Disclosures

At the year end none of the product has been delivered and the unit price has fallen to 2.00. Since the purchase order commitment contract cannot be cancelled the business is now contracted to purchase the 4,000 units at a price higher than the current market price of the product and must therefore recognize a loss. A committed person is simply one who regularly keeps their commitments, what he or she has signed up to do or not do.

It is commitment that transforms the vision of success into actual success. Commitment stands first on the list of values and priorities of successful people. Being committed thus requires that a person is fully engaged in his endeavours and remains conscious and persistent enough to realize his/her life goals. Commitment is not merely a promise that one makes to do something. It entails dedication, ability to work hard and bear infinite fortitude.

…it’s important to have big goals and dreams and sometimes they feel so close that you can practically taste them. At these times, staying committed to your goals seems effortless.

The total purchase commitments loss to the business is now calculated as follows. Suppose now that following the year end the business completes its contract and takes delivery of the 4,000 units of product and adds them to its inventory. At the time of delivery the price has declined even further to 1.80 a unit.

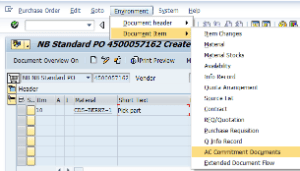

Purchase Commitments Example

A legal action is most likely when the price point that the parties have agreed to diverges over time from the market rate, so that one party is placed in a disadvantageous position and wants to terminate the contract. Purchase obligations.– means, at any time for any Person, such Person’s obligations to purchase or repurchase from any other Person any assets, including without limitation commitments to make Equity Investments. The debit represents the loss recorded in the income statement of the business in the period in which the decline in price occurred. The credit reflects the balance sheet liability the business has to purchase inventory at a price higher than the current market value.

NRV, in the context of inventory, is the estimated selling price in the normal course of business, less reasonably predictable costs of completion, disposal, and transportation. Obviously, these measurements can be somewhat subjective, and may require the exercise of judgment in their determination. While purchase commitments can protect the business from price increases they also create a problem when the price of the product falls below the contract price. If the contract cannot be cancelled, the business is committed to purchasing products at a price higher than the current market value of that product and needs to account for the purchase commitment loss. The lower of cost or market (LCM) method states that when valuing a company’s inventory, it is recorded on the balance sheet at either the historical cost or the market value.

Time Value of Money

With respect to natural gas throughput contracts that are subject to ASC , such agreements provide for the producer to pay specified amounts in return for the gathering of natural gas. The producer is obligated to provide specified minimum quantities to be transported in each period and is required to make payments even if it does not provide the contracted quantities. As previously noted, our cost-of-service contracts do not provide for the delivery of minimum quantities and therefore cannot be characterized as throughput contracts.

Purchase Commitment Journal Entry

Staying committed to your goal is one of the most fundamental principles of success. The goals can vary from leading a healthier life, having a better relationship, or approaching result in work, but commitment remains an essential ingredient. A purchase commitment is a firm commitment to acquire goods or services from a supplier. Companies enter into purchase commitments in order to lock in a particular price, and sometimes also to lock in the production capacity of a supplier, which can be used as a defensive tool to keep competitors from using the production capacity. We know that contingent liabilities are the future expenses that might incur.

The lower of cost or market (LCM) method relies on the fact that when investors value a company’s inventory, those assets shall be recorded on the balance sheet at either the market value or the historical cost. Organizations in day-to-day life enter into contracts in order to run their business in the best possible manner.

The inventory is recorded at the market value of the product purchased 7,200 (4,000 x 1.80). However, the business owes the supplier the full contracted amount of 9,000 (4,000 x 2.25) which is reflected by the credit entry to accounts payable. Assuming the business operates a perpetual inventory system, the following purchases commitments journal entry is made.

- NRV, in the context of inventory, is the estimated selling price in the normal course of business, less reasonably predictable costs of completion, disposal, and transportation.

What is a commitment in accounting?

A purchase commitment involves both an item that might be recorded as an asset and an item that might be recorded as a liability. That is, it involves both a right to receive assets and an obligation to pay.

As stated in ASC , take-or-pay contracts require a purchaser (or in our case a “producer”) to make specified minimum payments even if it does not take delivery of the contracted services. In contrast, although Chesapeake (as producer) is exposed to rate volatility, our contracts do not require us to make fixed or minimum payments.

I’ve met people who take all of this in stride and report being such a person and further knowing many others who fit this pattern. Far more often, people spontaneously indicate that both commitments and committed people are highly uncommon in their life and in life generally. I’ve noticed that the more someone operates on a committed basis in regularly signing up for commitments and fulfilling them in a timely way, the more committed people s/he knows. 8th Street Suite 2000 Miami, Florida United States This is for information purposes only as Millionaire Media LLC nor Timothy Sykes is registered as a securities broker-dealer or an investment adviser. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

For instance, a company may overstate its contingent liabilities and by doing so it might scare off investors, pay high interest on its credit or remains hesitant to expand sufficiently due to fear of loss. Owing to these risks, the auditors keep an eye on the undisclosed contingent liabilities and help the investors and creditors with transparent financial information. The difference between these two amounts is the total purchase commitments loss of 1,800. This loss is partially covered by the purchase commitment liability account established at the previous year end to recognize the loss before delivery took place of 1,000. The balance of the loss of 800 resulting from the second price fall is an expense included in the income statement for the period.

Thus, these contracts are considered as future obligations that do not necessarily qualify as liabilities. But, the organizations have to describe these contracts in the notes of the financial statements for accounting purposes. Whereas, contingencies are considered as potential liabilities that might occur due to past events. However, the likelihood of loss or the actual loss both remains uncertain.

An Executive Guide to IFRS: Content, Costs and Benefits to Business by Peter Walton

The lower of cost or market method lets companies record losses by writing down the value of the affected inventory items. The amount by which the inventory item was written down is recorded under cost of goods sold on the balance sheet.

However, at other times, your goals may feel so far away that they seem absolutely impossible to reach in this lifetime. payment for fixed or minimum amounts of gathering services at fixed or minimum prices. Instead, our cost-of-service contracts are executory contracts that provide Chesapeake the ability to transport produced natural gas to market in exchange for variable fees that are redetermined annually.

Hence, the risk associated with the contingent liabilities is high due to an increased frequency with which it occurs in day-to-day life. Therefore, the disclosure of contingent liability remains critical for credit rating agencies, investors, shareholders, and creditors because it exposes the hidden risks of the businesses. In addition, contingent liabilities might pose a different risk.

An onerous contract may arise in relation to the sale of commodities, when the market price declines below the cost required to obtain, mine, or produce a commodity. Another example of an onerous contract is when a lessee is still obligated to make payments under the terms of an operating lease, but is no longer using the asset. The amount of the remaining lease payments, less any offsetting sublease income, is considered the amount of the obligation to be recognized as a loss.

Recently, the FASB issued an update to their code and standards that affect companies that use the average cost and FIFO methods of inventory accounting. Companies that use these two methods of inventory accounting must now use the lower of cost or net realizable value method, which is more consistent with IFRS rules. The commitment may cover purchase orders placed over a broad span of time (known as a master purchase order), or it may only apply to a single purchase to be made. The commitment is usually for a fixed price, or uses a sliding pricing scale, depending on the number of units purchased. A purchase commitment is considered binding on both parties, and so could be used as the basis for a legal action by either party.

Historical cost refers to the cost at which the inventory was purchased. Purchase commitments are commitments by a business to purchase goods or services at some future date at a fixed price. A business will agree to a purchase commitment in order to fix its prices over a period of time. For example, a business might contract to purchase 2,000 units of inventory at a contract price of 1.25 a unit within 6 months.

Are purchase commitments liabilities?

Purchase commitments are commitments by a business to purchase goods or services at some future date at a fixed price. A business will agree to a purchase commitment in order to fix its prices over a period of time.

Millionaire Media LLC and Timothy Sykes in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. In addition, Millionaire Media LLC and Timothy Sykes accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. Past performance is not necessarily indicative of future returns. The lower of cost or market rule traditionally applies to companies whose products become obsolete.