Thegeneral journalis the all-purpose journal that all transactions are recorded in. Since all transactions are recorded in the general journal, it can be extremely large and make finding information about specific transactions difficult. That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal. A sales journal entry is a journal entry in thesales journalto record a credit sale of inventory. All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal.

Learn How to Record in a Sales Journal Exercise 7-1

Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal.

How do you write a sales journal?

The journal entry of cash sales is: Cash A/c Dr. The cash receipt journal is used to record sales of merchandise for cash. The credit sales is recorded in sales journal.

This entry records the amount of money the customer owes the company as well as the revenue from the sale. In reality, accounting transactions are recorded by making accounting journal entries. Just like everything else in accounting, there’s a particular way to make an accounting journal entry when recording debits and credits. Double entry system of bookkeeping says that every transaction affects two accounts. There is a proper procedure for recording each financial transaction in this system, called as accounting process.The process starts from journal followed by ledger, trial balance, and final accounts.

Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor). Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases.

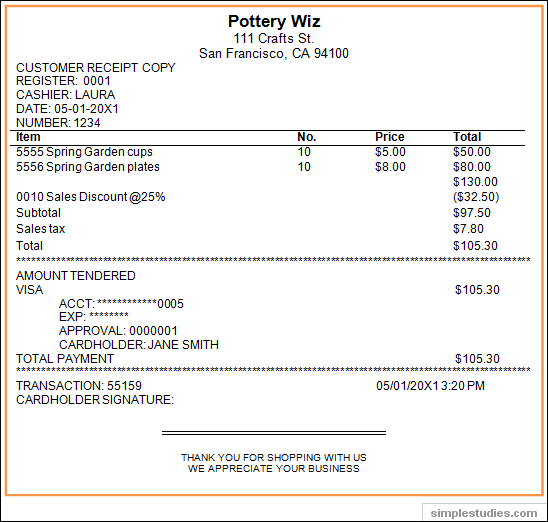

Format of sales invoice

Let’s say you own a cute little toy store and have many regular customers. In fact, you have a few customers who come in several times a week to buy books or toys from your store. You allow those customers to keep a running tab, and they pay you once a month.

Manual accounting systems will likely use special journals for recording routine transactions. Therefore, the general journal will have a limited amount of entries. Accounting principles help govern the world of accounting according to general rules and guidelines.

You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day. At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records. In accounting, journals are used to record similar activities and to keep transactions organized.

Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received.The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales.

Sales journal with a “sales tax payable” column

Cost of sales is also known as the cost of goods sold, and the two terms are used interchangeably. Generally in the cash receipts journal to debit columns for cash receipts and cash discount and three credit columns for accounts receivable, sales and other accounts are there. Cash received from various sources other than cash sales and account receivables are recorded in other accounts column. Sales journals record transactions that involve sales purely on credit.

- Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded.

- Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price.

GAAP attempts to standardize and regulate the definitions, assumptions, and methods used in accounting. There are a number of principles, but some of the most notable include the revenue recognitionprinciple, matching principle, materiality principle, and consistency principle. A cash receipts journal is used to record all cash receipts of the business.

One of the journals is a cash receipts journal, a record of all of the cash that a business takes in. It is reserved specifically for activities that involve receiving cash. You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced. Since the cost of sales is essentially the cost of doing business, it is recorded as a business expense on the income statement.

Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price.

Both cash and credit sales of non-inventory or merchandise are recorded in the general journal. In a cash receipts journal, there are debit and credit entries.

Accounting for Management

Provides a chronological record of all credit sales made in the life of a business. Credit sales are transactions where the goods are sold and payment is received at a later date. The source documents for the Sales journal are copies of all invoices given to the debtors. A column for the transaction date, account name or customer name, invoice number, posting check box, accounts receivable amount, and cost of goods sold amount. Since all sales recorded in the sales journal are paid on credit, there is no need for a cash column.

For example, when a company purchases merchandise from a vendor, and then in turn sells the merchandise to a customer, the purchase is recorded in one journal and the sale is recorded in another. When a piece of merchandise or inventory is sold on credit, two business transactions need to be record. First, the accounts receivable account must increase by the amount of the sale and the revenue account must increase by the same amount.

Journal and Ledger are the two pillars which create the base for preparing final accounts. The Journal is a book where all the transactions are recorded immediately when they take place which is then classified and transferred into concerned account known as Ledger. A general journal is used to record unique journal entries that cannot be processed in a more efficient manner. For example, checks written, sales invoices issued, purchase invoices received, and others can be recorded in a computerized accounting system when the documents are processed.

What is recorded in the sales journal?

The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal.

All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received. An additional posting must be made to balancing the transaction. Therefore, a credit is needed for one or more other accounts that are affected by collecting cash. The cash receipts journal is an important tool to keep track of cash collected by a business.