With a variable annuity, you put in money that’s already been taxed and then the account grows tax deferred. That means you’ll have to pay income taxes on whatever growth the annuity makes when you start taking money out in retirement. Unlike a fixed…

Bookkeeping 101

What Is Amortization?

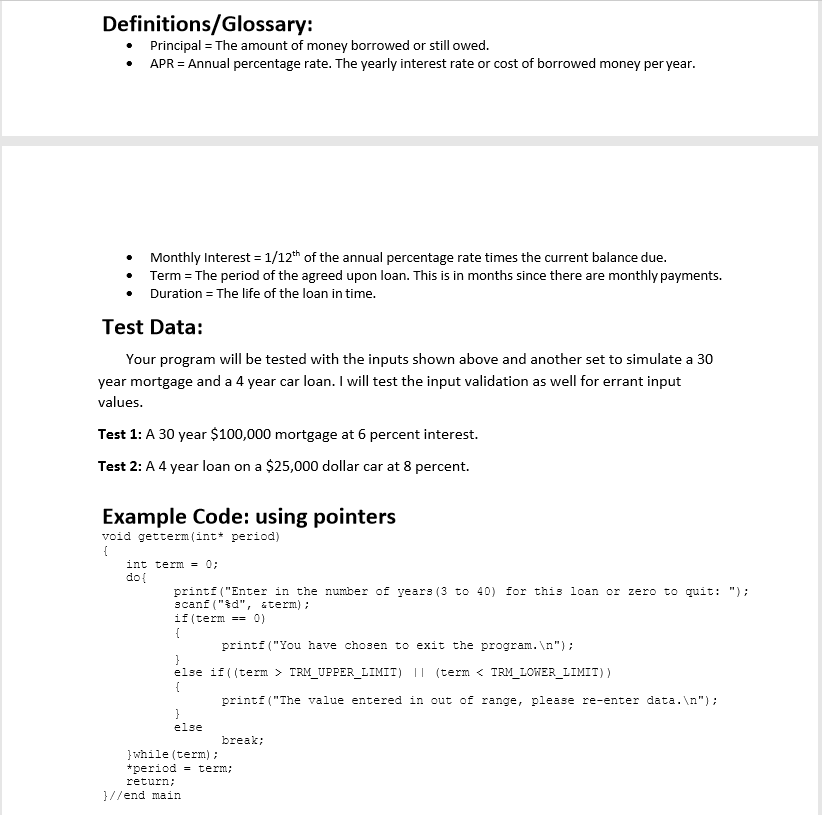

Posted on Posted on: 08.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Is Amortization?Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal. For month two, do the same thing, except star…

The accrual basis of accounting

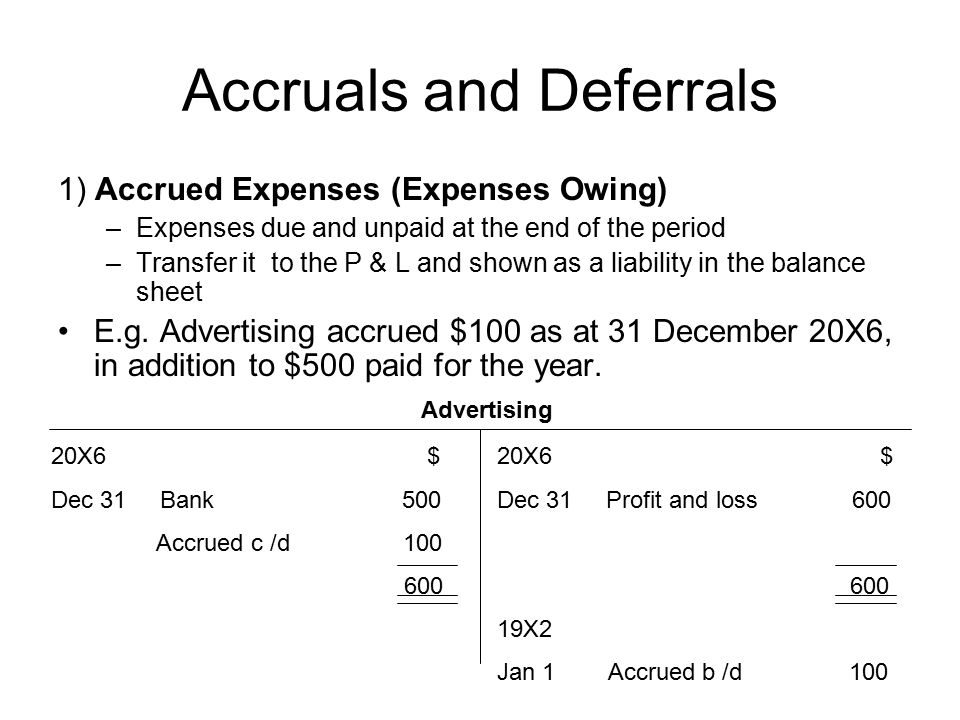

Posted on Posted on: 07.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The accrual basis of accountingThe accountant debits an asset account for accrued revenue which is reversed when the exact amount of revenue is actually collected, crediting accrued revenue. Accrued revenue covers items that would not otherwise appear in the general ledger at the …

Prepaid rent accounting

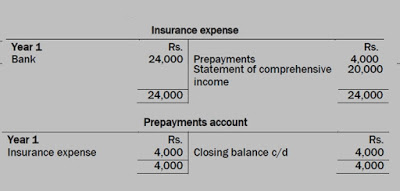

Posted on Posted on: 07.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Prepaid rent accountingThe calculation of this estimate is based on a number of factors, such as historical prepayment rates for previous loans similar to ones in the pool and future economic outlooks. These calculations are important when evaluating assets like mortgage-b…

Accounting memo sample

Posted on Posted on: 07.05.2020 Modified on: 12.09.2022Categories Bookkeeping 101 Leave a comment on Accounting memo sampleThe same goes for writing IN ALL CAPS or using exclamation points, especially if the memorandum is conveying news that may upset people. Business memorandum or memoranda — also called memo or memos — are specially formatted written communications wit…

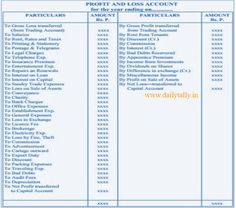

Income loss

Posted on Posted on: 07.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Income lossThese are the costs a company pays for holding inventory in stock before it is sold to customers. For example, a company that sells frozen foods needs to pay for refrigerated storage facilities, utility costs, taxes, employee expenses, and insurance….

Four categories of income are

Posted on Posted on: 07.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Four categories of income areAn extreme example would be if Apple decided to pay off $70 billion of its term debt, which totals approximately $93 billion listed on the balance sheet. The company would record the cash outlay of $70 billion dollars within the financing activities …

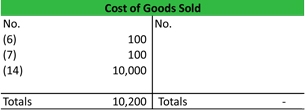

Format a table

Posted on Posted on: 06.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Format a tableLike the Currency format, the Accounting format is used for monetary values. But, this format aligns the currency symbols and decimal points of numbers in a column. In addition, the Accounting format displays zeros as dashes and negative numbers in p…

Accounting Guidelines for Contingent Liabilities

Posted on Posted on: 06.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Accounting Guidelines for Contingent LiabilitiesConsequently, a lawyer may not be able to form a conclusion with respect to such matters. In such circumstances, the auditor ordinarily will conclude that the financial statements are affected by an uncertainty concerning the outcome of a future even…

Accounts Payable (Q&A)

Posted on Posted on: 06.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Accounts Payable (Q&A)Examples of accounts payable include accounting services, legal services, supplies, and utilities. Accounts payable are usually reported in a business’ balance sheet under short-term liabilities….