The required rate of return should never be lower than the cost of capital, and it could be substantially higher. Exhibit V shows the SML risk/expected return spectrum employing the average betas for companies in more than three dozen industries. The result is a pricing schedule for equity capital as a function of risk.

The Formula and Calculating RRR

A risk premium can also be attached to the hurdle rate if management feels that specific opportunities inherently contain more risk than others that could be pursued with the same resources. A common method for evaluating a hurdle rate is to apply the discounted cash flow method to the project, which is used in net present value models. Most companies use a 12% hurdle rate, which is based on the fact that the S&P 500 typically yields returns somewhere between 8% and 11% (annualized). Companies operating in industries with more volatile markets might use a slightly higher rate in order to offset risk and attract investors.

The required rate of return RRR is a key concept in equity valuation and corporate finance. It’s a difficult metric to pinpoint due to the different investment goals and risk tolerance of individual investors and companies. Risk-return preferences, inflation expectations, and a company’s capital structure all play a role in determining the company’s own required rate.

What Is Required Rate of Return – RRR?

Because of its shortcomings, financial executives should not rely on CAPM as a precise algorithm for estimating the cost of equity capital. Nevertheless, tests of the model confirm that it has much to say about the way returns are determined in financial markets. In view of the inherent difficulty in measuring the cost of equity, CAPM’s deficiencies appear no worse than those of other approaches.

Its key advantage is that it quantifies risk and provides a widely applicable, relatively objective routine for translating risk measures into estimates of expected return. In theory, the company must earn this cost on the equity-financed portion of its investments or its stock price will fall. If the company does not expect to earn at least the cost of equity, it should return the funds to the shareholders, who can earn this expected return on other securities at the same risk level in the financial marketplace. Since the cost of equity involves market expectations, it is very difficult to measure; few techniques are available. The hurdle rate is usually determined by evaluating existing opportunities in operations expansion, rate of return for investments, and other factors deemed relevant by management.

The required rate of return (RRR) is the minimum amount of profit (return) an investor will receive for assuming the risk of investing in a stock or another type of security. RRR also can be used to calculate how profitable a project might be relative to the cost of funding the project. RRR signals the level of risk that’s involved in committing to a given investment or project.

Thus an investor is rewarded with higher expected returns for bearing only market-related risk. The required rate of return (RRR) is from the investor’s perspective, being the minimum rate an investor will accept for a project or investment. Meanwhile, the cost of capital is what the company expects to return on its securities.

RRR vs. Cost of Capital

- But estimating the cost of equity causes a lot of head scratching; often the result is subjective and therefore open to question as a reliable benchmark.

- An important task of the corporate financial manager is measurement of the company’s cost of equity capital.

- This article describes a method for arriving at that figure, a method spawned in the rarefied atmosphere of financial theory.

RRR is commonly used in corporate finance and when valuing equities (stocks). For investors using the CAPM formula, the required rate of return for a stock with a high beta relative to the market should have a higher RRR. The higher RRR relative to other investments with low betas is necessary to compensate investors for the added level of risk associated with investing in the higher beta stock. Since investors can eliminate company-specific risk simply by properly diversifying portfolios, they are not compensated for bearing unsystematic risk. And because well-diversified investors are exposed only to systematic risk, with CAPM the relevant risk in the financial market’s risk/expected return tradeoff is systematic risk rather than total risk.

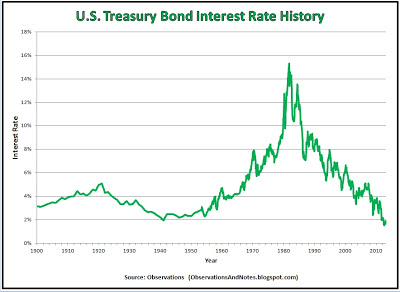

The capital asset pricing model (CAPM) is a finance theory that establishes a linear relationship between the required return on an investment and risk. The model is based on the relationship between an asset’s beta, the risk-free rate (typically the Treasury bill rate) and the equity risk premium, or the expected return on the market minus the risk-free rate.

Equity investing uses the required rate of return in various calculations. For example, the dividend discount model uses the RRR to discount the periodic payments and calculate the value of the stock. You may find the required rate of return by using the capital asset pricing model (CAPM).

What is the required rate of return?

The required rate of return is the minimum return an investor expects to achieve by investing in a project. An investor typically sets the required rate of return by adding a risk premium to the interest percentage that could be gained by investing excess funds in a risk-free investment.

The cost of equity, then, is essentially the amount that a company must spend in order to maintain a share price that will satisfy its investors. In corporate finance, whenever a company invests in an expansion or marketing campaign, an analyst can look at the minimum return these expenditures demand relative to the degree of risk the firm expended. If a current project provides a lower return than other potential projects, the project will not go forward. Many factors—including risk, time frame, and available resources—go into deciding whether to forge ahead with a project. Typically though, the required rate of return is the pivotal factor when deciding between multiple investments.

This article describes a method for arriving at that figure, a method spawned in the rarefied atmosphere of financial theory. The capital asset pricing model (CAPM) is an idealized portrayal of how financial markets price securities and thereby determine expected returns on capital investments. The model provides a methodology for quantifying risk and translating that risk into estimates of expected return on equity. Under these conditions, CAPM shows that the cost of equity capital is determined only by beta.

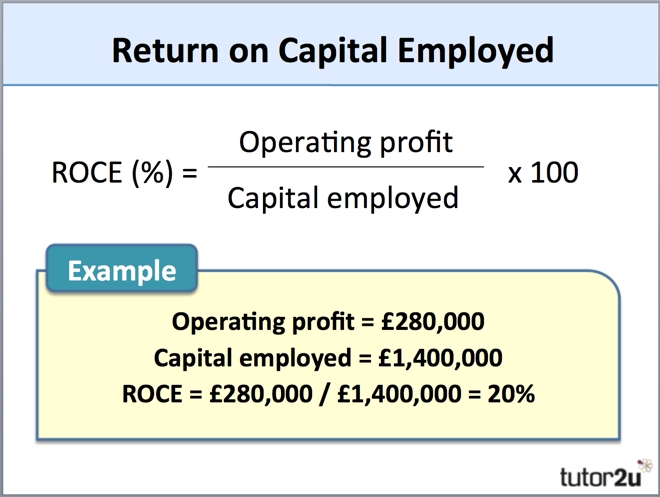

Each one of these and other factors can have major effects on a security’s intrinsic value. The required rate of return is not the same as the cost of capital of a business. The cost of capital is the cost that a business incurs in exchange for the use of the debt, preferred stock, and common stock given to it by lenders and investors. The cost of capital represents the lowest rate of return at which a business should invest funds, since any return below that level would represent a negative return on its debt and equity.

The spectrum represents shareholders’ risk/expected return opportunities in the financial markets and, therefore, shareholder opportunity costs to the particular company. Plugging the assumed values of the risk-free rate, the expected return on the market, and beta into the security market line generates estimates of the cost of equity capital. In Exhibit IV I give the cost of equity estimates of three hypothetical companies. The finance literature defines the cost of equity as the expected return on a company’s stock.

An important task of the corporate financial manager is measurement of the company’s cost of equity capital. But estimating the cost of equity causes a lot of head scratching; often the result is subjective and therefore open to question as a reliable benchmark.