Preferred share issuers are typically investment grade companies, so there is limited credit risk. The dividend payments rank in priority to equity holders and most importantly, they are trading today at substantial price discounts relative to the yield premium investors can collect over bonds. Perpetual preferred shares are paying premiums of nearly 4% over long dated bonds. Rate resets do carry some interest rate risk but that can be reduced substantially by buying issues with different maturity dates while investors can collect premiums of 5% or more over bonds.

Shareholders of preferred stock receive fixed, regular dividend payments for a specified period of time, unlike the variable dividend payments sometimes offered to common stockholders. Of course, it’s important to remember that fixed dividends depend on the company’s ability to pay as promised.

Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. Companies might exercise the call option on a preferred stock if its dividends are too high relative to market interest rates, and they often re-issue new preferred stocks with a lower dividend payment. There is no set date for a call, however; the corporation can decide to exercise its call option when the timing best suits its needs. Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate.

Preferred shares are equity, but in many ways, they are hybrid assets that lie between stock and bonds. They offer more predictable income than common stock and are rated by the major credit rating agencies. Unlike with bondholders, failing to pay a dividend to preferred shareholders does not mean a company is in default. Because preferred shareholders do not enjoy the same guarantees as creditors, the ratings on preferred shares are generally lower than the same issuer’s bonds, with the yields being accordingly higher. Preferred stock shareholders receive their dividends before common stockholders receive theirs, and these payments tend to be higher.

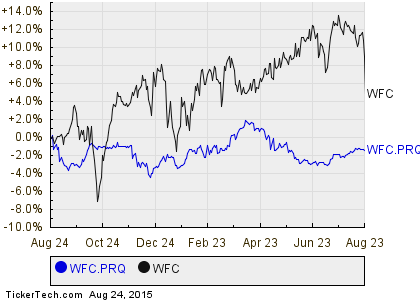

The market prices of preferred stocks tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise. The yield generated by a preferred stock’s dividend payments becomes more attractive as interest rates fall, which causes investors to demand more of the stock and bid up its market value. This tends to happen until the yield of the preferred stock matches the market rate of interest for similar investments.

Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates. However, the relative move of preferred yields is usually less dramatic than that of bonds. Some companies also issue preferred stock, and the features of preferred stock can differ greatly from common stock.

In the event that a company declares bankruptcy, preferred stockholders are paid before common stockholders. Unlike preferred stock, though, common stock has the potential to return higher yields over time through capital growth. Remember that investments seeking to achieve higher rates of return also involve a higher degree of risk. Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the LIBOR.

Preferred Stocks List

This is true during the company’s good times when the company has excess cash and decides to distribute money to investors through dividends. The dividends for this type of stock are usually higher than those issued for common stock. Preferred stock also gets priority over common stock, so if a company misses a dividend payment, it must first pay any arrears to preferred shareholders before paying out common shareholders. Unlike common stockholders, preferred stockholders have limited rights which usually does not include voting.

The market price of both bonds and preferred stocks is heavily influenced by movements in prevailing interest rates. Unlike bonds, which are debt instruments and don’t confer any ownership in the company, preferred stocks are equity instruments. If the company does well, the value of the preferred stock can appreciate independently of interest rate movements.

Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. The main disadvantage of owning preference shares is that the investors in these vehicles don’t enjoy the same voting rights as common shareholders. This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders. Although the guaranteed return on investment makes up for this shortcoming, if interest rates rise, the fixed dividend that once seemed so lucrative can dwindle.

Preference shareholders experience both advantages and disadvantages. On the upside, they collect dividend payments before common stock shareholders receive such income.

Shares of stock come in two primary classes: common stock and preferred stock.

Perpetual preferred shares – As mentioned previously, these preferred shares pay the same rate in perpetuity with no risk of the rate being reset. The vast majority of issuers are high quality, investment grade companies, such as the Banks, Life Insurance companies, and Utilities. For example, as 30 year bond rates have dropped over 0.5% in the past year, long-dated fixed income investments should have experienced price increases of over 10% based on financial math. A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value.

It’s because the owners know they will be paid back before the owners of common stocks will. As a result, many of these perpetual preferred shares are offering dividend yields of well over 5%, a premium of over 3.5% vs. government bonds. For long-term income investors, these preferred shares offer yields high enough to meet their spending needs and an opportunity for capital appreciation. Some investors confuse the face value of a preferred stock with its callable value – the price at which an issuer can forcibly redeem the stock. In fact, the call price is generally a little higher than the face value.

- So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company.

- A main difference from common stock is that preferred stock comes with no voting rights.

Preferred stock is sold at a par value and paid a regular dividend that is a percentage of par. Preferred stockholders do not typically have the voting rights that common stockholders do, but they may be granted special voting rights.

Thedividend yieldof a preferred stock is calculated as the dollar amount of a dividend divided by the price of the stock. This is often based on the par value before a preferred stock is offered. It’s commonly calculated as a percentage of the current market price after it begins trading. This is different from common stock which has variable dividends that are declared by the board of directors and never guaranteed.

A main difference from common stock is that preferred stock comes with no voting rights. So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company. In fact, preferred stock functions similarly to bonds since with preferred shares, investors are usually guaranteed a fixed dividend in perpetuity.

The market value of a preferred stock is not used to calculate dividend payments, but rather represents the value of the stock in the marketplace. It’s possible for preferred stocks to appreciate in market value based on positive company valuation, although this is a less common result than with common stocks. Preferred shareholders have a prior claim on a company’s assets if it is liquidated, though they remain subordinate to bondholders.

The nature of preferred stock provides another motive for companies to issue it. With its regular fixed dividend, preferred stock resembles bonds with regular interest payments. However, unlike bonds that are classified as a debt liability, preferred stock is considered an equity asset. Issuing preferred stock provides a company with a means of obtaining capital without increasing the company’s overall level of outstanding debt. This helps keep the company’s debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

The decision to pay the dividend is at the discretion of a company’s board of directors. Warren Buffet has often said that the key to investing is buying good companies at fair prices. I believe anytime that you can invest in high quality assets at a cheap price is equally effective.

In fact, preferred stock often looks a lot more like a bond, as it typically has a set dollar amount that the company can pay preferred shareholders to redeem the shares. Most preferred stock pays dividends, and the amount tends to be higher than what common shareholders receive. Preferred stock usually pays fixed dividends year in and year out, rather than seeing changes in payout amounts from quarter to quarter as common stock dividends are. Common stock represents shares of ownership in a corporation and the type of stock in which most people invest. When people talk about stocks they are usually referring to common stock.

Preferred stock

Preferred stock derives its name from the fact that it carries a higher privilege by almost every measure in relation to a company’s common stock. Preferred stock owners are paid before common stock shareholders in the event of the company’s liquidation. Preferred stockholders enjoy a fixed dividend that, while not absolutely guaranteed, is nonetheless considered essentially an obligation the company must pay. Preferred stockholders must be paid their due dividends before the company can distribute dividends to common stockholders.

What are preferred shares and why are they preferred?

premium on preferred stock. The amount of excess paid on the outstanding shares of preferred stock that a company holds.

Common shares represent a claim on profits (dividends) and confer voting rights. Investors most often get one vote per share-owned to elect board members who oversee the major decisions made by management. Stockholders thus have the ability to exercise control over corporate policy and management issues compared to preferred shareholders. In a liquidation, preferred stockholders have a greater claim to a company’s assets and earnings.

This could cause buyer’s remorse with preference shareholder investors, who may realize that they would have fared better with higher interest fixed-income securities. Preference shares, which are issued by companies seeking to raise capital, combine the characteristics of debt and equity investments, and are consequently considered to be hybrid securities.

But on the downside, they do not enjoy the voting rights that common shareholders typically do. Companies also use preferred stocks to transfer corporate ownership to another company. For one thing, companies get a tax write-off on the dividend income of preferred stocks. They don’t have to pay taxes on the first 80 percent of income received from dividends.Individual investorsdon’t get the same tax advantage. Second, companies can sell preferred stocks quicker than common stocks.

In fact, many companies do not pay out dividends to common stock at all. Like bonds, preferred shares also have a par value which is affected by interest rates. When interest rates rise, the value of the preferred stock declines, and vice versa. Both bonds and preferred stocks are considered fixed income securities because the amount of regular interest or dividend payments is a known factor.