While the payments in an ordinary annuity can be made as frequently as every week, in practice, they are generally made monthly, quarterly, semi-annually, or annually. The opposite of an ordinary annuity is an annuity due, in which payments are made at the beginning of each period.

Explaining Types of Fixed Annuities

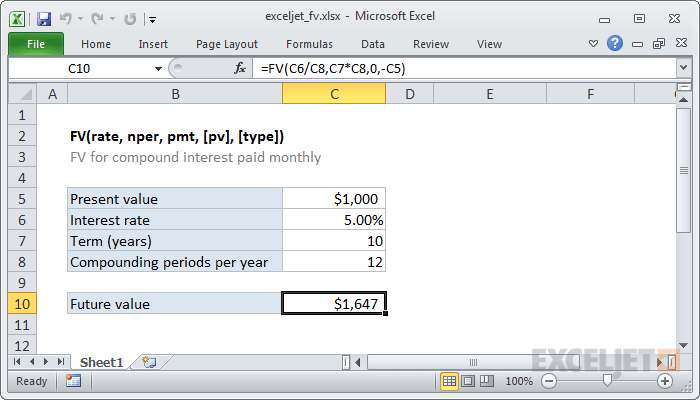

The payments you receive will depend on how well your investments perform. Future value is the value of a sum of cash to be paid on a specific date in the future.

These recurring or ongoing payments are technically referred to as “annuities” (not to be confused with the financial product called an annuity, though the two are related). An ordinary annuity is a series of equal payments made at the end of consecutive periods over a fixed length of time.

Ordinary annuities are often associated with the issuance of bonds with specific terms regarding the bond interest rate and the time to maturity. The bond terms allow us to determine the present value and the future value of the annuity payment. These calculations are useful when determining the true cash flows received or paid over the life of the annuity. An annuity is a financial instrument that provides regular payments to the holder each period until the end of the contract.

Annuities may be paid for the duration of a person’s life or may be set for a certain period of time. Annuities are tax-deferred, so the earnings from investments in these accounts grow without tax liability until the benefits are paid out. An ordinary annuity makes payments at the end of each time period, while an annuity due makes them at the beginning.

There are a number of retirement savings options available, though, such as a 401(k) through your employer, an individual retirement account (IRA) or an annuity. Annuities can help you supplement your retirement income, but they aren’t necessarily right for everyone. Talk to a financial advisor in your area to determine if an annuity is right for you. The income is deferred after premiums are paid until a later date, perhaps several years.

Annuities are a financial product sold by financial institutions (usually insurance companies) that are used as a way to grow funds to pay out a stream of income over a certain period of time. Annuities are typically used by individuals seeking a means to receive steady cash flow into retirement. This value is the amount that a stream of future payments will grow to, assuming that a certain amount of compounded interest earnings gradually accrue over the measurement period. A financial instrument that pays out the investor’s earnings on a regular, periodic basis for a set amount of time.

Either way, the fees and charges on annuities will conspire to diminish your retirement income. On the other hand, if you are looking for a plan that offers you a retirement income, then you should be considering annuities. Simply put—life insurance protects your loved ones if you die prematurely while the annuity protects your income if you live longer than expected. It seems that with annuity plans you are paying a lot with the hopes of reduced risk and guaranteed income. The opportunity cost of putting most of a retirement nest egg into an annuity is just too great.

How do you find the present value of an ordinary annuity?

present value of an ordinary annuity definition. The discounted value of a series of equal amounts occurring at the end of each equal time interval. To learn more, see our Present Value of an Ordinary Annuity Outline.

An annuity due is a series of payments made at the beginning of each period in the series. Therefore, the formula for the future value of an annuity due refers to the value on a specific future date of a series of periodic payments, where each payment is made at the beginning of a period. Such a stream of payments is a common characteristic of payments made to the beneficiary of a pension plan. These calculations are used by financial institutions to determine the cash flows associated with their products. PV of an ordinary annuity will be majorly dependent upon the current market interest rate.

The present value of these payments is the amount that an investor would have to invest today at a given interest rate to equate to the total amount of payments in the future discounted by the same interest rate. The most basic feature (and biggest pro) of an annuity is that you receive regular payments from an insurance company. These payments provide supplemental income during your retirement, and can help if you’re afraid that you haven’t saved enough to cover your regular expenses. Keep in mind that the value and number of your annuity payments will vary depending on the type of annuity you have and the terms of your contract. Once you figure out how much you need to save to retire, the real planning then begins.

Annuities that provide payments that will be paid over a period known in advance are annuities certain or guaranteed annuities. Annuities paid only under certain circumstances are contingent annuities. A common example is a life annuity, which is paid over the remaining lifetime of the annuitant. Certain and life annuities are guaranteed to be paid for a number of years and then become contingent on the annuitant being alive.

Alternatively, individuals paying an annuity due lose out on the opportunity to use the funds for an entire period. An annuity due payment is a recurring issuance of money upon the beginning of a period.

- In simple terms, you buy an annuity plan with one large payment or series of contributions.

- The money you put in grows through various investments made by the financial institution.

What Is an Ordinary Annuity?

Insurance premiums are another example of an annuity due, as payments are made at the beginning of a period for coverage lasting through the end of that period. With an ordinary annuity, payments are made at the end of a covered term. Ordinary annuity payments are usually made monthly, quarterly, semiannually, or annually. When a homeowner makes a mortgage payment, it typically covers the month-long period leading up to the payment date. Two other common examples of ordinary annuities are interest payments from bonds and stock dividends.

A fixed annuity guarantees a minimum rate of interest on your money, as well as a fixed number of payments from the insurance company. On the other hand, avariable annuity allows you to invest your money in different securities, such as mutual funds.

Due to the time value of money, in case of rising interest rates, the present value will decrease, while in the scenario of declining interest rates it shall lead to an increase in the annuities present value. Our focus throughout this topic will be on ordinary annuities—streams of equal cash amounts that are received or paid at the end of future periods. We’ll discuss calculations that determine present value, interest rate, and/or the length of time needed for identical payments to occur. The main sales pitch for annuities is that they provide a regular income stream in retirement that lasts for the rest of your life. If the money you invest in an annuity is depleted before you die, you will continue to receive the same amount of income.

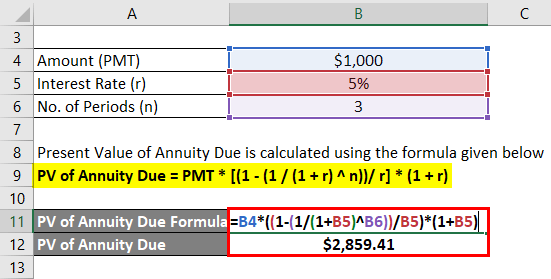

The formula for the present value of an annuity due, sometimes referred to as an immediate annuity, is used to calculate a series of periodic payments, or cash flows, that start immediately. If you’re liable for making payments on an annuity, you’ll benefit from having an ordinary annuity because it allows you to hold onto your money for a longer amount of time.

On the other hand, when interest rates fall, the value of an ordinary annuity goes up. This is due to the concept known as the time value of money, which states that money available today is worth more than the same amount in the future because it has the potential to generate a return and grow. Many monthly bills, such as rent, mortgages, car payments, and cellphone payments are annuities due because the beneficiary must pay at the beginning of the billing period. Insurance expenses are typically annuities due as the insurer requires payment at the start of each coverage period. Annuity due situations also typically arise relating to saving for retirement or putting money aside for a specific purpose.

When a bond issuer makes interest payments, which generally happens twice a year, the interest is paid and received at the end of the period in question. Similarly, when a company pays dividends, which typically happens quarterly, it is paying at the end of the period during which it retained enough excess earnings to share its proceeds with its shareholders. An ordinary annuity is a series of equal payments made at the end of each period over a fixed amount of time.

In simple terms, you buy an annuity plan with one large payment or series of contributions. From there, the financial institution distributes money back to you for a certain time frame, depending on what kind of annuity you purchase. The money you put in grows through various investments made by the financial institution. There are immediate annuities, meaning you would get your monthly payments immediately, as well as deferred annuities where the principal is held for a certain period of time before being distributed back to you. Fixed rate annuities guarantee a certain payment that does not fluctuate, while variable rate annuities’ income payout depends on the underlying investment performance.

Deferred annuities are further broken down into fixed (traditional, Fixed Indexed (FIA) and the Variable annuity. While annuities and life insurance both have similarities, they are not the same. Before you can understand the differences and determine which plan may be right for you relating to a retirement income plan, you have first to understand the key elements of each.

For example, a retirement annuity paid to a public officer following his or her retirement.The right to receive such an income.The duty to make such a payment or payments. Valuation of an annuity entails calculation of the present value of the future annuity payments. The valuation of an annuity entails concepts such as time value of money, interest rate, and future value. The future value of an annuity is the total value of payments at a specific point in time. The present value is how much money would be required now to produce those future payments.

That’s because insurance companies pool your money with other policyholders’ money, invest it, and then distribute annuity payments to everyone. The immediate annuity pays benefits starting no later than one year after you have paid your premium to the insurance company. Most immediate annuities are purchased with a one-time, lump-sum payment and are designed for beginning payments out no later than one year after the premium has been paid. This annuity plan is designed for people looking to a guaranteed income for life. Since payments are made sooner with an annuity due than with an ordinary annuity, an annuity due typically has a higher present value than an ordinary annuity.

present value of an ordinary annuity definition

The timing of an annuity payment is critical based on opportunity costs. For an individual collecting payment, the collector may invest an annuity due payment collected at the beginning of the month to generate interest or capital gains. This is why an annuity due is more beneficial for the recipient as he has the potential to use funds faster.

What is the meaning of ordinary annuity?

Definition: An ordinary annuity is a series of equal payments are paid at the end of each period for a defined amount of time.

Present Value of an Annuity Due Example

However, if you’re on the receiving end of annuity payments, you’ll benefit from having an annuity due, as you’ll receive your payment sooner. With an annuity due, payments are made immediately, or at the beginning of a covered term rather than at the end. A rent or lease agreement, for instance, is a common example of an annuity due. When a rental or lease payment is made, it typically covers the month-long period following the payment date.