Financial statements include the balance sheet, income statement, and cash flow statement. The cash flow statement (CFS) measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. The cash flow statement complements the balance sheet and income statementand is a mandatory part of a company’s financial reports since 1987. There are more items that just those listed above that can be included, and every company is different.

There is typically an operating activities section of a company’s statement of cash flows that shows inflows and outflows of cash resulting from a company’s key operating activities. Capital expenses are treated differently for business taxes purposes, because they usually involve investment in a long-term asset such as land or software development. Even though there are costs associated with capital expenses, they are listed as assets on the balance sheet, whereas all operating expenses are treated as expenses on the income statement.

Inventories, accounts receivable, tax assets, accrued revenue, and deferred revenue are common examples of assets for which a change in value will be reflected in cash flow from operating activities. Investors examine a company’s cash flow from operating activities separately from the other two components of cash flow to see where a company is really getting its money. As part of the Cash Flow Statement the cash flows of the operating activities, investing activities, and financing activities are segregated so the analyst can get a clear picture of the cash flows of all the company’s activities. Financial statements are written records that convey the business activities and the financial performance of a company.

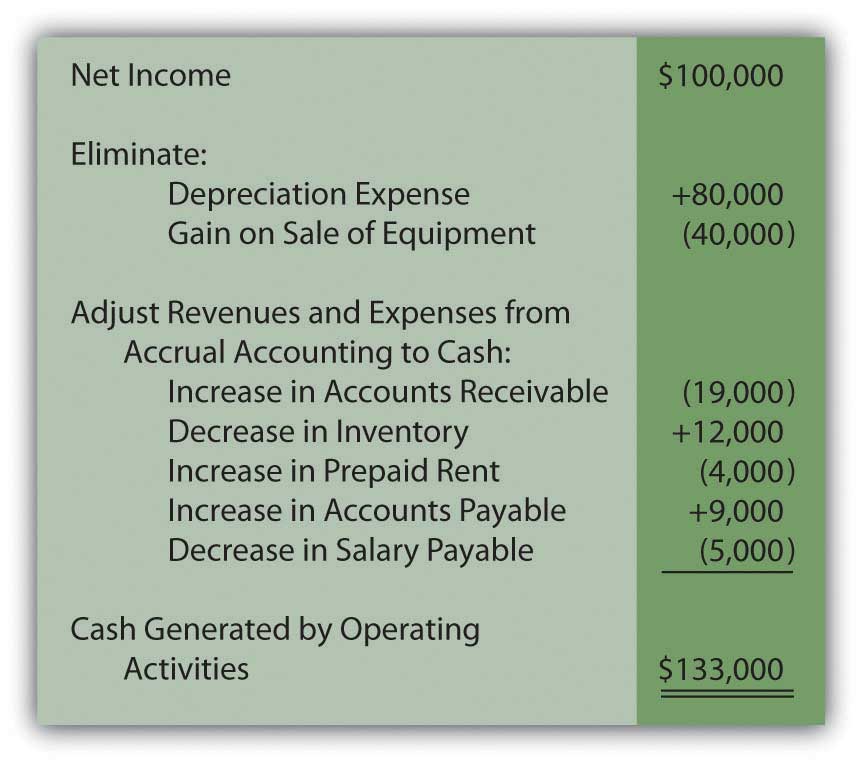

Most assets are allowed to be depreciated on taxes over time, helping the company offset future revenues resulting from the growth, while capturing the total value of the asset over time. These adjustments are made because non-cash items are calculated into net income (income statement) and total assets and liabilities (balance sheet). So, because not all transactions involve actual cash items, many items have to be re-evaluated when calculating cash flow from operations.

Operating Revenues

Specifically, these standards govern how a company reports changes to cash flow over time and how the company must manage its cash. GAAP standards apply to cash flow from operating, financing, and investment activities, but do not include cash from equity investments. The results of operating activities are reported in the operating income section of the income statement and in the operating cash flows section of the statement of cash flows. Cash flows from operating activities are among the major subsections of thestatement of cash flows.

Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. These activities can be found on a company’s financial statements and in particular the income statement and cash flow statement. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The cash flows from the operating activities section also reflect changes in working capital. A positive change in assets from one period to the next is recorded as a cash outflow, while a positive change in liabilities is recorded as a cash inflow.

Operating activities are the daily activities of a company involved in producing and selling its product, generating revenues, as well as general administrative and maintenance activities. The operating income shown on a company’s financial statements is the operating profit remaining after deducting operating expenses from operating revenues.

Investors want to see positive cash flow because of positive income from operating activities, which are recurring, not because the company is selling off all its assets, which results in one-time gains. The company’s balance sheet and income statement help round out the picture of its financial health. Operation cost, often referred to as operating cost, is the money that it takes to run your business. These are the day-to-day business expenses required to keep the lights on and to have the staff necessary to sell and fulfill customer needs.

- Then changes in balance sheet line items, such as accounts receivable and accounts payable, are either added or subtracted based on their previous impact on net income.

- These activities include many items from the income statement and the current portion of the balance sheet.

These are the company’s core business activities, such as manufacturing, distributing, marketing, and selling a product or service. Operating activities will generally provide the majority of a company’s cash flow and largely determine whether it is profitable.

These activities include many items from the income statement and the current portion of the balance sheet. The cash flow statement adds back certain noncash items such as depreciation and amortization. Then changes in balance sheet line items, such as accounts receivable and accounts payable, are either added or subtracted based on their previous impact on net income. If all of a company’s revenues were cash sales (no credit sales), and if the company paid out cash for all of its expenses, then it’s possible that the company’s net income would equal its net cash from operating activities. Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period.

These line items impact the net income on the income statement but do not result in a movement of cash in or out of the company. If cash flows from operating business activities are negative, it means the company must be financing its operating activities through either investing activities or financing activities. Many line items in the cash flow statement do not belong in the operating activities section. Operating activities are the functions of a business directly related to providing its goods and/or services to the market.

An Example of Cash Flow from Operating Activities

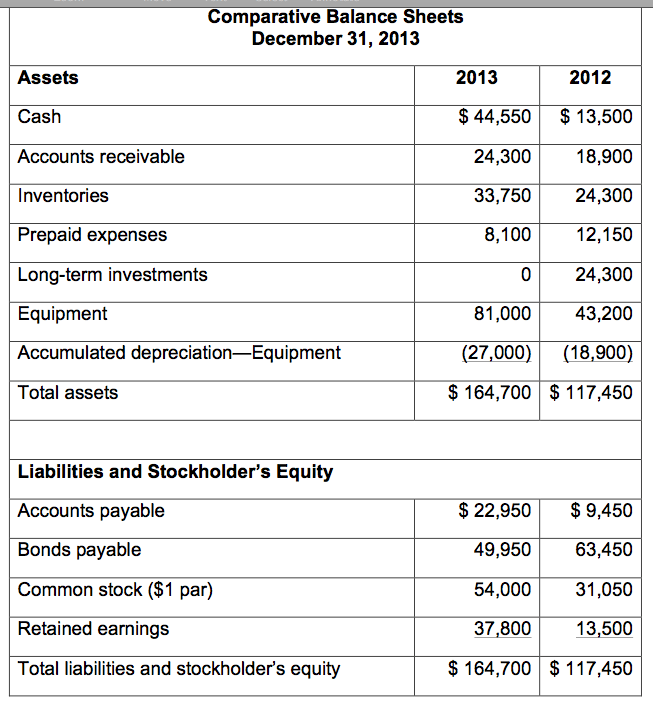

The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement. As with other financial statements, generally accepted accounting principles govern the preparation of a cash flow statement.

Because a company’s income statement is prepared on anaccrual basis, revenue is only recognized when it is earned and not when it is received. The indirect method also makes adjustments to add back non-operating activities that do not affect a company’s operating cash flow. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included. However, purchases or sales oflong-term assetsare not included in operating activities.

What are operating activities in accounting?

Operating activities are the functions of a business directly related to providing its goods and/or services to the market. These are the company’s core business activities, such as manufacturing, distributing, marketing, and selling a product or service.

This typically includes net income from the income statement, adjustments to net income, and changes in working capital. It must record the cash transactions that arise from all of the activities of the business, which include operating activities, but also can include financing and investing activities.

The Basics of Operating Activities

What are the 6 basic business activities?

Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period. This typically includes net income from the income statement, adjustments to net income, and changes in working capital.

The line item “capital expenditures” is considered an investing activity and can be found in this section of the cash flow statement. For example, even though loan proceeds and repayment involve financing activities, interest expense is reported as an operating activity because interest expense is reported in the income statement. The indirect method begins with the company’s net income based on the accrual method.

Incoming cash that comes from operating activities represents the revenues that a business generates. To arrive at the total net cash flow from operating activities, a business subtracts its operating expenses from its operating revenues. With theindirect method, cash flow from operating activities is calculated by first taking the net income off of a company’s income statement.