ll need to write in the name of your “home” credit union. If you have pre-printed deposit slips from the back of your checkbook, this is already done for you.

- Keep in mind that most banks have a limit to the amount of mobile deposits you can make each day.

- Using a ready-made invoice template will not only save you time billing customers but also ensure that your invoices are always accurate, consistent, and professional.

- Only accepted checks for collection shall be credited to the depositor’s account and only upon receipt of proceeds.

- Jotform has more than 70 invoice templates, so you can choose a design that fits your creative brand.

- If you’re depositing numerous items at once, use the back of your deposit slip or ask a bank employee for guidance.

Using this process for each invoice will establish an efficient and consistent billing process for every client. Once you build your invoice, you can save it as a template to use as needed. Automatically generate PDF invoices with this free Generic Invoice Template. This Construction Invoice Template contains information about the client, the invoice, job description, project description, payment method, and total amount. When your entire deposit consists of checks, you might want cash now so that you don’t have to make a withdrawal later.

What does an invoice look like?

The template will then convert each form submission into a professional PDF receipt, easy to download, print, or send via email. No matter which industry you work in, Jotform’s Simple Invoice PDF Template lets you generate polished invoices at the touch of a button. Have customers fill in a form with their contact details, chosen products, and payment details to instantly generate professional PDF invoices. You can even accept online payments or collect e-signatures for added security.

Your custom invoice template will automatically generate PDF invoices for each form submission, making it easier to keep track of every purchase from your business. Preparing invoices for clients is necessary for making sure you get paid for your products or services. But writing and mailing paper invoices by hand isn’t the most efficient use of your time when you could be bringing in more business. Using a ready-made invoice template will not only save you time billing customers but also ensure that your invoices are always accurate, consistent, and professional.

We have prepared a professional invoice PDF template to help you to send invoices in seconds! You can gather the billing information, shipping information, invoice details by using this invoice form template. Generally, Bank Five Nine makes funds from your deposit available to you on the first business day after the day we receive your deposit. Electronic direct deposits will be available on the day we receive the deposit.

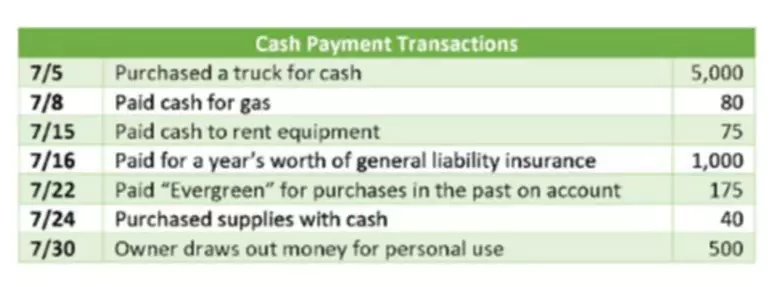

Upon entering a bank, a customer can typically find a stack of deposit slips with designated spaces to fill in the required information to complete the deposit. The customer is required to fill out the deposit slip before approaching the bank teller to deposit funds. You can add even more information and change the design to make it more personalized. Both the deposit slip duplicate and the receipt received from the bank must be kept by the depositor.

Deposit Slip: What It Is, How It Works, Benefits

If necessary, customers can request a copy of their deposit including the deposit slip to show the itemized amounts that made up the total deposit. The depositor must ensure that the correct amount shall be credited. The bank shall not be responsible for any incorrect amount entered and validated by the teller to the deposited account. All banks have a funds availability policy, which explains how long you need to wait to spend the money.

Most importantly, don’t assume that you can spend all of the money from large check deposits immediately. Although the deposit receipt proves the deposit was made, the receipt only shows the total of the deposit. If there’s a dispute with the bank, customers can request a copy of their deposit including the deposit slip to show the itemized amounts that made up the total deposit.

For both the customer and the bank, a deposit slip serves as a form of protection. Other information can include details of the money received, e.g., coins and the type of notes. The original deposit slip and the deposit (cash or check) are kept by the teller at the bank, and the depositor is provided with a receipt and sometimes along with a duplicate of the deposit slip. Deposit slips can also be called deposit tickets and depending on the bank, their designs may differ.

Hourly Invoice

Only accepted checks for collection shall be credited to the depositor’s account and only upon receipt of proceeds. We are happy to help with any questions regarding how to fill out a bank deposit slip! If you want to score bonus points with the teller, enter your deposit amounts in dollars and cents. The box on the far right is for the decimal (or cents) portion, and the next box to the left is for the dollar amount.

A self-employed invoice is a document stating the work that has to be done and the agreed rate per hour. This sample template is a self-employed cleaner invoice template you can use to record your hours worked for a particular task and present it to your client. All information that appears in the the deposit slip shall be deemed as true and correct and shall be processed by the teller accordingly. The bank shall not be responsible for processing of any incorrect information provided and the responsible for any information that appears and furnished shall redound to the depositor. Every deposit slip must be limited to one for each currency, one for type of check, or one for type of deposit.

Deposit slips identify you and provide instructions to your financial institution. It includes the name of the depositor and the account number, along with the name of the account holder to whom the deposit is being made to. Pre-printed deposit slips from checkbooks usually already have the information filled in for the checkbook holder. Additional information, such as the date and branch information, can be filled out. ATM deposit receipts are available before completing the deposit including receipts that contain images of the checks being deposited.

The account can be the individual’s own account or an account of another person. A deposit slip is a form that is used to itemize the checks and cash being deposited into a bank account. The form contains the name on the account, the account number, the amount of each check being deposited, and the amount of any bills and coins being deposited. A deposit slip is a small paper form that a bank customer includes when depositing funds into a bank account. A deposit slip, by definition, contains the date, the name of the depositor, the depositor’s account number, and the amounts being deposited. Beyond the required financial and business information, invoices typically include a few common design elements.

This Free Consultant Invoice Template uses the Form Calculation widget that displays the subtotal, tax, and total amount of the services fee. It also uses the Unique ID widget to automatically generate the invoice number. No matter what type of business you operate, you can easily create and send invoices using these free invoice PDF templates. Each invoice template will instantly convert submitted information into professional PDF invoices.

What is the Difference Between a Credit Card and a Debit Card?

Once the funds are available, you may withdraw the funds in cash and we will use the funds to paychecks you have written. Exceptions for this occur during weekends (Saturdays and Sundays), Federal Holidays, and during other delays. Another great way to know how much you can spend is to check your available balance or ask a Bank Five Nine teller when the funds will become available. You typically only need to sign a deposit slip when you want cash back from your deposit.

How To Fill Out a Deposit Slip

Due to their reusability, invoice templates streamline your processes by reducing the work that goes into billing clients. Banks and financial services can use this free Deposit Slip Template to generate bank deposit slips for customers. After filling in the required monetary information, the depositor fills in the sub-total of the cash and check deposits being made. If any withdrawals are being made from the checks (common for check deposits into own accounts), they are subtracted from the sub-total to obtain the total deposit. Finally, once all the information has been filled in, the depositor is required to sign the deposit slip. For bank customers, a deposit slip serves as a de facto receipt that the bank properly accounted for the funds and deposited the correct amount and into the correct account.

Signing the slip is required if you are getting cash from your deposit. Go to My Forms and delete an existing form or upgrade your account to increase your form limit.