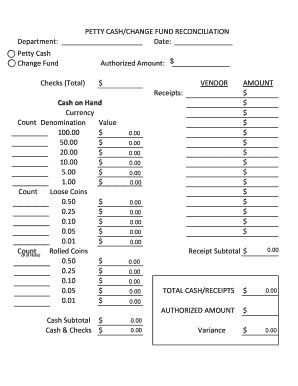

Such disbursements are a common problem in petty cash, where there is a high risk of fraud. Also, since most petty cash custodians are not trained as accountants, they may incorrectly record disbursements. For these reasons, a petty cash reconciliation should be conducted at regular intervals. The review can be treated as an audit, which means not warning the petty cash custodian of the arrival of the reviewer. This lack of warning is useful for detecting any personal withdrawals from the petty cash fund by the custodian.

To control the petty cash fund properly and record it correctly for tax purposes, the fund should be stored in a secure location and reconciled frequently. Petty cash is a highly liquid asset, which means that it’s easily stolen.

The total of the receipts and the remaining cash should always equal the amount you started with. For example, if you have a $100 petty cash fund and spend $27.52 on office supplies, your receipt for the purchase plus the remaining money in the fund will add up to $100. Establish a starting dollar balance for the petty cash fund. This should be small enough that employees won’t be tempted to steal it but large enough that you don’t have to replenish it too often.

If every employee has access to petty cash, bad or nonexistent record keeping usually results. Instead, designate one employee to be responsible for the petty cash fund. Require that employees maintain a running petty cash log for every transaction, including receipts.

ACCOUNTING

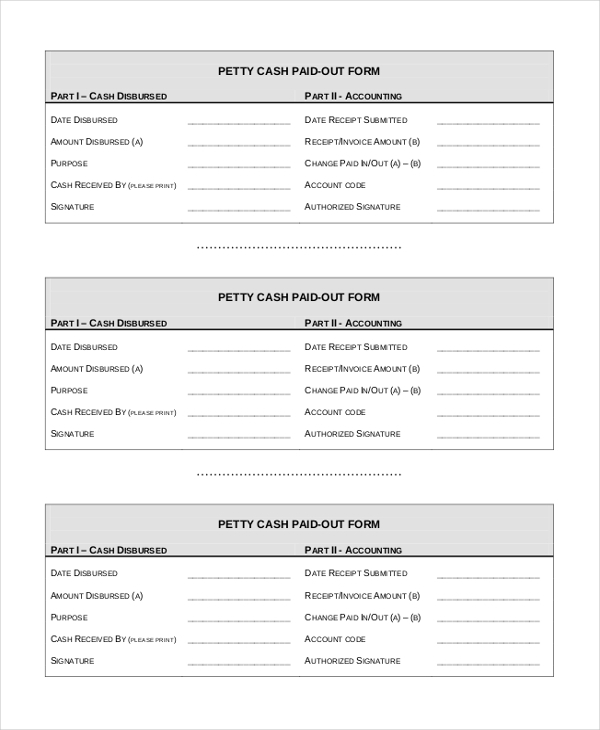

When the employee returns with the receipts, simply fill out the “revised amount” column and have the payee and the Custodian initial the voucher in the far right hand column. If it is necessary to replenish cash funds while advances remain outstanding, the total advance should be charged against the appropriate Banner account. Make a copy of the PCV and submit the original with the Petty Cash Replenishment Request. When the employee returns with the receipts, submit the copy of the PCV attached to a new PCV indicating the amount of cash returned by the employee (if any) in brackets. When preparing the INV to replenish the fund, be sure to credit the original FOAPAL charged if there is cash returned by the employee.

Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs. Examples of these payments are office supplies, cards, flowers, and so forth. Petty cash is stored in a petty cash drawer or box near where it is most needed.

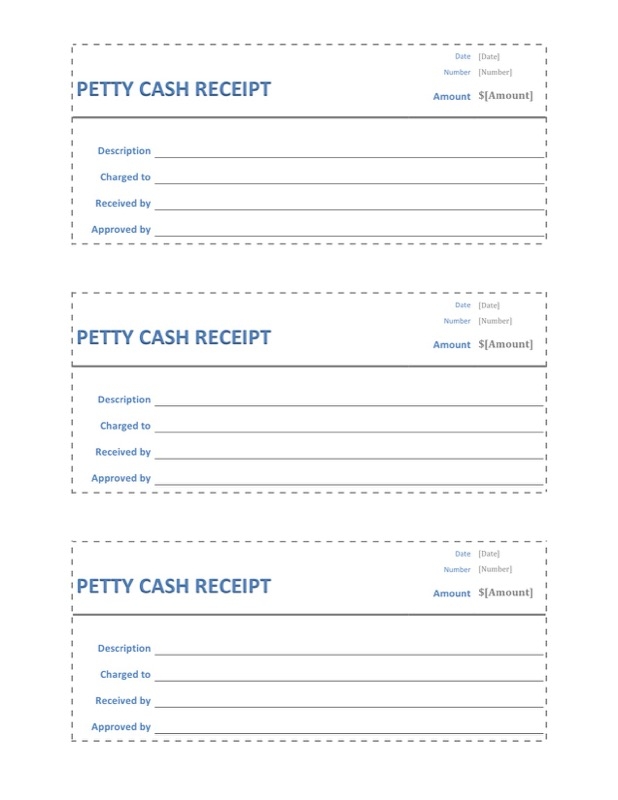

How do you write a petty cash receipt?

Every time money from the petty cash fund is used, a petty cash receipt is issued. The petty cash receipt includes details, like how much money was used, what was it used for, the date when it was used, the person who gave permission for using it, and the person who received the said payment.

Only you and the employee designated to oversee the fund should have the keys. The petty cash custodian then disburses petty cash from the fund in exchange for receipts related to whatever the expenditure may be. There is no journal entry at this point; instead, the cash balance in the petty cash fund continues to decline, while the number of receipts continues to increase. The total of the receipts and remaining cash should equal the initial amount of petty cash funding at all times. However, recordation errors and theft may result in a variance from the initial funding amount.

When petty cash is used for business expenses, the appropriate expense account — such as office supplies or employee reimbursement — should be expensed. Petty cash is a small amount of money for small expenses. Most people use petty cash for things like buying office supplies, paying for postage, and so on. The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. The cashier creates a journal entry to record the petty cash receipts.

Pick a dollar amount you think will cover small office expenses for a month or so. A petty cash fund between $100 and $500 is sufficient for many small businesses. In some cases, the petty cash Custodian may find it necessary to advance up to $200 cash to an employee for travel or for miscellaneous business supplies. Contact Accounts Payable immediately if advances are not resolved fully within 4 days. When petty cash is advanced to the employee, complete all sections of the Petty Cash Voucher, including the “original amount” column, and obtain the payee’s signature.

Petty cash is a small amount of money, but it adds up quickly as it’s replenished. To track the cash, create a petty cash account in the asset section of your chart of accounts. When you’re ready to replenish the fund, record the expenses in your accounting software based on the petty cash expense log.

Even if you trust your employees, cash left out on a table or desk could be stolen by an office visitor or a customer. To combat this risk, keep the petty cash in a locked filing cabinet or cash box.

There may be several petty cash locations in a larger business, probably one per building or even one per department. A separate accounting system is used to track petty cash transactions. The petty cash is controlled through the use of a petty cash voucher for each payment made. The expenses will be recorded in the company’s general ledger expense accounts when the petty cash on hand is replenished.

Then, record the replenishment by debiting the petty cash account and crediting the bank account you used to refill the fund. Petty cash is a current asset and should be listed as a debit on the company balance sheet. The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account.

- Petty cash is a small amount of money, but it adds up quickly as it’s replenished.

- When you’re ready to replenish the fund, record the expenses in your accounting software based on the petty cash expense log.

The petty cash account should be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for. The accountant should write a check made out to “Petty Cash” for the amount of expenses paid for with the petty cash that month to bring the account back up to the original amount.

The receipts will provide the backup to the petty cash replenishment checks when you need to top up the fund. When petty cash gets low, always check the balance with receipts before adding more. To replenish the fund, write a company check to “Petty Cash,” cash it and add the money to the box. The receipts and petty cash reconciliation sheet go to the bookkeeper for entry into the accounting system. The receipts for the expenses go into the box along with any change from the transactions.

The received cash on account journal entry will be as follows. You can set up your petty cash float – the maximum, fixed amount of on-hand cash – by cashing a check, usually ranging from $100 to $500 depending on the size of your business. Larger companies often have a petty cash fund for each department. The amount you select for your petty cash fund must be sufficient to cover small expenses over a designated period, usually one month. You will also need to set up a petty cash account in the asset section of your financial reports.

The amount of petty cash will vary by company and may be in the range of $30 to $300. Most companies keep a small amount of cash on hand to pay minor business-related expenses that don’t warrant the writing of a check or use of the corporate credit card. A petty cash fund is a convenient method to pay for small business transactions such as postage, delivery fees or emergency office supplies. It is important to keep accurate records of all petty cash expenditures for bookkeeping purposes. The IRS requires receipts for all expenses over $75, but it is a good habit to get receipts for every petty cash transaction, no matter how small.

BUSINESS IDEAS

To set up a petty cash fund, the cashier creates a check in the amount of the funding assigned to a particular petty cash fund (usually a few hundred dollars). Alternatively, the cashier could simply count out the cash for the petty cash fund, if there are enough bills and coins on the premises.

If your receipts indicate that there should be more money in the fund, this could indicate that you’re not keeping track of all disbursements or that someone is stealing from petty cash. A petty cash system helps businesses pay small expenses quickly without recording each transaction. It is a separate fund of cash that is set aside to pay for supplies or other low-dollar expenses.

This is a credit to the petty cash account, and probably debits to several different expense accounts, such as the office supplies account (depending upon what was purchased with the cash). The balance in the petty cash account should now be the same as the amount at which it started. Petty cash or a petty cash fund is a small amount of money available for paying small expenses without writing a check. Petty Cash is also the title of the general ledger current asset account that reports the amount of the company’s petty cash.

Managing your petty cash funds begins as soon as the first check has been cashed to create the petty cash float. Keeping meticulous records can help you when it’s time to file taxes. You’ll be able to note, for example, the amount of money you’ve disbursed to cover office expenses or employee meals. You’ll also be able to quickly recognize discrepancies or mismanagement of funds.

The check should be cashed at the company’s bank and the cash placed back in the petty cash safe or lock box. Petty cash is a useful tool for small and medium-sized businesses as it keeps money available for small expenses. Recording those expenses helps to budget for future ones, and even though those might be small, they add up. When all disbursements are recorded diligently by the petty cash custodian and the money is replenished on a regular basis, using petty cash can be a real timesaver. That’s a long way of saying it’s “shoebox money” for expenses which are usually too small to bother using a credit card or writing a check.

When the cash balance in the petty cash fund drops to a sufficiently minimal level, the petty cash custodian applies for more cash from the cashier. This takes the form of a summarization of all the receipts that the custodian has accumulated. The cashier creates a new check in the amount of the receipts, and swaps the check for the receipts. The petty cash journal entry is a debit to the petty cash account and a credit to the cash account.

DOCUMENTS FOR YOUR BUSINESS

Each entry in the petty cash book should include the date, the amount, and what was purchased with the petty cash. Review your petty cash register before you replenish the petty cash fund. The purpose of a petty cash fund is to provide business units with sufficient cash to cover minor expenditures. The intent is to simplify the reimbursement of staff members and visitors for small expenses that generally do not Exceed $25.00, such as taxi fares, postage, office supplies, etc.

FINANCE YOUR BUSINESS

Petty cash funds are small, but they do need to be managed properly. You’ll want to ensure that the money isn’t mishandled, and you’ll want to make sure that those little expenses are accounted for when tax time rolls around. Here’s how you can set up an effective, easy-to-manage petty cash system. A petty cash reconciliation is a formal review of petty cash records. The intent of this activity is to see if there have been any undocumented disbursements.