Working capital is calculated as current assets minus current liabilities on the balance sheet (see Lesson 302). Just as the name suggests, working capital is the money that the business needs to “work.” Therefore, any cash used in or provided by working capital is included in the “cash flows from operating activities” section. Operating cash flow (OCF) is cash generated from normal operations of a business. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The cash flows from the operating activities section also reflect changes in working capital.

Cash Flow from Operations

Many line items in the cash flow statement do not belong in the operating activities section. This increase would have shown up in operating income as additional revenue, but the cash had not yet been received by year end. Thus, the increase in receivables needed to be reversed out to show the net cash impact of sales during the year. The same elimination occurs for current liabilities in order to arrive at the cash flow from operating activities figure. The three categories of cash flows are operating activities, investing activities, and financing activities.

What is net cash flow from operations?

Cash flow from operations is the section of a company’s cash flow statement. that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. Operating activities include generating revenue.

The company’s balance sheet and income statement help round out the picture of its financial health. Operating activities are the daily activities of a company involved in producing and selling its product, generating revenues, as well as general administrative and maintenance activities. The operating income shown on a company’s financial statements is the operating profit remaining after deducting operating expenses from operating revenues. There is typically an operating activities section of a company’s statement of cash flows that shows inflows and outflows of cash resulting from a company’s key operating activities.

Financing activities include cash activities related to noncurrent liabilities and owners’ equity. On financial statements, your business income and your cash are not the same things. On the company income statement, accounts payable – the bills you haven’t paid yet – is a negative entry, representing a loss of income. The cash flow statement doesn’t treat accounts payable as a negative.

Operating cash flows, however, only consider transactions that impact cash, so these adjustments are reversed. Let’s begin by seeing how the cash flow statement fits in with other components of Walmart’s financials. The final line in the cash flow statement, “cash and cash equivalents at end of year,” is the same as “cash and cash equivalents,” the first line under current assets in the balance sheet. The first number in the cash flow statement, “consolidated net income,” is the same as the bottom line, “income from continuing operations” on the income statement.

Cash Flow from Operations vs Net Income

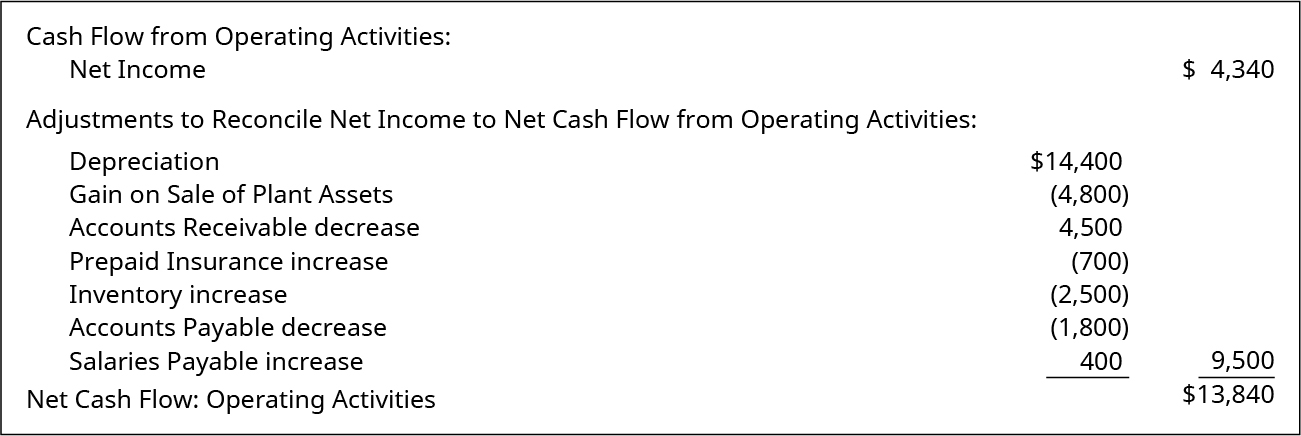

Operating cash flows concentrate on cash inflows and outflows related to a company’s main business activities, such as selling and purchasing inventory, providing services, and paying salaries. Any investing and financing transactions are excluded from operating cash flows section and reported separately, such as borrowing, buying capital equipment, and making dividend payments. Operating cash flow can be found on a company’s statement of cash flows, which is broken down into cash flows from operations, investing, and financing. Net income is carried over from the income statement and is the first item of the cash flow statement. Net cash flow from operating activities is calculated as the sum of net income, adjustments for non-cash expenses and changes in working capital.

Cash Flows From Other Activities

Because the cash flow statement only counts liquid assets in the form of cash and cash equivalents, it makes adjustments to operating income in order to arrive at the net change in cash. Depreciation and amortization expense appear on the income statement in order to give a realistic picture of the decreasing value of assets over their useful life.

This typically includes net income from the income statement, adjustments to net income, and changes in working capital. Operating cash flow represents the cash impact of a company’s net income (NI) from its primary business activities.

- Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows.

- To calculate cash generated from operations, one must calculate cash generated from customers and cash paid to suppliers.

Operating cash flow, also referred to as cash flow from operating activities, is the first section presented on the cash flow statement. Cash flow from operating activities also reflects changes to certain current assets and liabilities from the balance sheet. Increases in current assets, such as inventories, accounts receivable, and deferred revenue, are considered uses of cash, while reductions in these assets are sources of cash. Investors examine a company’s cash flow from operating activities separately from the other two components of cash flow to see where a company is really getting its money. Operating activities are the functions of a business directly related to providing its goods and/or services to the market.

As a result, these expenses are added back into the cash flow statement. There are more items that just those listed above that can be included, and every company is different. The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement.

How do you calculate net cash flow from operating activities?

Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period. This typically includes net income from the income statement, adjustments to net income, and changes in working capital.

To calculate cash generated from operations, one must calculate cash generated from customers and cash paid to suppliers. The difference between the two reflects cash generated from operations. Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows. For example, if a company’s accounts receivable increase at the end of the year, this means that the firm collected less money from its customers than it recorded in sales during the same year on its income statement. This is a negative event for cash flow and may contribute to the “Net changes in current assets and current liabilities” on the firm’s cash flow statement to be negative.

Cash flows from operating activities are among the major subsections of thestatement of cash flows. It is separate from the sections on investing and financing activities. The Cash Flow Statement provides the cash flow of the operating, investing, and financing activities to disclose the entire cash flow in a consolidated statement. The Operating Cash Flow Calculation will provide the analyst with the most important metric for evaluating the health of a company’s core business operations. The indirect method begins with the company’s net income based on the accrual method.

How Do the Balance Sheet and Cash Flow Statement Differ?

The money you’ve set aside to pay those bills counts as cash on hand that hasn’t flowed anywhere yet. Cash flows from operating activities, which is the numerator, come from the statement of cash flows. However, certain items are treated differently on the cash flow statement than on the income statement. Non-cash expenses, such as depreciation, amortization, and share-based compensation, must be included in net income, but those costs do not reduce the amount of cash a company generates in a given period.

However, both are important in determining the financial health of a company. Investors want to see positive cash flow because of positive income from operating activities, which are recurring, not because the company is selling off all its assets, which results in one-time gains.

A positive change in assets from one period to the next is recorded as a cash outflow, while a positive change in liabilities is recorded as a cash inflow. Inventories, accounts receivable, tax assets, accrued revenue, and deferred revenue are common examples of assets for which a change in value will be reflected in cash flow from operating activities.

How Do Net Income and Operating Cash Flow Differ?

These are the company’s core business activities, such as manufacturing, distributing, marketing, and selling a product or service. Operating activities will generally provide the majority of a company’s cash flow and largely determine whether it is profitable. Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. These activities can be found on a company’s financial statements and in particular the income statement and cash flow statement.

Net income is typically the first line item in the operating activities section of the cash flow statement. This value, which measures a business’s profitability, is derived directly from the net income shown in the company’s income statement for the corresponding period.

Operating activities include cash activities related to net income. Investing activities include cash activities related to noncurrent assets.

On the flip side, if accounts payable were also to increase, it means a firm is able to pay its suppliers more slowly, which is a positive for cash flow. Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period.