You’ll typically pay a fee for a cashier’s check to the bank, with the average fee at the nation’s largest banks hovering around $10. As with many other bank services, stop payments typically come with a fee. Here’s what you can expect to pay at some…

Bookkeeping 101

Should You Really Buy Stocks Now or Wait a While Longer?

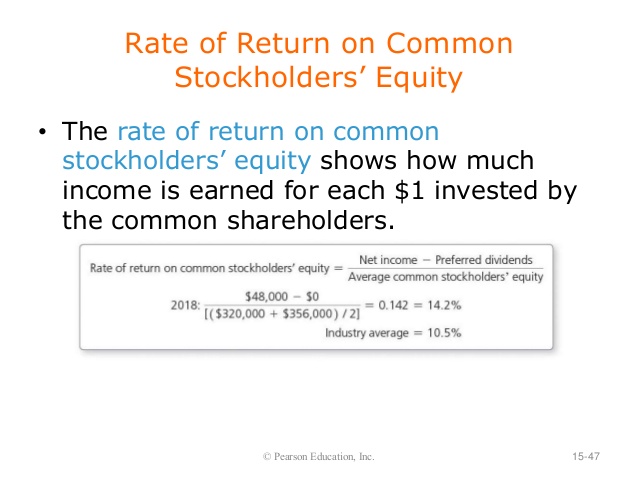

Posted on Posted on: 18.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Should You Really Buy Stocks Now or Wait a While Longer?Therefore, investors tend to rely on dividends in much the same way that they rely on interest payments from corporate bonds and debentures. If people were used to getting their quarterly dividends from a mature company, a sudden stop in payments to …

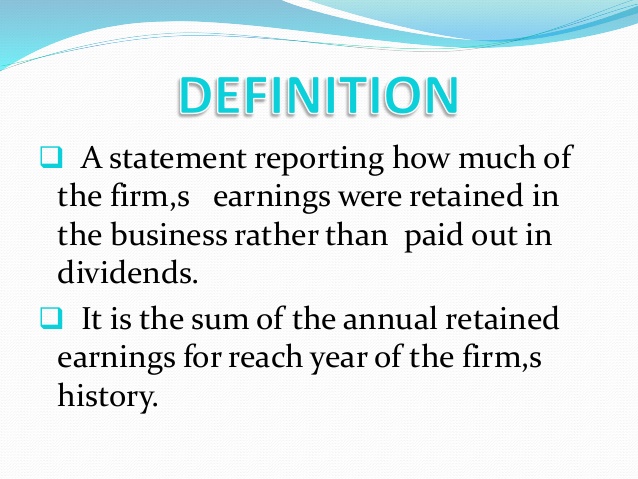

Retained earnings

Posted on Posted on: 18.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Retained earningsHowever, it can also be calculated by taking the beginning balance of retained earnings, adding thenet income(or loss) for the period followed by subtracting anydividendspaid to shareholders. Due to the nature of double-entry accrual accounting, reta…

What Is the Maximum I Can Receive From My Social Security Retirement Benefit?

Posted on Posted on: 15.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Is the Maximum I Can Receive From My Social Security Retirement Benefit?Currently, the Social Security tax is 12.4% — half of which is paid by the employer, with the other 6.2% paid by the worker through payroll withholding. For Medicare, that tax is a combined 2.9%, split between the employee and employer. (Self-employe…

Secured and unsecured borrowing explained

Posted on Posted on: 15.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Secured and unsecured borrowing explainedIf you’re turned down for unsecured credit, you may still be able to obtain secured loans. But you must have something of value that can be used as collateral….

Sales mix

Posted on Posted on: 15.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Sales mixYou need the sale price for each item in your inventory as well as fixed costs for your business. For example, your business may produce both large and small candles using the same wax mixture. Variable costs will take into account the costs of raw m…

2-1 The three major elements of product costs in a manufacturing company are direct materials, direct labor, and manufacturing overhead. 2-2

Posted on Posted on: 15.05.2020 Modified on: 03.03.2022Categories Bookkeeping 101 Leave a comment on 2-1 The three major elements of product costs in a manufacturing company are direct materials, direct labor, and manufacturing overhead. 2-2Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred …

LLC Perpetual vs. Indefinite

Posted on Posted on: 15.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on LLC Perpetual vs. IndefiniteChanges the Internal Revenue Service made to its codes encouraged states to modify their laws to allow LLCs to also have a perpetual existence. However, whereas all corporations automatically are perpetual until dissolved, when they create the LLC or…

How to Find a Manufacturing Facility

Posted on Posted on: 14.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Find a Manufacturing FacilityThese can include rent or mortgage payments, depreciation of assets, salaries and payroll, membership and subscription dues, legal fees and accounting costs. Fixed expense amounts stay the same regardless if a business earns more — or loses more — …

Payroll tax

Posted on Posted on: 14.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Payroll taxPayroll tax and income tax are similar concepts, and if you work a job in the United States, you’ll likely see withholdings for both on your paycheck. The payroll tax system usually refers to taxes for Medicare and Social Security that are withheld a…